With a 20% annual increase on 2019, publishers promoting thousands of brands across the network drove an average of 28 sales a second throughout the 24 hours.

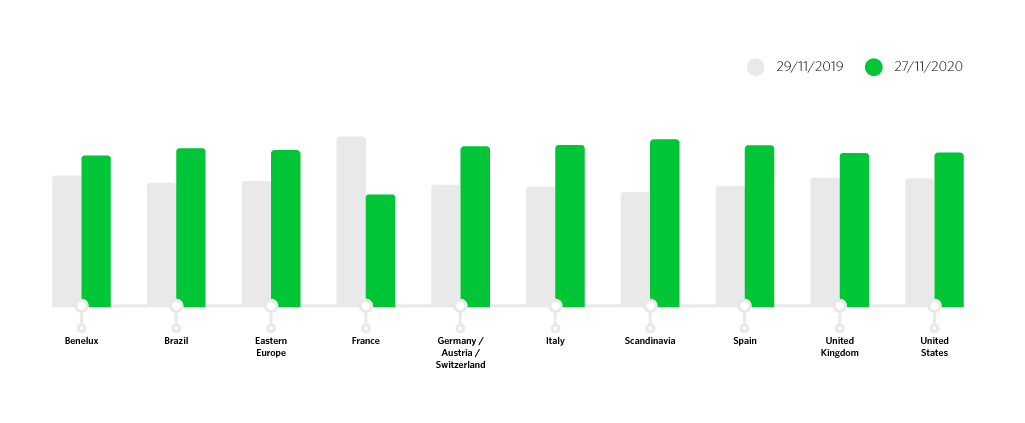

Spain, Italy and Germany were the markets with some of the biggest year on year growth, but the Nordics saw sales grow by almost 50%, posting the biggest regional annual gain.

One of the day’s peaks occurred in the early evening when the network tracked almost 70 sales a second, another Awin record.

Black Friday is no longer limited to the performance across one day, or indeed the wider Cyber weekend. Many brands have shifted their promotions earlier in November, marking it as a much longer promotional window for publishers.

Black Friday in 2020 relative to the performance of the same day last year is plotted here for each of Awin’s European and American markets:

- Italy and Spain’s robust performance could be related to the significant surge in new online customers both countries saw during the Spring lockdown. At the time, just 38% of Italian’s shopped at least once a year online, compared to twice the number in the UK. With more than 2.5m new online shoppers in Italy this year, this may have fuelled ecommerce sales.

- France was the only country where Black Friday shrunk on 2019’s numbers. This was forecast following last week’s news that Economy Minister Bruno Le Maire agreed with organisations representing supermarkets, large retail chains and e-commerce platforms (including Amazon), to postpone Black Friday by a week to allow shops currently closed because of a national lockdown to participate.

- Elsewhere Brazil and Eastern Europe posted around one in four more sales across Black Friday, with the US and UK tracking on average one in five additional sales. Benelux saw transactions increase by 15%.

While physical stores have been open across the majority of countries Awin operates in, shopping in the safety and comfort at home will no doubt have contributed to the robust performance. 2020’s growth has seen sales on Black Friday more than double since 2018 as more countries adopt the American consumer event.

Retail offsetting the ongoing travel slump

The growth comes despite the depressed performance of travel. This manifested itself in the shift of sales Awin tracked across the four main sectors it runs affiliate programmes in. With more than 90% of the network’s campaigns categorised as retail, it’s no surprise that this vertical dominates, but there has been a noticeable sector shift as the pandemic continues to wreak havoc for overseas and domestic travel:

- Retail commissions increased from 76% to 84% of all total tracked publisher revenue.

- Retail revenue surged from 89% to 96% of the €233m total order value tracked on Black Friday

- The UK’s reputation for its strength in the telco sector saw more than £1m paid out to publishers promoting the network’s telecoms brands.

- The Benelux region increase the share of commissions paid out on their range of financial programmes, bucking the trend seen elsewhere.

As retail surged so the lower average order values had a knock-on impact on commissions which typically saw more modest increases.

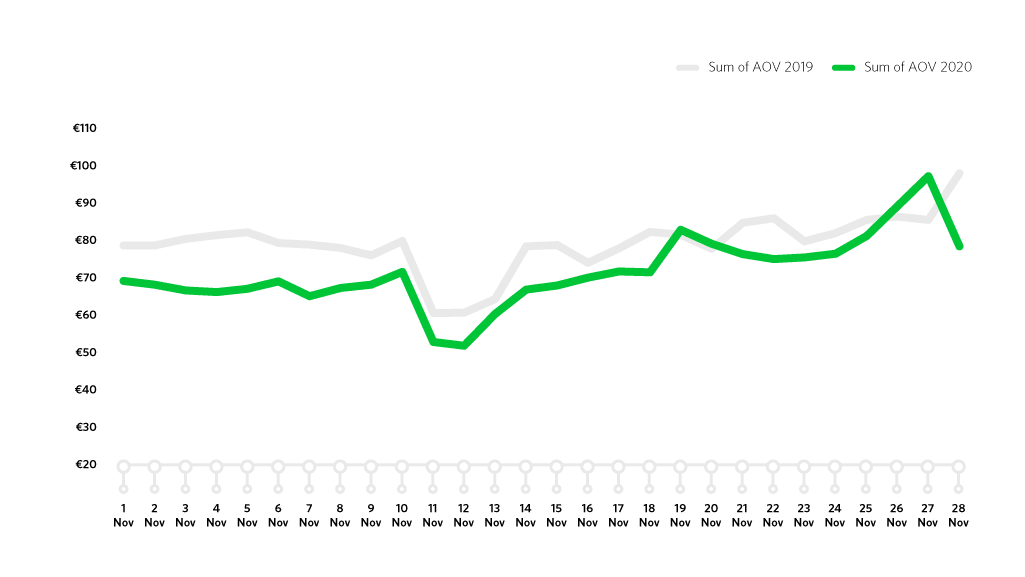

Black Friday is notable for its focus on high ticket electrical items which invariably sees a surge in the size of the typical basket. This is evident from average orders tracked across November when compared to last year’s performance:

That said, the average sale in 2020 was around 9% less than that seen across Black Friday in 2019, signifying a wider trend across the whole month. This may also be indicative of deeper discounting that has been witnessed as brands try to offload excess stock as well as a desire to recoup losses suffered this year.

According to UK retail body, the IMRG, more than double the number of retailers they monitor are offering whole site discounts compared to 2019.

The publisher picture

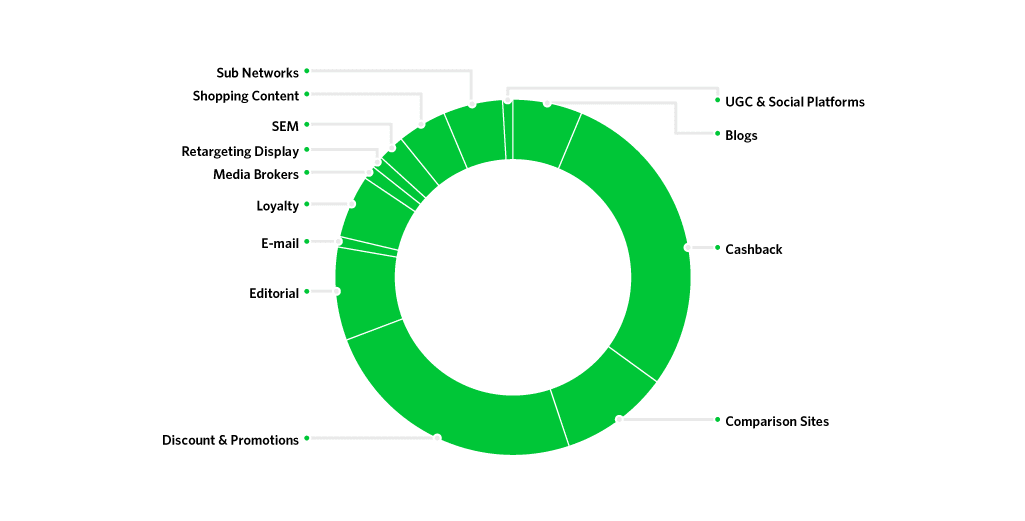

One of the biggest winners from this year’s Black Friday has been in the voucher and coupon space.

Cashback sites emerged the biggest overall publisher type, but their growth was a little slower in 2020 than in 2019, meaning their market share shrunk by one percent. Vouchers and coupons by contrast gained three percentage points to account for around a quarter of all commissions. Combined, coupon and cashback categorised affiliates made up 53% of the network’s commissions.

- Elsewhere price comparison sites made up 10%, editorial 9% and blogs 6% of tracked commissions.

- There is considerable regional and sectoral variance, with price comparison sites seeing a surge in their earnings, tracking half of all telco sales.

- Meanwhile the clothing sector in the UK relies heavily on cashback and vouchers, with almost 70% of tracked commissions being driven by these publishers.

- Germany retains one of the most diverse publisher mixes, with discounting, loyalty, reward and cashback sitting at around 55% of all commissions

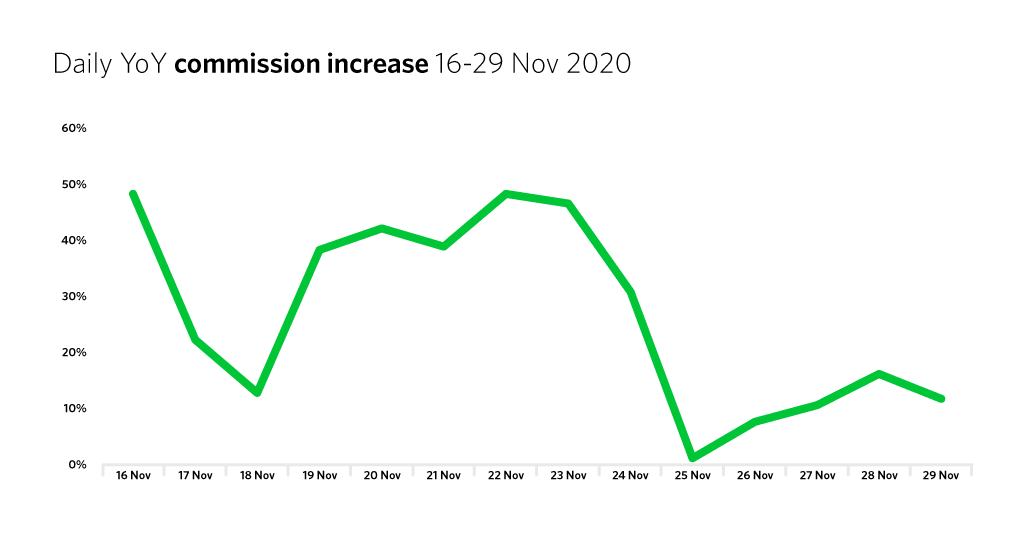

Commissions piled on in mid-November

A combination of lower commissions for higher ticket electricals, diminished rates for repeat customers and a lower number of weighty, promotional telco bounties around Black Friday saw YoY publisher earnings slow around on the big day. While the weekend before Black Friday saw 2020 commissions increase by almost 50% on 2019’s numbers, this trend dropped to more modest single-digit hikes in the run up to Black Friday, before recovering some ground:

Other insights

Without the context of Cyber Monday, we can’t be sure whether the US will continue to buck the trend of Black Friday being the smaller online sales day and whether Brazil’s performance will dominate the month.

But there are some quick takeaways:

- New customers flocked to popular publisher sites. YoY increases saw the number of new shoppers increase from 40% to 48% via editorial sites, 42% to 46% for comparison portals with vouchers and coupons seeing a slight increase from 42% to 43%.

- The biggest relative increase saw cashback sites attract almost one in three new customers via their offers. The saw their numbers surge from 23% to 32%

- Overall the network’s sales hit almost 40% shoppers, a 15% actual increase on 2019’s numbers.

- Mobile sales hit 58% of all transactions in the UK and surged in Germany to 53%.

Remember, you can monitor the weekly performance of the network through November and December using this tracker.