17:24: Until 4pm today, two-thirds of the way in, total sales tracked across the global network are approaching 700k (618k), considerably up on last year.

That's us data-ed out for today, but there's more to come. From tomorrow our interactive report will be available on site and next week we'll be providing a full digest followed by our top insights from this most important of retail events.

Thanks for joining us today and remember to check back over the next few days for deeper and fuller insights!

_________________________________________________________________________________

17:06: Currently being sustained by beer and biscuits. Stay tuned for our final numbers of the day!

_________________________________________________________________________________

17:00: As our commentary draws to a close, IMRG has put together a snapshot of the day so far (with a handy little mention for our European numbers). Read what we know so far about the wider picture here.

_________________________________________________________________________________

16:54: What's happening to AOVs and conversion rates?

One major department store has seen a 10% bump in average baskets. From a publisher perspective we can take a look at a major discount and voucher site who experienced an increase in click-to-sale conversion from 9.7% to 10.3% and a hike in average basket by £4 meaning their EPC went up by 25%.

_________________________________________________________________________________

16:45: Awin's Black Friday insights getting industry coverage

Good to see our analysis and data getting some coverage in this nice little summary of Black Friday trends on the PerformanceIN site. A lot of the trends and patterns that we've seen emerge over the course of day have, interestingly, been echoed by other figures in the industry.

_________________________________________________________________________________

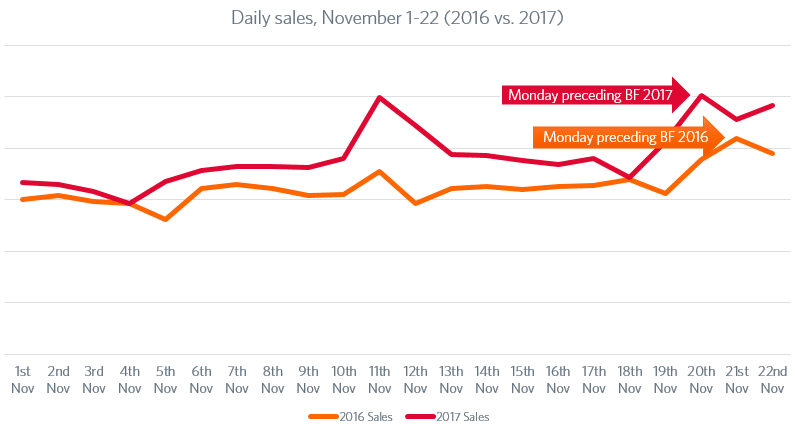

16:06: What about the day before Black Friday?

While Black Friday 2017 has still to fully play out, the day before is a good indicator of what the flow of traffic is likely to be. For the Awin network we tracked 15% more sales on the Thursday prior to the big day.

Take a look at this graph that shows November performance YoY:

_________________________________________________________________________________

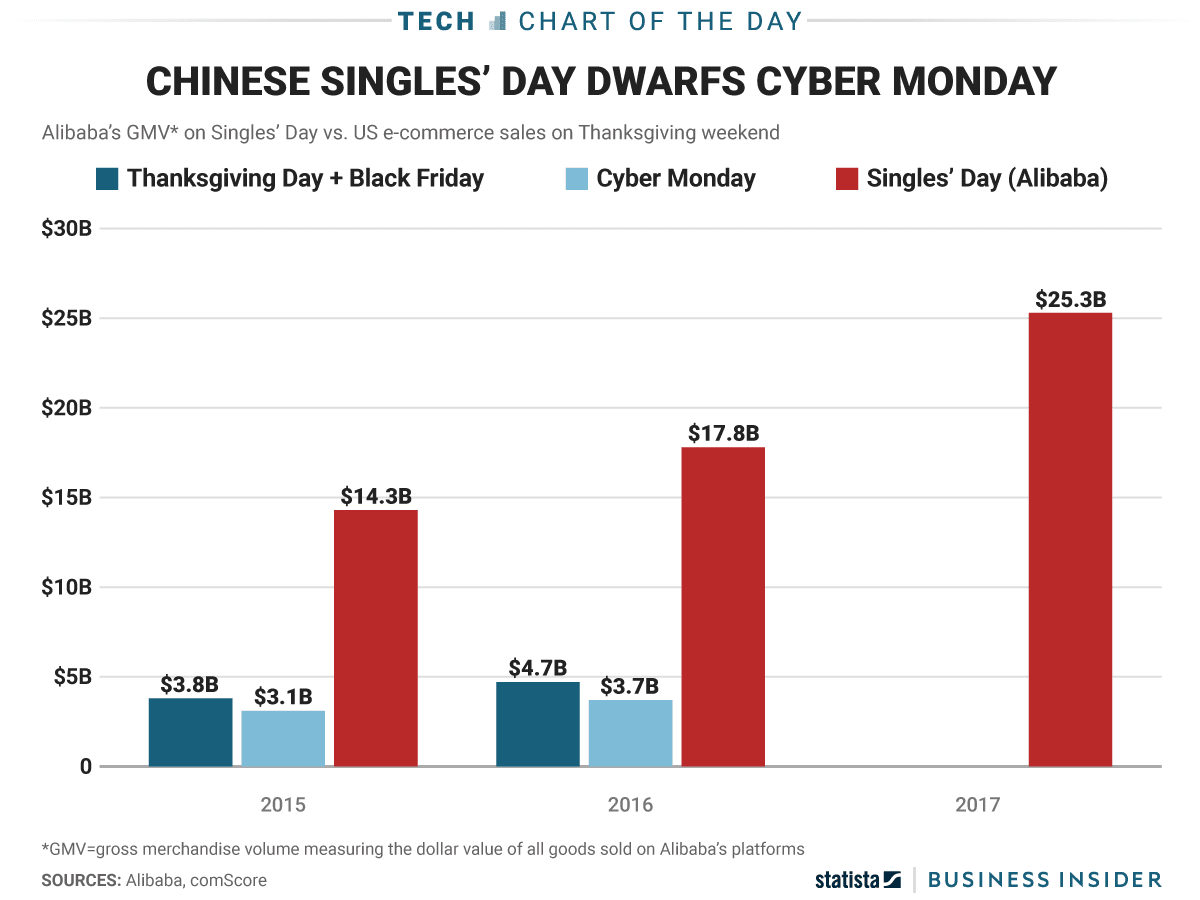

16:04: Black Friday still dwarfed by Singles' Day

While today is Black Friday’s chance to shine there’s no getting away from the fact that it’s been overshadowed in recent years by the world’s biggest shopping event, Singles’ Day. This year the Chinese shopping phenomenon broke its own monumental records and posted figures that dwarf Black Friday and the wider Cyber Weekend.

We published a two-part series analysing Singles’ Day recently focusing on the unusual tactics used by Chinese retailers and then looking at some of the activity that Awin’s network tracked on the day.

_________________________________________________________________________________

15:20: Price comparison affiliates seeing large growth in basket value this year

Global statistics on the growth of revenue driven by publisher types are in and reveal some interesting gains and losses for different types of affiliate and the size of the baskets they’re converting.

Cashback (+34%), content (+22%) and price comparison (+62%) affiliates are all driving sales of larger value during Black Friday 2017, however discount code affiliates are down (-14%) year-on-year.

_________________________________________________________________________________

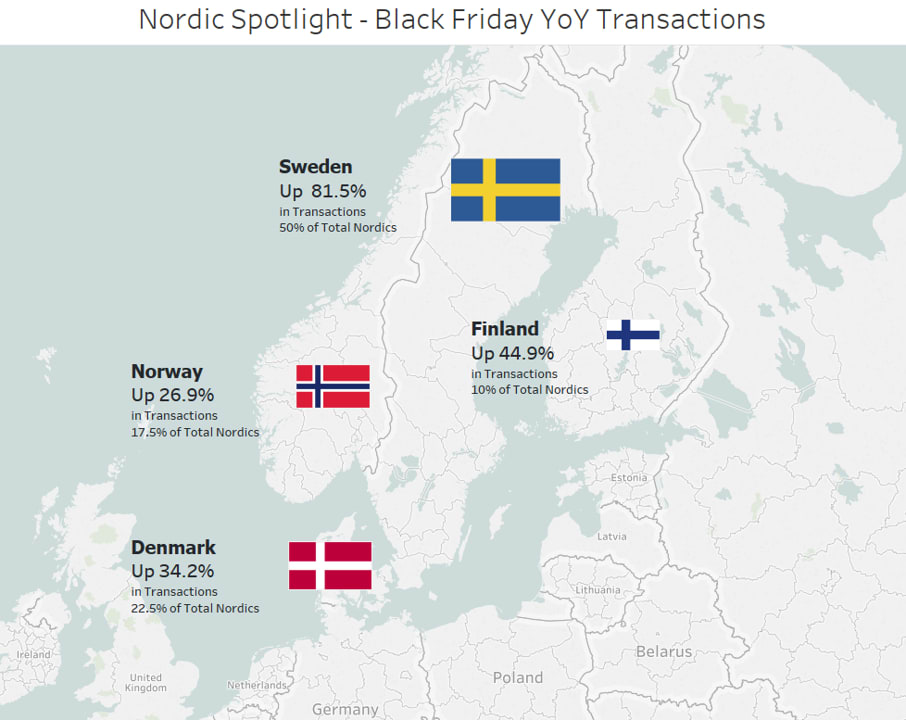

15:05: Insight from the North:

Awin runs affiliate programmes across all the Nordic countries. Splitting the data out we can see the split between the four territories and the percentage YoY uplift:

_________________________________________________________________________________

14:55: Early morning indifference giving way to afternoon appetite? This Black Friday could be remembered for a slow start to the day. That's born out by one of our major retailers in the UK whose sales were completely static at the start of the day but post-lunch are seeing an overall 4% increase. Since lunchtime they're up 7%

_________________________________________________________________________________

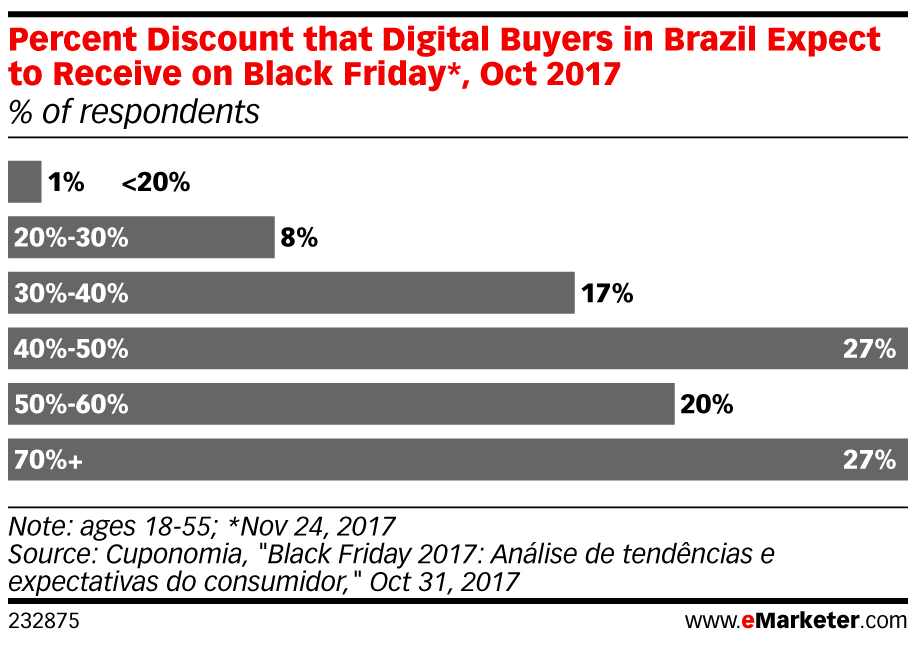

14:44: Brazil’s shoppers optimistic about level of Black Friday discounts this year

Research published by eMarketer highlights the high levels of discounts that Brazilian shoppers expect from retailers this year. Black Friday has been eagerly adopted by Brazilians and clearly consumer expectation is high after previous sales from advertisers there.

_________________________________________________________________________________

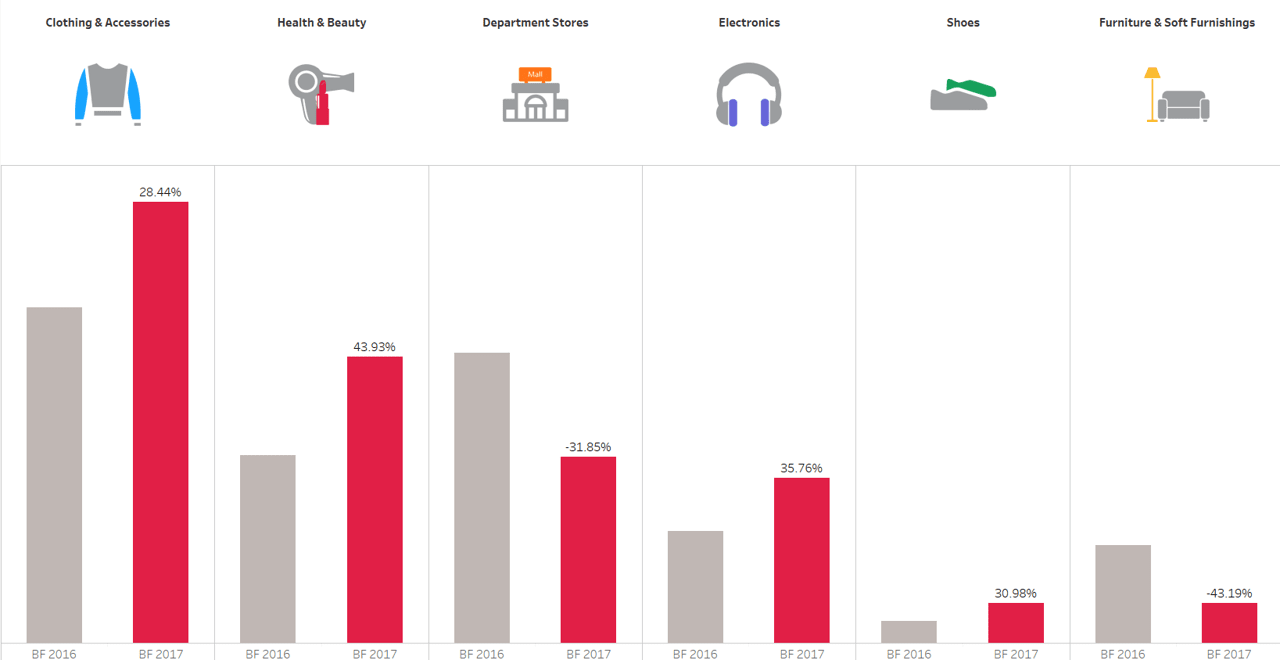

14:22: Sector splits. Here's the data to late morning showing the sector split across the network and the YoY variances:

_________________________________________________________________________________

14:10: Early conclusions: So we have around ten hours to go but the data produced so far leads us to the following initial conclusions:

- Certain European markets who have proved resistent to fully embracing Black Friday have piled on the numbers in 2017. France, The Netherlands and Sweden have all witnessed significant sales' surges.

- The UK's performance has been far more muted. Possibly indicative of the UK's adoption of Black Friday earlier and very probably because of the surge of offers up to a month in advance, has resulted in single figure growth this morning. The event is still huge, so context is everything.

- Smartphones have continued to surge. While desktop remains the largest driver of sales, in the UK handsets pulled in more sales for three hours this morning. Overall smartphone sales are up by around one-third.

- The usual big brand suspects have continued to pile on the sales. From a sector perspective, clothing and accessories is the largest driver of sales, followed by health and beauty and department stores. The first two categories have seen growth in market share while department stores have dropped back.

- UK consumers appear to have been relatively indifferent at midnight, again possibly because many offers and deals were already live.

_________________________________________________________________________________

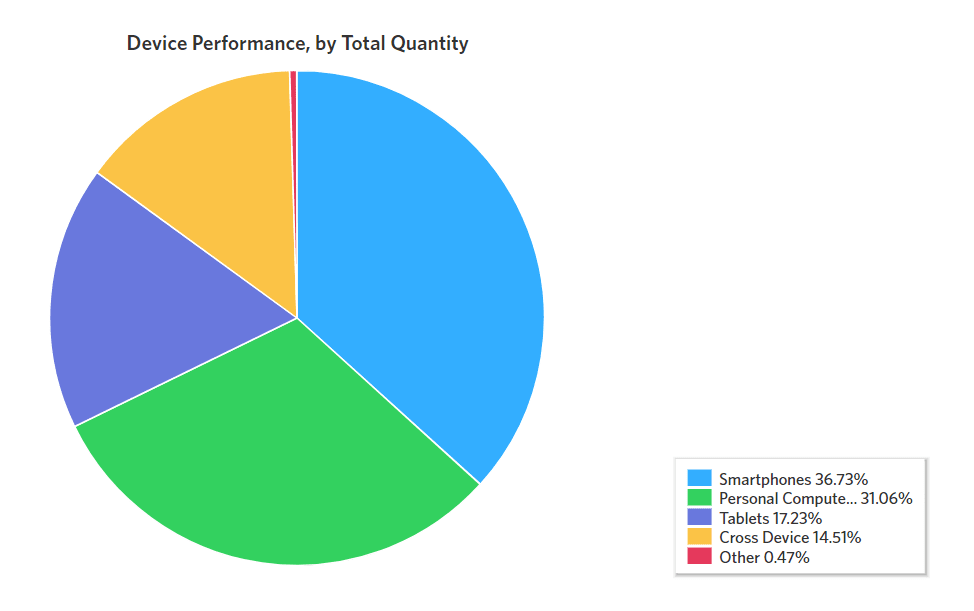

14:08: Red Letter Days emphasise value of cross-device tracking

One retailer who has already recognised the value of cross-device tracking is Red Letter Days in the UK. In an interview with their Online Marketing Manager, Dan Williams, he revealed how being able to track users across devices was helping them attribute Black Friday sales more accurately: "We are seeing more and more people come to the site on mobile but convert through desktop. With the start date for Black Friday promotions getting earlier and earlier every year it has become more important to us to make sure we have as much visibility on cross-device journeys as possible. Our average time between click and sale on one device is less than one day, whereas on cross-device sales it is around six days. Having cross-device in place means we will be able to see how much our early promotions help drive sales on the day itself."

_________________________________________________________________________________

13:57: The importance of next generation, cross-device tracking.

Having shared smartphone stats from across the network, one of the most important considerations is how sales track across devices. If you want to understand the additional impact - often on content, social and longtail blogger - then look at this sales mix for one of our major retailers:

_________________________________________________________________________________

13:51: Black Friday chaos ensues in stores in South Africa

While mature markets like the US haven’t seen the same level of crowds in-store this year it would appear that in other regions, where Black Friday has only recently been adopted, chaos is still something of a characteristic for the event and retailers have struggled to cope. These videos from South Africa are just one example…

_________________________________________________________________________________

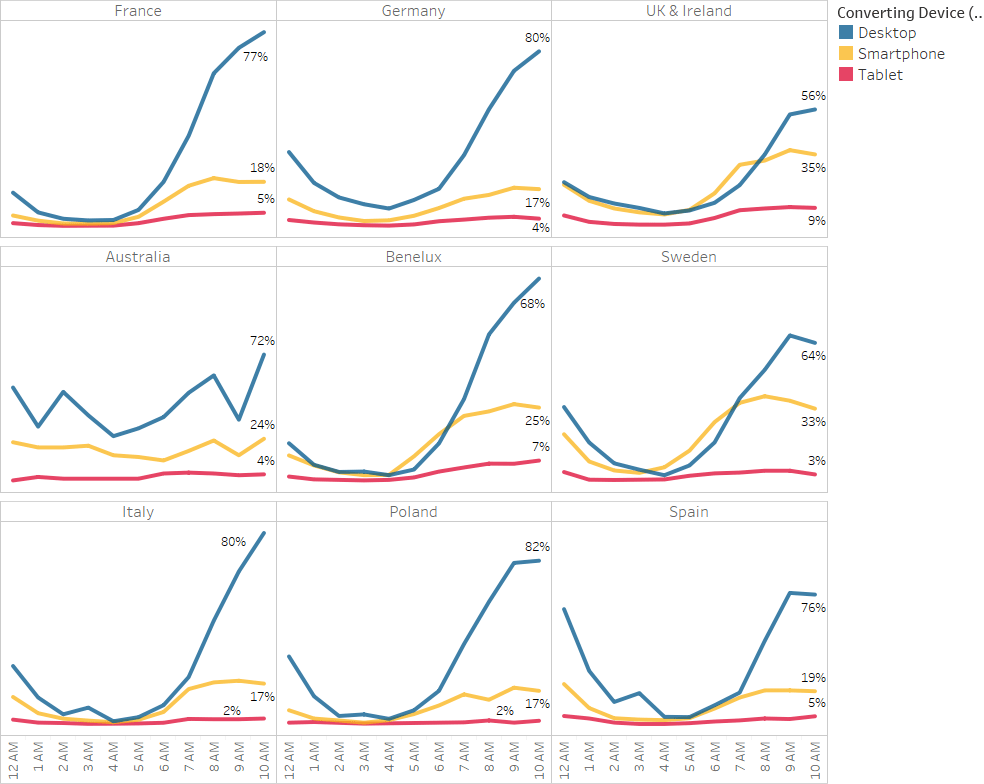

13:33: Smartphone stats around the world: One of the most interesting insights to consider across Black Friday is which devices drive sales in different markets. Here we present nine markets with desktop, smartphone and tablet splits to 11am this morning:

_________________________________________________________________________________

13:15: Good morning America!

It's approaching 9am across the Atlantic and Reuters are reporting that there have been distinctly fewer shoppers turning out in the early hours at high street shops and department stores in the US as more people turn to online shopping for their Black Friday deals. With US advertisers focusing more effort on ecommerce, agencies like PartnerCentric are helping them utilise affiliate sites to target these shoppers. Read more about their advice for Black Friday tactics in our recent interview with them.

_________________________________________________________________________________

13:01: Awin UK data echoes wider country trends

Retail Week's own analysis of Black Friday 2017 performance reveals a similar trend to what we're seeing on our UK network with declines in sales growth in the early hours (see 12:32).

In partnership with PCA Predict they've been monitoring sales trends and have been "surprised" by a 24% decline in purchases between midnight and 7am today. PCA Predict's head of marketing stated earlier: "This longer sales period has shifted the emphasis away from Black Friday being a major retail event in its own right, towards becoming part of a pre-Christmas mini season or “Golden Quarter” for retailers."

_________________________________________________________________________________

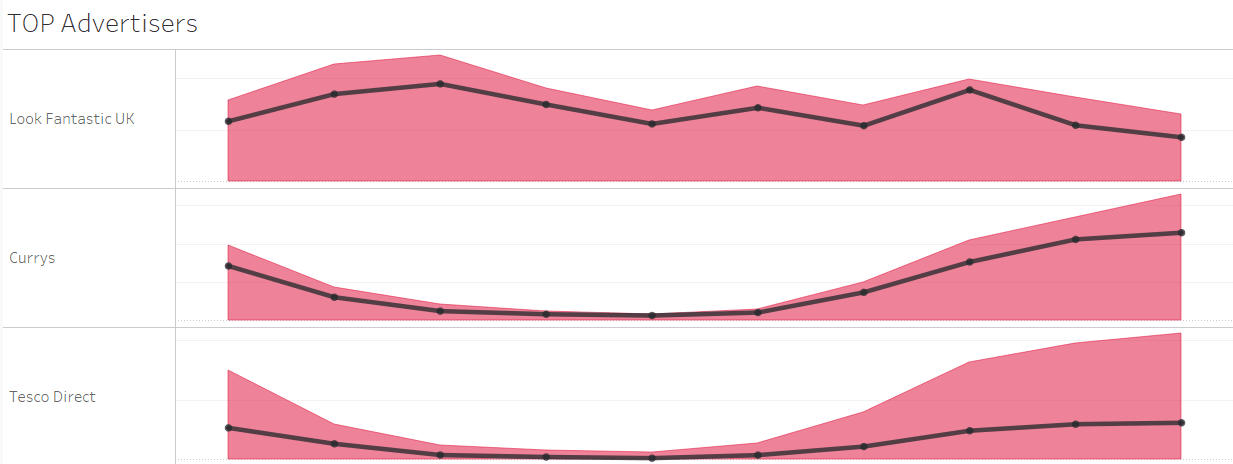

12:42: More analysis on Awin's top three advertisers...

Top three advertisers until 9am show consistent performance for two, the black lines here referencing the commission across the same time period by hour. Look Fantastic continues to pull in huge numbers in the early hours because of the attractiveness of their proposition to overseas consumers:

_________________________________________________________________________________

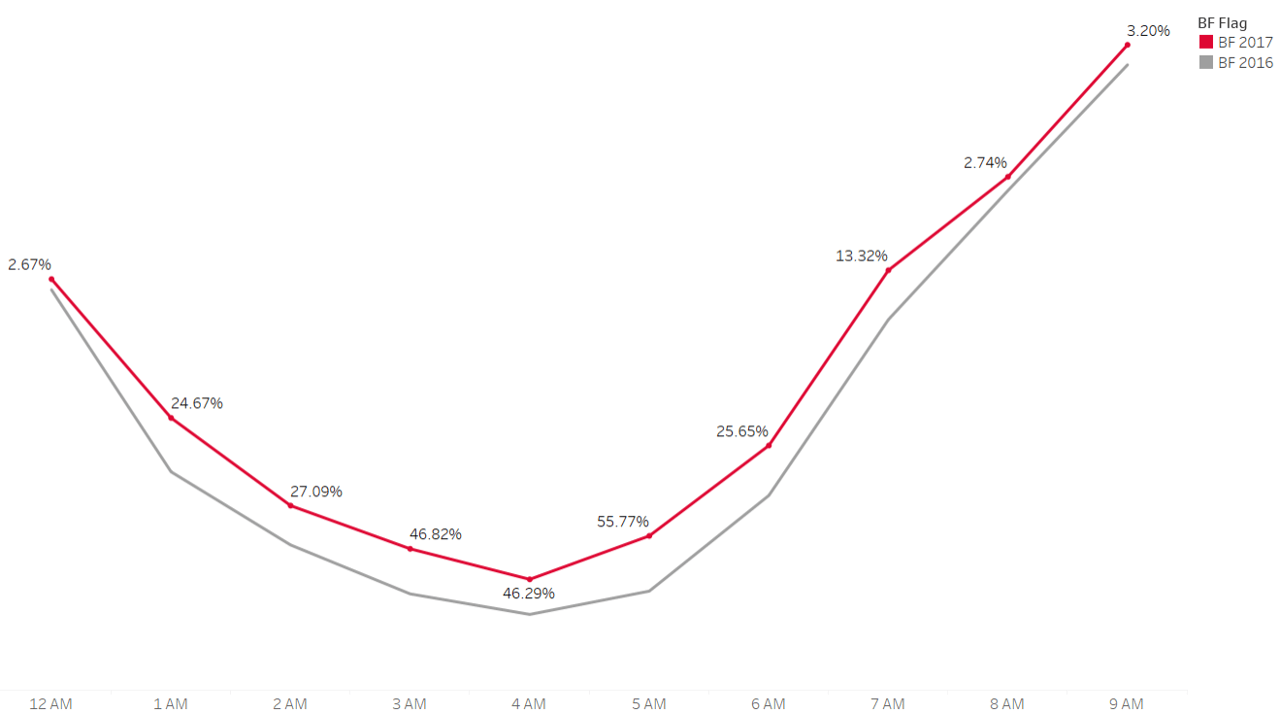

12.32: Global sales growth being driven by early morning shoppers

Across the network, yet again the early hours of the morning are proving to show the biggest YoY increases, with growth slowing as the sales rise.

The double digit numbers are disguising lower than anticipated UK growth; could the wall-to-wall offers that have been dominating the ecommerce landscape for the past two weeks have created buyer exhaustion?

The picture is mixed, the consequence of several big brands scaling back on certain promtions having a huge impact on their numbers. That said, those who've hit Black Friday hard are seeing high double and sometimes treble digit growth.

YoY growth, figures showing hourly percentage uplift on 2016:

_________________________________________________________________________________

12:28: Top three performing advertiser programmes so far...

LookFantastic, Currys and Tesco are leading the way as far as sales are concerned across the network this year. Will these three manage to retain the top positions by the end of the day?

_________________________________________________________________________________

12:10: Italian shoppers keen to take advantage of Black Friday deals

Italy's Consumer Protection and Advocacy Association (ADOC) have carried out a survey with consumers there to gauge their appetite for Black Friday this year. According to the results around 30% of the population are keen to take part in the deals that will be made available and prepared to spend on average around €250 each in order to take full advantage of these.

Italy's Consumer Protection and Advocacy Association (ADOC) have carried out a survey with consumers there to gauge their appetite for Black Friday this year. According to the results around 30% of the population are keen to take part in the deals that will be made available and prepared to spend on average around €250 each in order to take full advantage of these.

_________________________________________________________________________________

11:40: Top three global markets so far revealed...

Looking at Awin's global markets so far today, the top three markets for Black Friday sales growth year-on-year have been Sweden (+70%), France (+42%), Benelux (+39%).

_________________________________________________________________________________

11:07: Black Friday not a threat to Christmas shopping period say PwC

PwC data suggests that Black Friday is much more about people shopping for themselves rather than for gifting ahead of Christmas. Their findings came from a survey of 2,000 UK adults and Lisa Hooker, Consumer Markets leader at PwC said “Black Friday is not yet threatening the Christmas shopping period, with our survey showing the majority of purchases made over the weekend will not be gifts. Therefore, the first few weeks of Christmas shopping in December will still be vital for retailers, who will need to carefully manage their stock availability, IT systems and delivery infrastructure to deal with both shopping periods.

"Black Friday does have the potential to cannibalise the January sales, a shopping period more traditionally used by consumers to buy items for themselves - something shoppers may now be bringing forward to November.

“Many Black Friday sales have begun early and will extend past the weekend and could be turning into 'Black Fortnight' in some sectors. Whilst perhaps due in part to subdued October sales, it also reflects more planned promotions over this period. Although we predict another year of Black Friday sales growth in the UK, it does fall comparatively early this year, before pay day for many consumers. This may present a cashflow issue for some shoppers and could result in slightly more muted growth.”

_________________________________________________________________________________

10:25: First global numbers from across Awin network arrive...

The first overall numbers for the day are in and we're seeing positive year-on-year growth. We'll bring you some more granular detail over the next couple of hours but the first data is showing sales up just shy of 20% across the whole network.

_________________________________________________________________________________

10:22: Germany's largest electronics retailer prepared for huge Black Friday interest

Luisa Beck, Online Marketing Manager - Influencers & Public Relations fornotebooksbilliger.de, revealed the work that has been done in the background to prepare for this year’s event. “We equip our website for the high demand with six additional servers and carry out further optimisations in our system, so that customers can shop at any time on all platforms (desktop, mobile, app) trouble-free. Before the Black Weekend, special resilience tests are carried out to guarantee the perfect start to the action.” Read more about their preparations and predictions for Black Friday in Germany in our interview with Luisa.

_________________________________________________________________________________

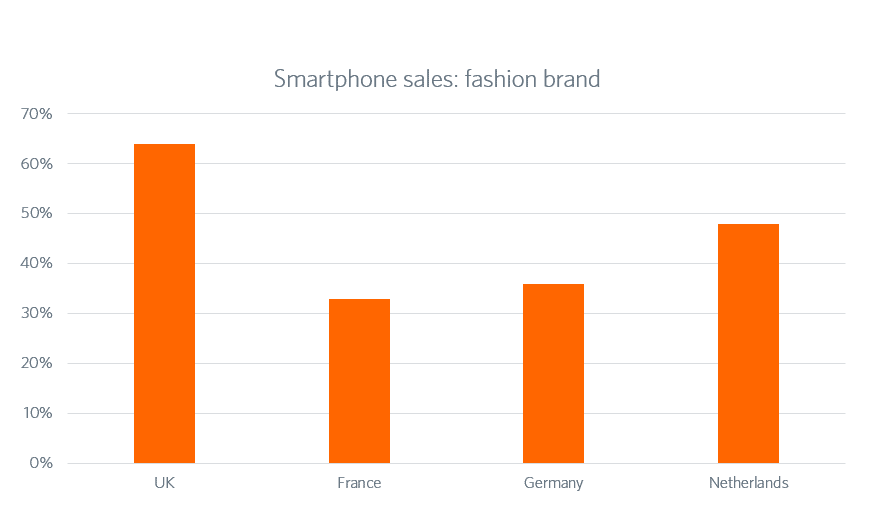

10:03: Mature markets show interesting differences

One of the interesting comparisons is between mature digital markets. Taking a fashion brand who run a series of programmes across Europe we assessed the percentage of sales tracking through smartphones. As you can see all markets are driving significant volumes of handset sales with the UK tracking two-thirds through smartphones and The Netherlands almost 50%:

09:45: Some of the most interesting stats that emerge in the first few hours of the day are around mobile as people search at midnight from their smartphones and on the way to work in the morning. Factoring in certain advertisers, such as fast fashion brands including Missguided and Boohoo, whose natural demographic is mobile first, and a powerful smartphone story emerges.

Looking at one of our key fast fashion brands we can see that 64% of their sales so far today are tracking through handsets, dwarfing desktop at just 23%.

_________________________________________________________________________________

09:40: Vouchercloud data viz highlights UK offer redemptions

We're big data viz fans at Awin Towers and so couldn't let the efforts of our friends at Vouchercloud go unnoticed. Using geo-location data, they're plotting where redemptions are happening across the UK. Rather coincidentally they're also linking to their best and most popular offers.

_________________________________________________________________________________

09:20: Smartphone sales up across the globe

Our first global stats of the day show that smartphones are trending up 30% in sales, as they continue their march to overtake desktop transactions. That's highly unlikely this year but we will be keeping an eye on some specific smartphone skewed advertisers to see where the mobile hotspots are.

_________________________________________________________________________________

09:17: What is this Black Friday business all about then?

If you're tuned into our live commentary then it's unlikely that you're completely ignorant of the shopping extravaganza currently kicking off around the world. But you may be unfamiliar with its historical origins and evolution in recent years. If so, have a look at our informative 101 guide to get you up to speed.

_________________________________________________________________________________

08:50:

Amazon Australia a no-show on Black Friday 2017

Continuing with the focus on Australia, the media Down Under was buzzing with expectation about the anticipated launch of Amazon's dedicated local site on Black Friday. However the launch failed to materialise on the day with only a limited storefront selling Kindle titles. With speculation rife in recent weeks that Black Friday would be the date of the big launch for the ecommerce giant, there is now much debate around when the launch will take place as this article from one of our affiliate partners, finder.com, explains.

_________________________________________________________________________________

08:25: Black Friday 2016 vs 2017

What happened last year? Black Friday 2016 was the biggest day in Awin's history. Tracking almost €118m in sales across the day, the network recorded in excess of 1m affiliate sales. It was a pivotal day for smartphones as Awin hit more than €1m in sales revenue for a single hour for the first time.

What can we expect this year? Black Friday 2017 presents an intriguing prospect. A glance at a number of UK retailers shows many of them have been in sale for more than a week already.

Will this dilute the impact of today's biggest deals?

Across the global network we saw around 50% growth in 2016; it would take something spectacular to see that figure bested. Double digit growth would certainly be positive. There are some other longer term trends that we won't be able to make conclusions about today.

Last year Black Friday in the US came within a whisker of overtaking Cyber Monday; could there be a role reversal in 2017? Similarly we'll be keeping an eye on smartphone numbers as they cement their position at the heart of many affiliate campaigns. There's going to be a lot of number crunching!

_________________________________________________________________________________

24/11 - 07:37

In Australia Black Friday is well underway and with just over six hours of the day to run there we have some statistics from our friends at Commission Factory:

- Measured at 2PM AEDT, 2017 Black Friday trending to beat 2016 by +52%.

- The massive growth is stemming from the increase in Australian retailers getting involved in the Black Friday / Cyber Monday weekend.

- If the trend continues we will see a new network record set, before 5pm AEDT.

- Popular verticals have been beauty, fashion and consumer electronics, especially gaming consoles.

Few people outside Australia know about Click Frenzy, a local event earlier in the month that also pulls in significant numbers, making November an absolutely huge time of the year there. These are the numbers from Awin for that event:

Sales + 26%

Revenue + 50%

_________________________________________________________________________________

Thurs 23rd Nov - 10:48

We will be reporting live on Friday across the day, pulling in the data from the network and trying to shine a light on the developments as they happen. At just after 8am we'll be bringing you our initial top level numbers and reporting on how Black Friday is performing against 2016.

The team will also be sharing individual success stories and graphs and charts that build a picture of the day as it progresses. In the meantime, don't forget to check our predictions for the day here.