Awin x Forrester Deep Dive: Have Opinions of Affiliate Marketing Changed in the Last Year?

Written by Richard Towey on 5 minute read

A year after surveying almost 700 senior marketers to gauge their thoughts on affiliate marketing, we order a repeat to assess whether things have changed.

Uncertainty over the future of third-party cookies. The rapid emergence of new partners. The growing presence of AI. You can pack a lot into a year, and don’t marketers know it.

Many recent events have worked in the favor of affiliate marketing, particularly the rising cost of paid media clicks and a reckoning for big tech. For its transparency, measurability, and ever-growing selection of partners, the affiliate channel provides a haven for prescious marketing spend.

But would these circumstances change how marketing leaders feel about the channel?

In 2023, Awin teamed up with Forrester to survey almost 700 marketers at director level or above to get their opinion on affiliate marketing’s strengths, uses, and areas for improvement. The results were used to create our original report looking into why more marketers are investing in the channel.

As part of our new “Deep Dive” series, we went back out to a fresh survey group at the end of 2024 to see if a similar group of marketers would share the same views a year later.

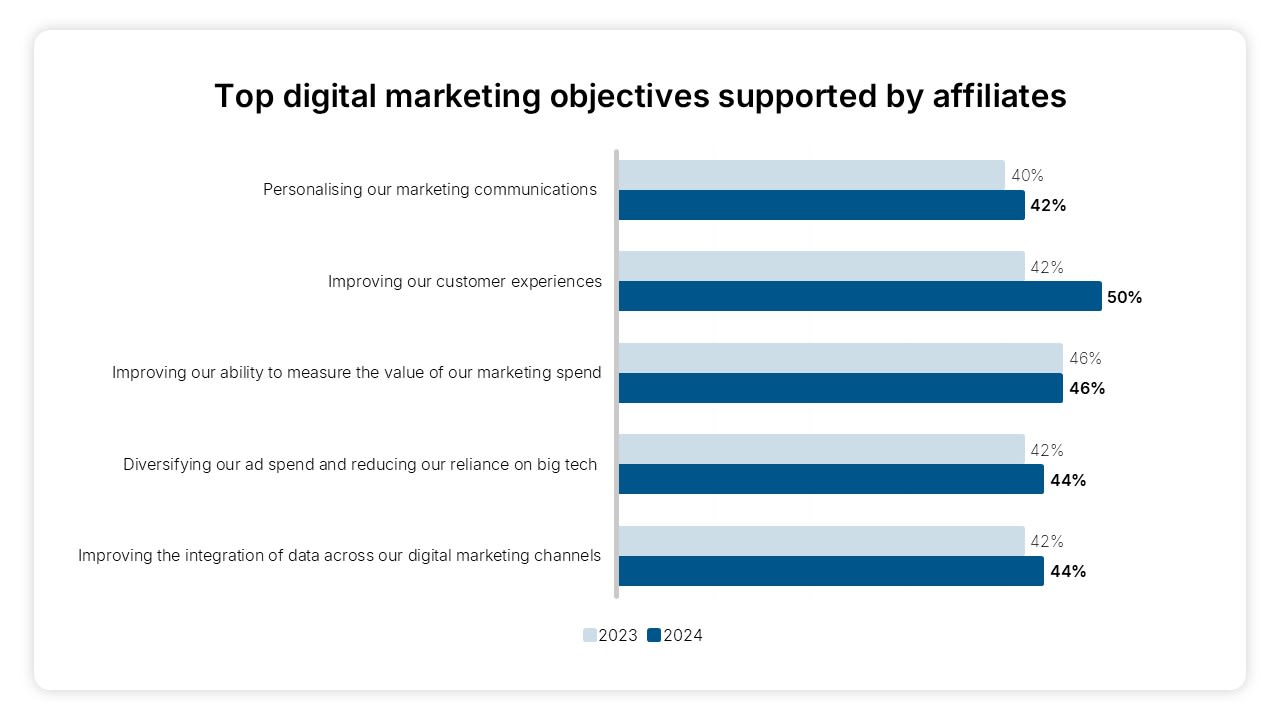

Top digital objectives supported by affiliate marketing

Top movers:

- Personalization (+26%)

- Improving customer experiences (+17%)

- Improving retention and loyalty rates (-9%)

Over half of the group (52%) cited “personalizing marketing communications” as a top-five digital marketing objective that could be supported by affiliates, making it the fastest-growing and number-one choice.

It’s easy to see the influence of tech partners here, with many conversion rate optimization solutions helping brands to engage customers on a 1:1 level. In a typical success story from 2024, Vodafone drove an additional 2,000 sales per month by using SaleCycle’s SMS and email tools to issue incentives and motivate customers showing signs of abandonment.

Similarly, we have “improving customer experiences” at number two. Cited by 50% of the group, this is another growing consideration, aided by the wider education piece on retailers outsourcing on-site features like product recommendations, virtual shopping assistants, and cart abandonment solutions.

As affiliate becomes more ingrained in certain digital marketing projects, it’s being used slightly less in others, at least according to our survey group. “Improving customer retention and loyalty” drops -9% vs 2023, which tallies with the decline in usage of loyalty/reward partners we’ll discuss later on.

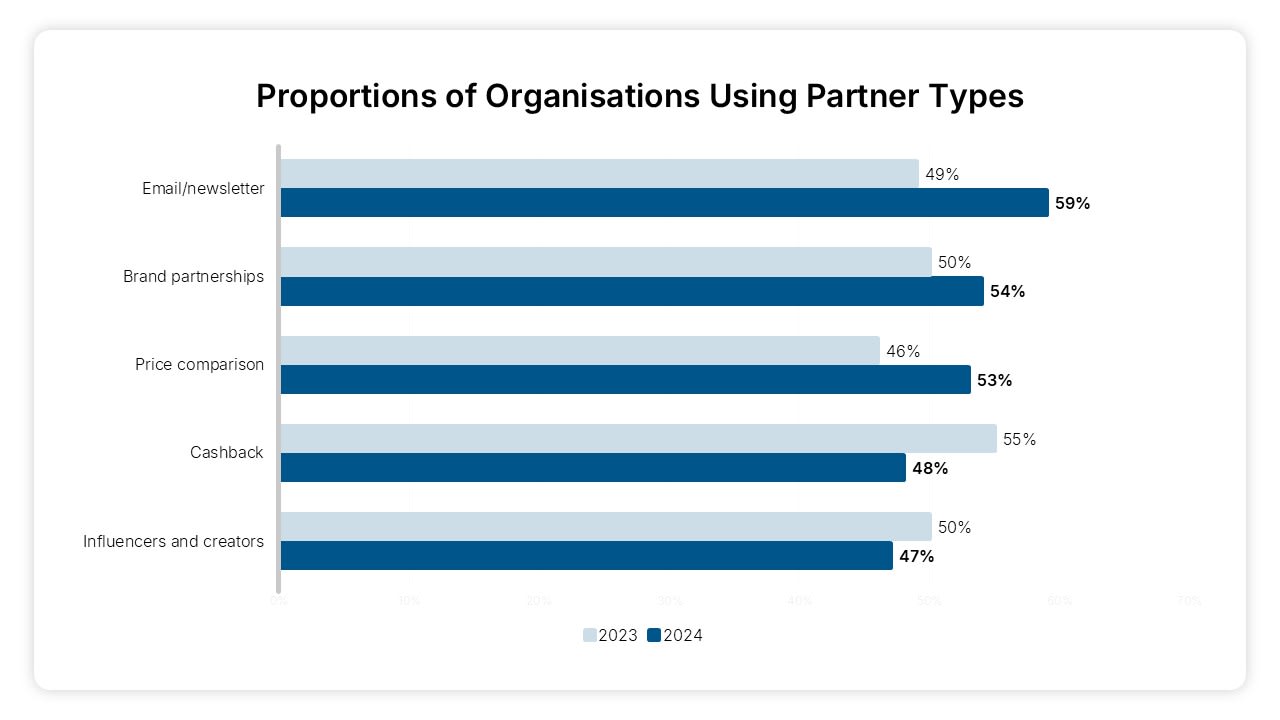

Use of affiliate publisher models

Top movers:

- Email/newsletter partners (+19%)

- Media house partners (-17%)

- Price comparison partners (+14%)

We saw slightly less movement when comparing the use of partner types between 2023 and 2024, but with some positive stories.

Email/newsletter partners enjoyed a resurgence (+19%) as the marketers went back to basics with an old favorite. The majority (59%) of the group had these partners in their program, far exceeding both growth and uptake for trending partner types like Buy Now Pay Later (BNPL) (-1%).

Brand partnerships (+8%) are also now on the majority of affiliate programs (54%), although Awin’s own data paints a truer picture of their contribution. Sales are up a staggering +93% year on year on our platform, making them our platform’s fastest-growing partner type in fiscal terms.

And who could forget a mention of price comparison partners? A staple of the affiliate marketing industry, their usage among the survey group is up +14% year on year, potentially buoyed by retailers attempting to reach price-sensitive customers facing tough economic circumstances.

As for the casualties, uptake for media house partners dropped -17%. A cluster of these affiliates had a rough 2024 as Google’s controversial site reputation abuse policy decimated the search rankings of those hosting coupons in a way that breached its hazy guidelines.

It’s also surprising to see loyalty/reward partners declining by -16%. At a time when retailers are desperately looking for ways to stay profitable, we’d expect a strong showing from partners involved in sustaining a customer base.

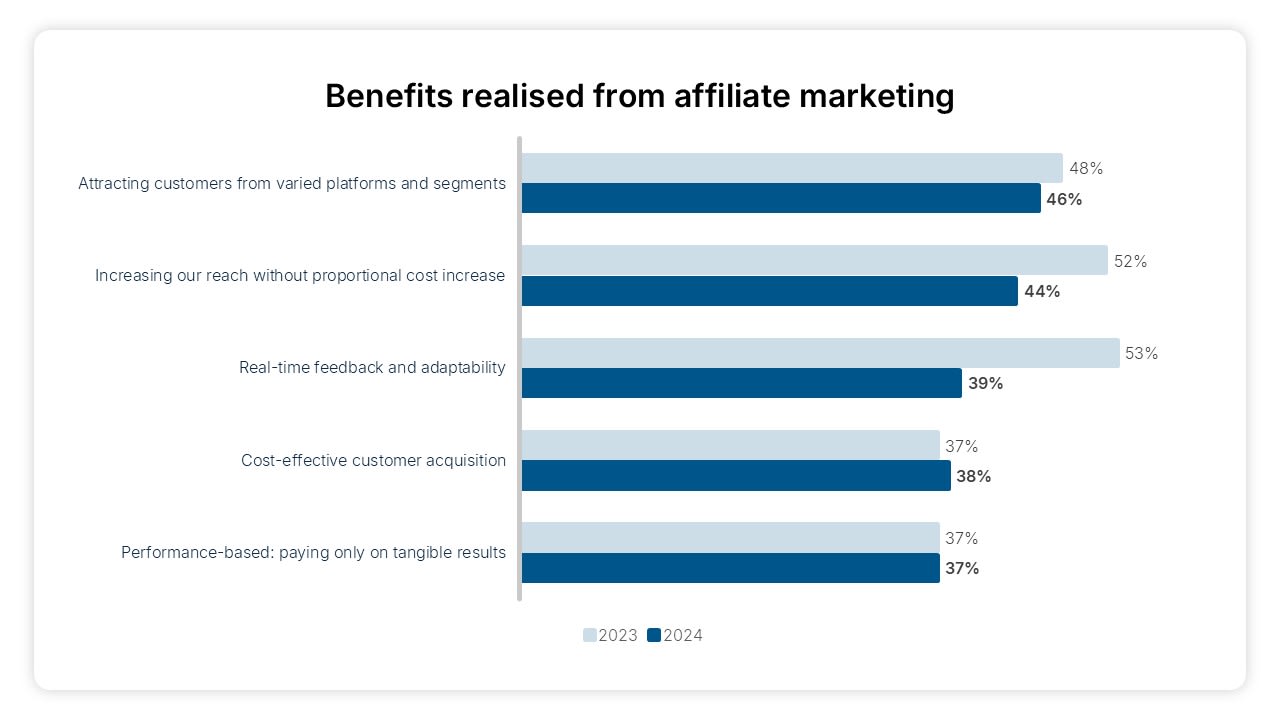

Benefits realized by affiliate marketing

Top movers:

- Enhanced reach and exposure (+86%)

- Improved customer loyalty (+86%)

- Real-time feedback & adaptability (-30%)

Largely minor declines for the most commonly cited benefits realized by affiliate marketing, including diverse traffic sources, scalability, and real-time feedback, have only created a more even spread of advantages for marketers to tap into.

“Enhanced reach and exposure” is up +86% (to 25%), while “access to niche audiences” increased +18% (to 24%). Whether it’s the influencer factor or increasing recognition of affiliates for driving upper-funnel contributions, considering more respondents cited “brand awareness and recognition” as an objective affiliate can support (+7%), there’s mounting evidence of senior marketers realizing the role of affiliate beyond sales.

“Improved customer loyalty” is another big gainer, up +86% (to 15%), which goes some way to softening the decline in uptake for loyalty partners and use of affiliate for improving retention rates.

Get a true state of play for the affiliate channel

For more insights on why senior marketers invest in the affiliate channel, and what would make them increase that investment, download the full Forrester report.

You can also view our recent webinar with Forrester to see what these findings say about the state of the channel in 2025.