Insight of the Month: Cyber Weekend 2025 Wrapped

Written by Alfie Staples on 10 minute read

Sales-day flops, pets getting Christmas presents, and rising tenancy spend all make our roundup of headlines from Cyber Weekend.

Quietly optimistic would be the easiest way to summarize expectations going into this year’s Black Friday and Cyber Monday shopping window. Though still far below pre-COVID norms, modest growth for the global economy in 2025 led to a reasonably positive build-up to retail’s golden quarter compared to the mood music of 2024.

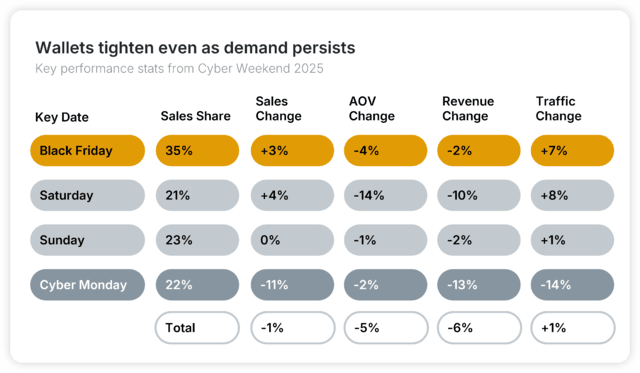

Awin’s Peak Shopping Tracker has been running since the start of Q4, keeping everyone informed on purchases passing through 30,000 advertisers and one million affiliates. Looking at a cohort of like-for-like advertisers to gauge a general feel for performance, the big numbers over Cyber Weekend were:

- Sales: -1%

- Revenue: -5%

- Traffic: +1%

Interesting. Were shoppers buying earlier? Were retailers less willing to compete?

Spend, sub-categories, purchase times, top sales drivers – we’ve looked in all the right places to pluck out some of the most interesting findings from Awin’s platform. Here is what we found.

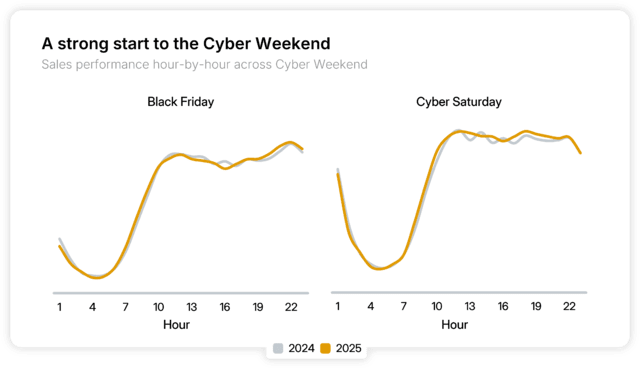

Cyber Monday flop has major impact on Weekend

Sales-wise, Cyber Weekend started on a positive note. Black Friday sales rose +3% year on year (YoY) and carried into the Saturday, which saw an even bigger rise of +4% YoY. An influx of purchases from 5:00pm until 9:00pm flooded into our network as workers clocked off and started to make decisions.

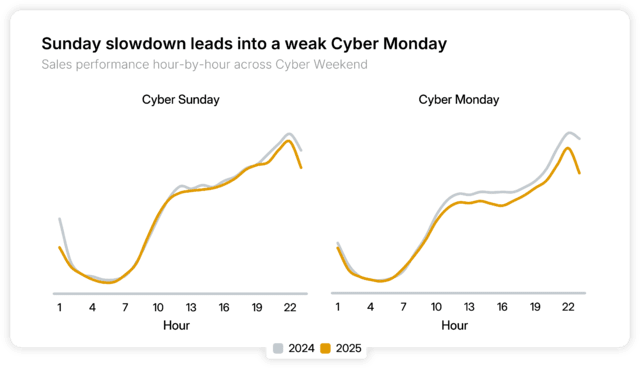

Then things slowed. On Sunday, the morning brought a relatively even set of readings before tapering off. By Cyber Monday, the gaps between 2024 and 2025 grew wider and wider, particularly around traditionally peak shopping hours like 9:00pm.

A look at performance over the entire Weekend showed just how disappointing Cyber Monday had been, as an -11% dip in sales YoY and a -13% decline in revenue fell way beneath the overall readings of -1% and -6% respectively.

Even traffic levels, which showed great promise in the early stages (+7% YoY on Black Friday and +8% on Saturday), fell by -14% vs 2024 readings as the appetite for mere product research slowed to a halt.

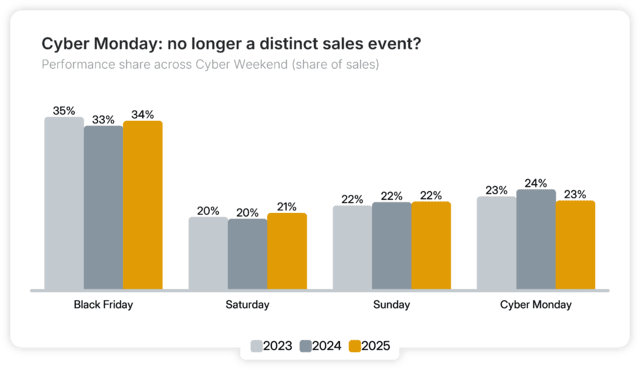

Has Cyber Monday’s demise been coming? Not so. Its share of sales from the Weekend (Black Friday to Cyber Monday) actually increased to 24.2% from 23.2% last year. At 22.6% for 2025, it just about scraped above the sales share of Sunday (22.4%), whose PR team must now be accepting all reasonable suggestions for names. (Savings Sunday, anyone?)

The obvious theory is that with sales running right through November, the concept of an additional event after Black Friday is slightly outdated. It seems consumers simply didn’t have the appetite nor the wishlists to accommodate it.

Across November, sales on Awin’s platform were up 1.5% year on year. Meanwhile, new headlines are being made much earlier in the month, like a +31% increase in sales YoY for Singles Day on November 11, China’s biggest shopping event.

Consumers make purchases but keep budgets tight

Overall, the biggest decreases were seen across spend rather than sales and research, indicating a desire to save rather than avoid purchasing altogether.

Revenue and average order values (AOV) were both down throughout Cyber Weekend despite positive readings for traffic.

These stats might also tally up with a small decline in the use of discounts, potentially due to a lack of availability, which we’ll cover a little later.

Tenancies help advertisers stay visible

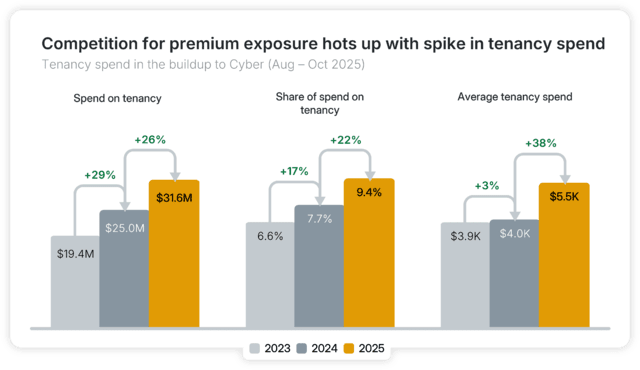

In recent years, we’ve seen a noticeable rise in advertisers straying from the paid-on-performance model by allocating tenancy spend to maximize the visibility of their promotions.

Actual tenancy spend, percentage of budgets spent on tenancies, average spend – it’s all up year, on year, on year.

Tenancy spend has been on the rise since 2023. This year, advertisers committed over $31 million in flat fees to secure prominent spots with their partners, up +26% YoY.

Awin advertisers spent an average of $5449 on tenancies between August - October 2025, 35% up vs 2024, and the percentage of budgets committed to these arrangements is now up to 9.4% (+21% YoY).

The increased use of tenancies shows a growing appreciation of the affiliate channel beyond simply paying for actions. Partners are now in a great position to sell enhanced exposure in front of their audiences, which are evidently valued by advertisers.

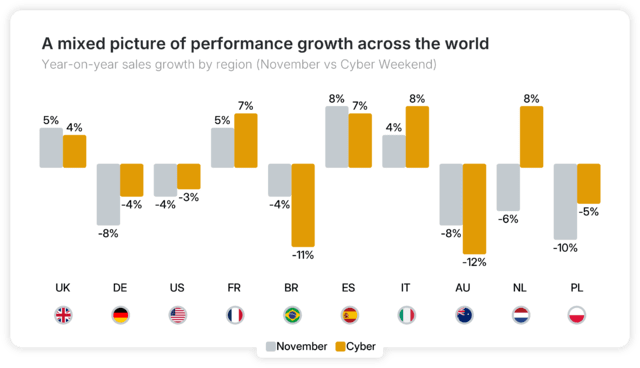

Europe shows resilience but US sees post-tariff declines

The UK, Italy, France, Spain, and the Netherlands all reported sales growth over Cyber Weekend. In fact, Germany (-4%) and Poland (-5%) were the only anomalies in a bright picture for Europe despite the ongoing cost of living crisis.

At the other end of the table, the US (-3%), Brazil (-11%), and Australia (-12%) all saw declines over Cyber Weekend, despite sales stabilizing a little more in November on the whole.

Much was made of the potential impact of tariffs on goods imported by US retailers going into peak season. Those increased costs resulted in many high-profile retailers raising their prices, and external analysis seems to confirm the impact on US Cyber Weekend sales and spend.

Advertisers get strategic by using brand partners to convert sales

Looking into sub-sections of partners, an increase in sales driven by brand partnerships, Awin’s fastest-growing partner type globally last year, appeared to back up a theory we had going into the Weekend.

In an effort to preserve their already squeezed margins, rather than discounting their own products, retailers could seize an opportunity to offer rewards from brand partners to incentivize their sales.

While established partners like cashback (-5%) and comparison sites (+7%) saw single-digit dips and peaks over Black Friday itself, brand partnerships turned in a +12% increase, raising its sales share by +7% YoY.

Story spotlight

As an example of the type of strategy powering things forward, look no further than reward programs. These saw a +9% in sales over Black Friday as advertisers passed on deals from their brand partners to unlock an extra stream of revenue on top of their peak season earnings.

Recently, we profiled EE’s launching of a reward program via brand partnership technology provider Tyviso, which led to a -5% reduction in customer churn.

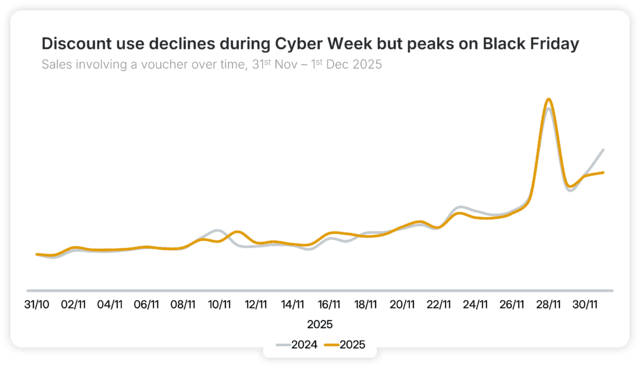

Use of discounts slows in the lead-up to crunch time

Trends like the leveraging of brand partnerships could reflect a wider story around retailers being more strategic in how they incentivize sales over key periods. Or, perhaps more significantly, it might be a sign that our biggest Black Fridays are behind us.

Sales involving a voucher were consistently higher YoY in the weeks leading up to Sunday November 23 as advertisers went earlier with their sales. We’d have expected a reliably high use of discounts to at least maintain those levels heading into Cyber Weekend. Instead, five days out, we saw the reverse.

Fewer sales were being driven by discounts on Monday November 24, then Tuesday, then Wednesday. It took Black Friday itself to reverse the trend before discounts went back to having less of an impact vs 2024.

To reiterate, this is sales involving a coupon rather than sales from coupon partners themselves, which adds a fresh lens to the overall outlook for incentive-led strategies.

Influencers, tech partners, and brand partnerships were expected to play a bigger role in distributing discounts this year in an effort to reach new audiences. In fact, influencer sales involving a coupon over Cyber Weekend declined by -9% YoY. Did consumers already know what they wanted, therefore stifling their capacity to discover new products via content creators?

Considering the potential influence from advertisers (i.e. the supply of discount codes) makes the situation even more puzzling. Either advertisers should have gone earlier with their sales to maximize the Black Friday window, or we’d have seen fewer sales involving a discount over Black Friday itself. Instead, we got both.

These mixed signals could fit the narrative of a sales event in transition. And at this crossroad, 2026 could bring anything from a more even spread of sales and less participation over Cyber Weekend to a dip in peak season discounting altogether.

Pets and pet care lead the sub-sector pack

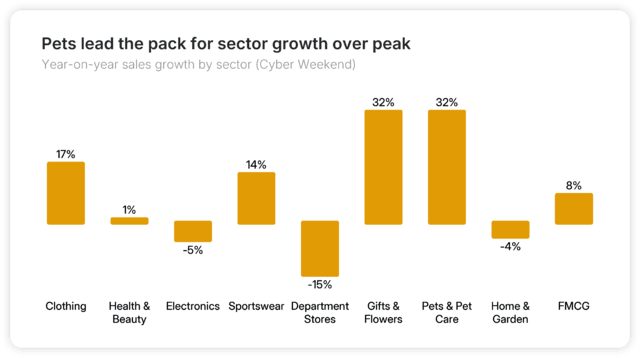

Looking into individual sub-sectors, many were happy to buck the overall trend by reporting year-on-year increases in performance, with one in particular catching our eye.

Safe to say a few dogs and cats might have something under the tree this Christmas.

Pet ownership is rapidly rising in core markets like the US, which saw a +15% increase in 2024. How we shop and care for our pets is changing, too, with owners’ increasing awareness of wellness, comfort, and engagement leading to a boom for the pet accessories market.

Pets and pet care was a big winner throughout November, reporting a +22% sales increase YoY. But it was the Cyber Weekend where it really shone – a +32% improvement matching or bettering efforts from established peak season players like gifts and flowers (+32%), sportswear (+14%) and clothing (+17%).

At the other end of the scale, one of the deepest dips over Cyber Weekend was seen in Home and Garden (-13% for November, -4% over Cyber Weekend), which has been in decline since September.

Story spotlight

Lots of pet and pet care retailers are taking to the affiliate channel to capitalize on the increased demand for their products.

If you’re interested in a tale (rather than tail) from the front line, see how pet retailer VioVet activated AI product bundling solution Increasingly on its Awin affiliate program to capitalize on the near endless amount of cross-selling opportunities for pet owners.

Department stores see declines as consumers go direct

Finishing on the sector analysis, department stores saw a decline in sales through both November (-9%) and Cyber Weekend (-15%).

It’s made more interesting when positioned against growth for some of their main suppliers, including:

- Health & Beauty (+7% for November, +1% for Cyber Weekend)

- Clothing (+15% for November, +17% for Cyber Weekend)

- FMCG (+14% for November, +8% for Cyber Weekend)

Are consumers choosing to seek out brands directly rather than making impulse buys? Awin has shared plenty of stories of brands using the affiliate channel to increase their direct sales, and the signs indicate it could be working.

Story spotlight

To sell more on its own site, beauty brand Umberto Giannini needed to enhance its experience. It rapidly deployed Envolve’s Virtual Shopping Assistant, an AI-powered chatbot, to answer customer queries and deliver relevant product recommendations.

If you’re interested in learning about how affiliate tech partners help brands sell more directly, check out our interview with Rosie Donoghue, Digital Marketing Manager at Umberto Giannini, and Dan Harding, Commercial Director at Envolve Tech, on the Awin-Win Marketing Podcast.

Our thoughts

Cyber Weekend 2025 highlights a retail landscape in flux. While overall sales dipped slightly, early-November activity, rising tenancies, and new strategies provide positive signs that advertisers are experimenting with new ways to maximize their sales periods while protecting margins.

We’re at a point where peak season is getting further away from being defined by the success of a single weekend or day. And if that continues, the strategic outlook is fascinating.