What do the current macro health and economic influencers mean for both customer confidence and performance marketers?

Since March 2020 more customers have been shopping online than ever before. The Highstreet may now be back open, but the continued threat of COVID-19 is still driving people to internet retailing. It has widely been reported that many years of online retail growth has been compacted into a number of months; in February this year internet sales were reported at 19% of total retail sales, in the peak of lockdown in May this was close to 33%. Even with the stores back open, in August this is online share is holding strong at near 27% (ONS). This translates to UK consumer spend forecasted at £141.33 billion online this year, up a massive 34.7% from 2019 (eMarketer).

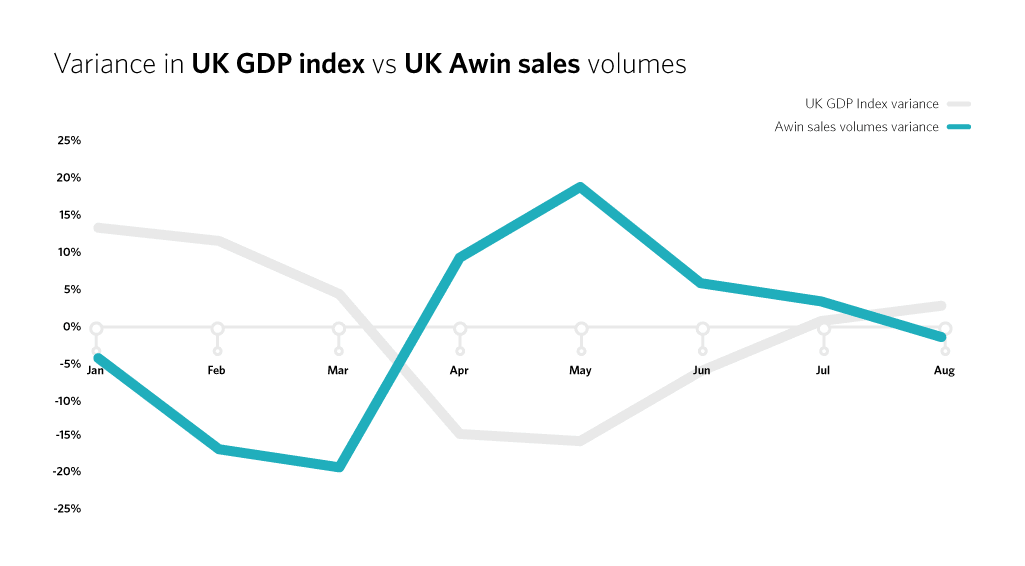

However, on the flip side of these impressive online growth stats the economy is struggling overall, and fears of an upcoming recession dampening customer confidence. The pandemic led to the biggest fall in quarterly GDP on record at -20% in Q2. Compare this to the 2008 Recession, where GDP shrunk by no more than 2.1% in a single quarter and the huge detrimental impact of the covid19 on the economy is starkly clear.

The UK has seen growth again each month since May; but after a promising few months with lockdown easing measures announced, this slowed again to 2.1% in August. When comparing the variance in UK GDP to the variance in Awin’s sales performance data we can see there is almost an exact negative correlation – the decline in UK GDP index mirrors the growth in Awin UK sales:

Figure 1: Variance in UK GDP index vs UK Awin sales volumes

This phenomenon was intrinsically linked to nature of the pandemic and lockdown rules, and won’t necessarily be repeated in a longer term downturn. Therefore there are still two big questions on most marketers minds - how will customers behave in an extended period of recession driven by COVID-19, and what does that mean for the performance channel? There are two key areas that can provide some guidance:

1. Customer behaviour and online activity in peak lockdown

Firstly, let’s rewind back to peak lockdown in April and May when we could only leave our homes for an hour a day, shops were shut and even outdoor meetings with those outside of your household were forbidden. This Autumn’s ‘rule of six’ and tiering system suddenly doesn’t seem quite so restrictive.

Sales volumes across the different verticals tracked through Awin UK saw stark differences; clothing sored whilst travel fell off a cliff, home and garden increased whilst Finance and Telco stayed relatively consistent. These shifts in sector performance were heavily influenced by new growth markets, with athleisure wear being the prime driver behind the increase in clothing sales. Health and beauty increased were initially driven by ‘functional’ beauty but as lockdown progressed and news of the economy opening spread this growth shifted to luxury products and brands. There was a rise of Direct to Consumer activity, and we saw huge growth across the micro SME segment supported by Awin Access. This led to a 5% shift in spend away from Awin’s brand portfolio towards the SME base, which was also driven by some larger retailers supply issues. There were increases of customers choosing alternative payment options, such as Klarna, offering the chance to spread the cost of products without an interest charge.

Customers were still reactive to seasons, with the Home and Garden vertical increases interlinked with the Easter weekend and warm weather, and can be demonstrated now by the huge 179% increase in Google searches for outdoor heaters over the past two weeks! (Google trends)

All this demonstrates the micro niches and fast paced nature of the digital environment, the importance of reacting quickly and having a secure supply chain to be able to take advantage of sudden changes in demand.

2. Performance marketing trends from 2007-2009 during the height of the last recession

Secondly, lets rewind the clock further and travel all the way back to 2008.The publisher landscape was very different back then. Cashback was still a relatively new concept, and the main affiliates driving sales for advertisers were price comparison, PPC and content. However, the recession fuelled the growth of a key publisher type that has become one of the main volume drivers of the channel due to its resonance with consumers - VoucherCodes

Dampened consumer confidence led to more price consciousness, and the ‘savvy’ online consumer was born. They demanded the best deals and weren’t afraid to shop about to find them. User Generated Content also started to flourish, and MoneySavingExpert and HotUKDeals became havens for these new savvy consumers to share deals and offers.

Looking outside of the affiliate channel, in January 2008 Clickz reported seven top online marketing trends including the rise of social media, search marketing extending to Mobile, and behavioural targeting becoming more widespread. Not all of those predictions turned out to be true (Myspace grabbing share from Facebook?), but a focus on the customer and reaching them in their chosen environment is what ultimately helped drive continued performance. The Drum agrees, and as part of their article discussing what marketers should do in the face of the upcoming downturn, they advise to ‘do less better’ allowing squeezed budgets go further, to invest in digital transformation, and importantly to focus on the customer.

What does this all mean for performance marketers looking forward?

There are five key learnings to consider:

1. The acceleration of digital will continue

The pandemic is creating a snowball effect; customers have been forced online and we’ve seen reduced the footfall in the Highstreet. Reduced Highstreet profits means retailers are shifting budget and focus online too. Drapers recently reported there have been a record number of UK store closures in the first half of 2020, with 60 closing a day. There has also been an increasing number of CVAs as advertisers pivot to focus on online offerings and reduce costs through reducing their retail estate footprint.

Whilst a pandemic is an uncertain time, and the huge increased in online performance from lockdown wont continue long term, it’s clear that a increased focus on digital from both advertisers and consumers is here to stay.

2. Clear KPIs with agnostic measurement is paramount

The digital marketing environment was complicated enough before the pandemic, and this heightened focus will only add to the complexity. The abundance of digital marketing channels each have their own tracking methodologies, reporting and platforms, and adding to the confusion each has its own success and payment metrics. Some work to CPC, others to CPM with likes, shares and views added on top.

There are also an plethora of new marketing technologies, that overlay and interact with digital media buys and site content. These offer additional inherent value, but also operate to their own self-reported success metrics. The result is an overlapping digital media and technology mix, but with the individual components of this mix reporting and measuring success in silos, ultimately obscuring the true ROI.

One solution to ensuring agnostic and aligned measurement is through using a single ecosystem, such as Awin, in which all participants have control over how they collaborate and contract with each other. Performance marketers can not only activate and deactivate these technologies, but also track, report and pay for them on a CPA basis alongside their other media channels.

3. The balance between performance and brand budgets is delicate

The acceleration of digital and reduced consumer confidence means more considered investment decisions are vital. Even with the strong ROI the digital performance channels deliver, performance marketers are often working to tightly controlled budgets, and the pandemic has tightened purse strings even further. The Gartner 2020 CMO Spend Survey reports that 44% of CMOs have seen their budgets cut this year, and alternative methods of digital brand marketing are becoming much more important as economies around the world enter recession and the fight for survival begins.

Insightsforprofessionals.com discusses that the core of any successful marketing strategy is the ability to build a meaningful and lasting relationship with your customer, and how brands can get ahead of the curve through telling stories they connect to and offering solutions through the pandemic. This balance between brand messaging and performance channels is therefore of utmost important - ensuring the stories are told, but they convert to ROI.

4. New Publisher types will emerge

The 2008 recession led to the development and success of the VoucherCode segment, and it will be interesting to see what new types of publishers emerge from the pandemic. In the past 12-18 months the most prominent new partner type witnessed across the Awin network has been the technology partners. This latest wave is only just scratching the surface of its potential. New scale and sophistication can be attained through digital marketing technologies integrated in Awin’s Mastertags. These powerful technologies leverage machine learning, AI, and connect into new devices within the ever expanding world of IoT.

Whether a technology partner or another new emerging publisher type, these new opportunities need to be embraced. They are driven through entrepreneurship and customer need, and testing new partnerships in line with long term strategies will help find new sweet spots.

5. A consistent strategy produces stronger results

We know from many studies including the famous Harvard Business Review research that is it important to continue marketing during a recession. However at Awin we have found the consistency of strategy is as importance as the consistency of spend. We have previously conducted research into a selection of fashion programmes, and categorised them into those who had a consistent strategy over a three year period, and those who changed strategies.

We found that also almost every core programme KPI was positive when the programme strategy remained consistent versus a programme with continuously fluctuating channel objectives. This included higher increases in traffic, sales, revenue, ROI and AOV.

Outside of these key areas of focus, there are other considerations and best practices to adhere to which will help ensure success through a prolonged period of economic downturn. As an industry its vital to ensure tracking and rewards are supportive and fair, and communication is open, honest and frequent.

We are fortunate to have the data and learnings from both this extortionary year and the past recession to help guide us, but ultimately it will be down to individual performance marketers to understand their customers, optimise budgets, and measure agnostically to support online growth during the months and years ahead.

Interested in hearing more insights from Awin's Client Partnerships Team? Sign-up to our newsletter here.

For any questions on the team's research please feel free to reach out directly.