The New Loyalty

The industry is incredibly dynamic, and travel companies who want to continue growing should evolve and innovate to address the needs of the market. Travel advertisers use voucher codes and increased cashback rates as a tool to encourage users to transact online.

In an age of real-time and user-generated content, the way that travellers engage with brands is changing. The “social consumers” rely on Buzzfeed or TripAdvisor to choose their hotel or browse Instagram for holiday inspiration. Data shows that people watch travel videos more than ever before. As an affiliate network, Awin were the first to launch a partnership with Monotote, an e-commerce technology that transforms inspirational images and video into shoppable moments.

As travel advertisers focus their efforts on diversifying their publisher mix, they should adjust their objectives and strategy to accommodate the needs of their new partners.

Travel publishers should invest in their own social presence and build their brand in a way that makes them relevant and trustworthy to the eyes of their digital travel audience.

Publisher empowerment

New travel publishers can struggle to monetise their content. Travel is a unique vertical within affiliates due to the complexity of the customer journey and the low customer retention rates.

The journey will often start at the point of inspiration from a content-based website or platform. At this stage you will usually find affiliates who sit at the top of the funnel, like influencers or vloggers, and the chances of converting are lower.

In the next stages of the customer journey – from confirming to comparing and booking - we find price comparison and incentive publishers. However, loyalty is still low because the customer is after the best deal regardless of the website that provides it.

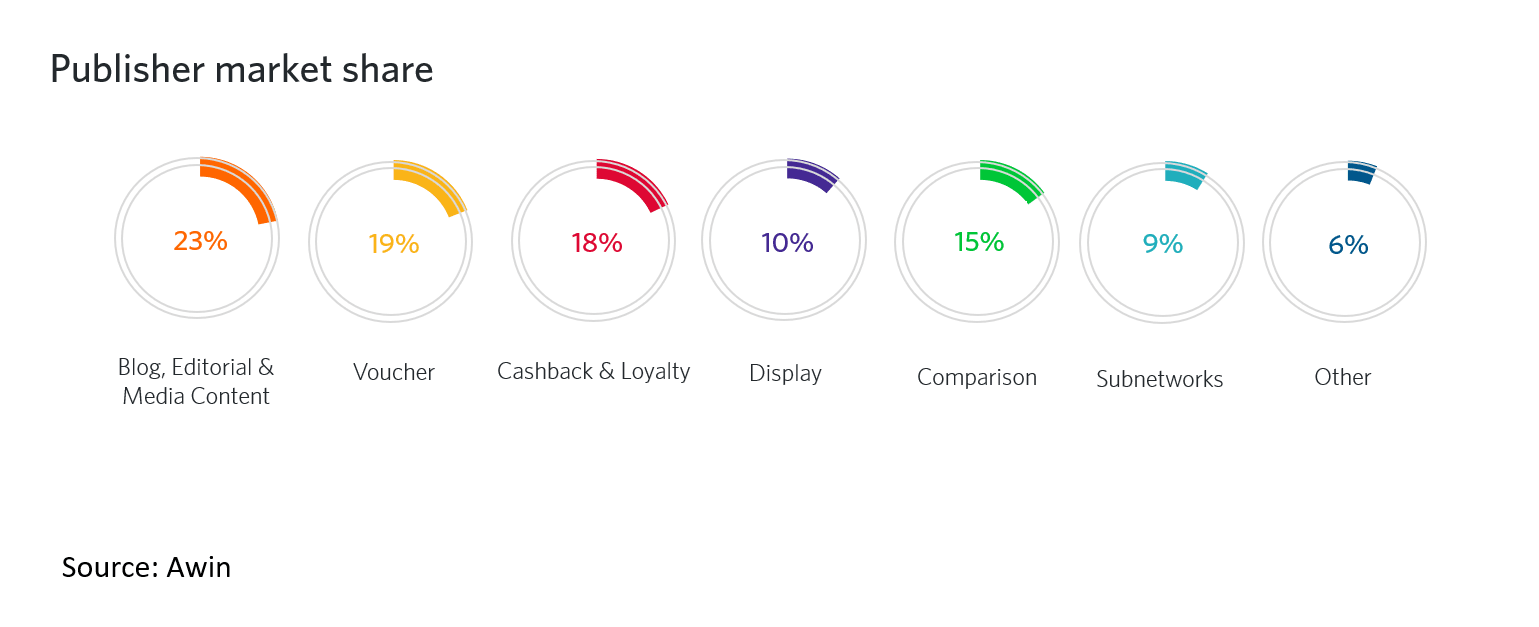

This behaviour creates a lot of traction in the publisher funnel. Many and different affiliates show up in a single customer journey “fighting for the last click”. The graph below, showing the distribution of sales between the different publisher groups in 2017, demonstrates the high level of competition.

Consider now that most bookings take place in Q1 but operators and airlines will make most of their profits in the second half of the year when people go on their holiday. This has a tremendous impact in validation rates and payment. According to Awin data, the average pay-out time in travel is 130 days, but it can take up to 500 days for a commission to be released.

Although this is the nature of travel, smaller and new publishers find it increasingly difficult to support their businesses under the strength of the financial pressure. As a result, the number of new travel publishers joining the vertical is declining YoY and so is engagement of existing affiliates. Network data shows that one in four new travel affiliates will leave the channel within the first 12 months.

As the trend evolves, advertisers should focus on onboarding and supporting their publisher base to drive programme value.

Tips for Advertisers

- Form consistent marketing and business objectives across all channels. If your brand is new to affiliates, having a clear vision will allow you to choose the right commission structures and additional tracking methods.

- Scale the level of communication. Knowing what the behaviour is you want to incentivise, Awin can consult you on alternative tracking and attribution models that will make sense to your business but also to the publishers. It will be easier to achieve the desired result when all parties are working towards the same direction.

- Travel brands that have reduced validation periods saw a positive effect in affiliate engagement. Validating sales before stay date can help reducing pay-out time and empower long-tail publishers. Advertisers can achieve this by applying cancellation rates to all sales or following this approach only for premium publisher groups.

All the above strategies constitute a long-term investment, since they can improve publisher loyalty and allow growing affiliates to re-invest that money back to their business delivering further growth.