How 2021 tells us what to expect for the Telco sector in 2022

Written by Alex Parmar-Yee on 8 minute read

As consumers depend on reliable communications and desire improved online experiences, the telco sector continues to innovate and adapt as we approach 2022.

For many sectors 2021 was about assessing the long-term future that was put in place by the various shockwaves of 2020. Looking at the UK telecoms sector in particular, the market had just gone through a year where reliable communications had been essential to functioning within society. Telecoms merchants were essential in providing reliable connections at home for video conferencing; mobile phones that enabled Track and Trace as well as at-table ordering; or even providing access to the latest TV and films to occupy those lockdown days. Before presenting any predictions, I think it’s important to look at 2021 to assess what may happen in 2022 and beyond.

Less churn within broadband

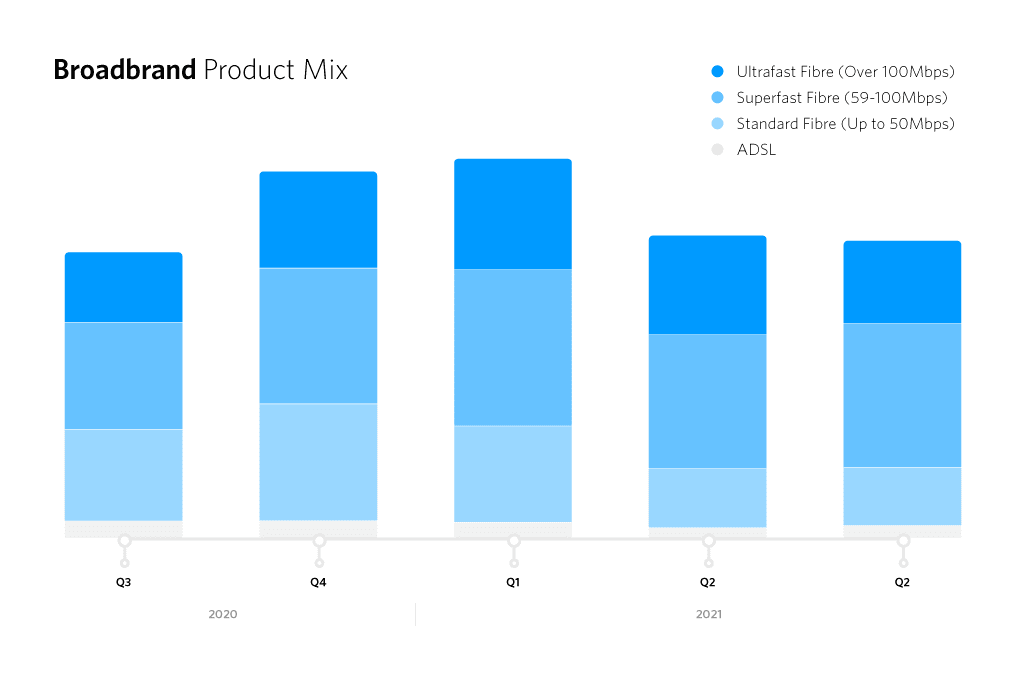

Within broadband, this year has been very much shaped by the impact of the accelerated shift to premium fibre products which can be partially attributed to working, learning and socialising from home demands. Awin’s market data showed that whilst the mix for fast products remained strong, volumes really suffered in 2021 even as we hit the expected out-of-contract points for lockdown switchers. I explored the impact of whether the end of lockdown in the summer was a driver, but as volumes remained low even as the short British summer eclipsed, it is clear something else was at play. For years, ISPs were keen to push fast products as not only was there a higher MRC but also, the thinking was that reliability would mean that churn would decrease as people were more satisfied with their service. With a huge chunk of the population moving to faster products the switching mentality may have shifted.

Lack of handset hype

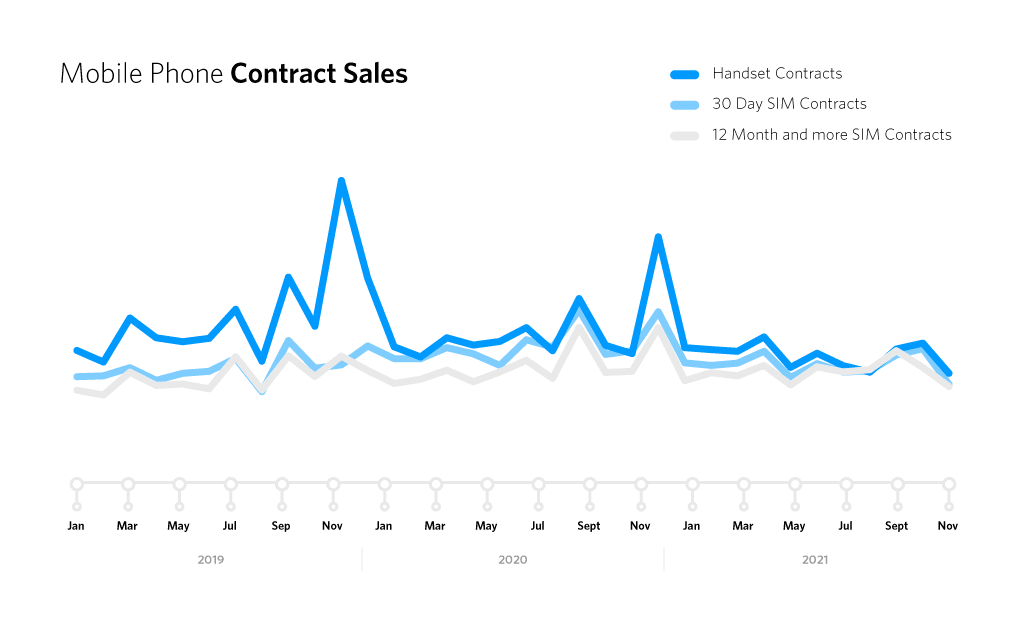

Within the mobile communications market, 2021 saw further continuation of a deflated handset market. 2020 saw the handset market struggle as handset launches failed to generate the hype of years gone by, coupled with the global chip shortage affecting launch dates and supply. 2020 did see both short- and long-term SIM contracts grow. This year handsets continued to struggle with a combination of a lack of handset innovation, meaning that people held onto their existing handsets, but also the increased choice for people to buy handsets outright with more affordable devices and alternative financing. The slow handset market again shows a change in consumer behaviour within the market. There are plays at moving away from the stagnant monochrome glass rectangle with more folding phone releases, but their impact is yet to materialise.

Within the mobile communications market, 2021 saw further continuation of a deflated handset market. 2020 saw the handset market struggle as handset launches failed to generate the hype of years gone by, coupled with the global chip shortage affecting launch dates and supply. 2020 did see both short- and long-term SIM contracts grow. This year handsets continued to struggle with a combination of a lack of handset innovation, meaning that people held onto their existing handsets, but also the increased choice for people to buy handsets outright with more affordable devices and alternative financing. The slow handset market again shows a change in consumer behaviour within the market. There are plays at moving away from the stagnant monochrome glass rectangle with more folding phone releases, but their impact is yet to materialise.

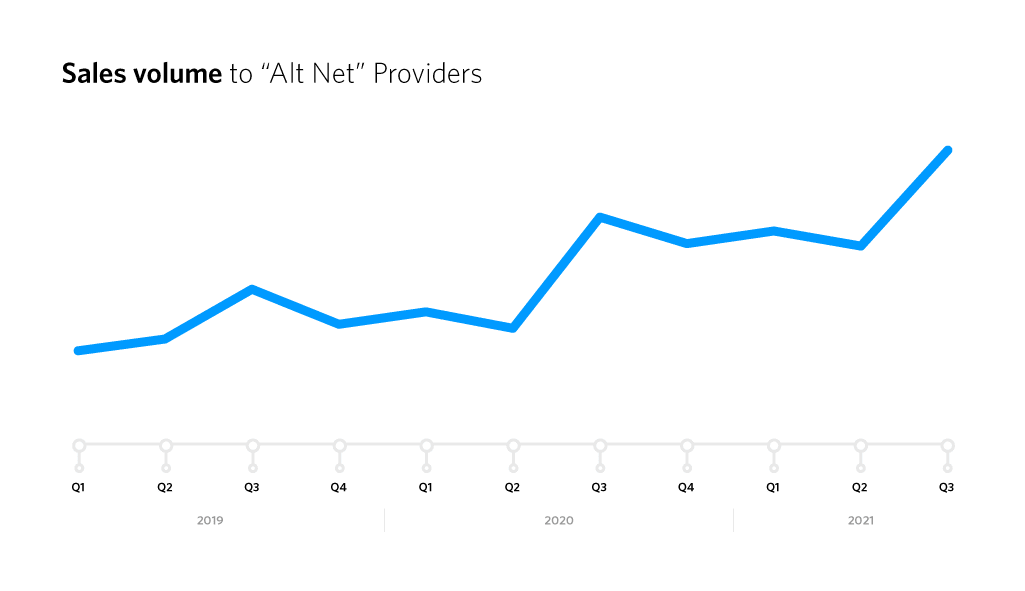

The absence of handset innovation isn’t indicative of the whole telecoms space. There’s been a lot of movements across a number of areas. Within media streaming we’ve seen more solutions to aggregate the growing number of streaming options with Google TV software and Sky Glass hardware. In a bid to move consumers away from copper-based products like FTTC, we’re also seeing a boom in local fibre networks as investment flows in. Even Openreach reliant providers are being pushed to this with the “Stop Sell” of copper products in specific locales. And it’s not just fixed line, the increased number of players straddling mobile and broadband such as Virgin Media O2 and BT Group has meant there are more market attempts at merged offerings.

All of the above lead me to the following predictions for the telecoms sector that will manifest and take root in 2022:

1. Experience First

The broadband market’s movement to premium has meant that switching mentality has moved away from being price-driven. With premium products also offering better customer experience in terms of reliability and speed, the battle to get someone to switch is now partly providing a reason why. One area that could break through are products that are about the best experience, where there is little reason to think about your internet provider and focus more on the content you are consuming. BT’s Halo 5G redundancy means that consumers may no longer notice when there’s a network fault; mesh routers like the Eero available with TalkTalk, mean that you may no longer think about Wi-Fi blackspots; and Sky Glass which doesn’t even have a Sky logo on the front may mean you are just focused on binge watching. Selling in the experience Telco enables will be key to growing these products but success may mean people think even less about switching. The effect of this on the affiliate channel is that brands and publishers need to consider how to provide a view of qualitative features where the focus used to be so much on price.

2. Alternatives Accelerate

The market shift to faster products has definitely been helped by the growth of so called “alt-net” providers. These localised fibre network providers have been growing reach and customer size especially with the level of investment from venture capital. In 2022 I predict that this investment will result in improved roll-out capabilities for these providers. The premium prices associated with these products, which were once a barrier, are less of an issue in the premium skewing market. In fact, Openreach’s “Stop Sell” will maybe reset the expectation of broadband speeds and price further. I believe this could be exasperated by bundle add-ons like TV being more internet dependent with services like Sky over IP or streaming aggregation on Apple or Google making it easier to unbundle. There’s a real incentive to being the first to FTTP as it will make it less financially viable for competitors to move in. As such within the affiliate space it probably makes sense for traditional providers to think about how they compete in areas with strong alt-net presence as their share increases. For publishers, the growing importance in regional specifics may mean that greater consideration for location-based targeting which has been more prevalent in retail and other sectors.

3. Content Curation

Within last year’s predictions, I spoke about the “Streaming Wars” and how the continued exclusive content would drive people to get locked into more services. 2022 saw many of us hooked on shows like Squid Game on Netflix, Loki on Disney+ and Clarkson’s Farm on Amazon Prime, to name a few. The jumble of these services has meant that tech providers seek to aggregate in similar ways to Paid TV services with products like the Android powered Google TV and Apple TV box. We’ve also seen renewed plays from telcos with bundling of streaming services and subscriptions into premium or flexible packages. Then, most strikingly is Sky’s launch of Sky Glass firmly stepping in to competing with big tech with a TV which also has software to help combine Sky TV and streaming into an experience with less friction. What this means is that in 2022, we’ll likely see more plays by telcos and tech to own the living room. It’ll be interesting to see if tech companies become more like telcos, and telcos become more like tech companies in the fight to be the home of media consumption. What this may mean in the channel is activity like technology retail with more content on hardware and services but perhaps greater consideration to marketing around key content releases.

4. Feature Focus

Within mobile handsets, the market is showing clear signs of stagnation with handset launches not able to catalyse the market. That being said, new approaches are hitting maturity, the folding form factor is moving from luxury novelty to more mainstream with devices like folding phones from Samsung hitting their 3rd generation. There’s been a refinement in the marketing message where the messaging now speaks about what the form factor enables in areas like pocket space, productivity and photography. We’re also seeing feature separation beyond tech with the annual upgrade and service bundling with Samsung, Apple and Google Pixel devices. I predict that we’ll see a renewed focus on feature differentiation and exclusivity by handset manufacturers to drive volume. This approach could also be adopted by networks who may seek to push features mentioned within experience first but maybe with wider brand credentials. For example, the climate emergency may cause consumers to expect real action with initiatives like Sky Zero. Within the channel, there’s a few implications such as potential to use more content partners to provide clear messaging on features, potentially as a brand partnership between manufacturer and retailer. Awin, has already run such activity in this area including this campaign between Oculus and Currys. The manufacturing plans like the iPhone upgrade plan and Pixel Plan, may have interesting implications as manufacturers nurture D2C relationships and create eco-system lock-in, making them very carrier-like.

5. Switching Support

The market across telecoms in 2021 has seen less switching activity than normal. That being said we are seeing steps from the regulators to make switching easier. Ofcom’s text-to-switch approach appears to be coming to broadband, with one-touch switch in 2023 making switching easier. For services and publishers that facilitate switching, the EECC regulations will also help with information quality within the market, supported by areas such as feed and API improvements, which has been a focus area with Awin and our partners. Improving switching also extends to areas such as phones with the EU’s requirement for all wired charging to utilise USB-C connectors, which helps consumers and reduces e-waste associated with the billions of plastic chargers bundled in with phones at present. Based on this and signals within other sectors, I predict that we will see more pro-switching regulations and standards. Perhaps we’ll see interoperability of internet hardware in the same way that utilities saw with the 2nd generation of smart meters which will resonate well with reducing environmental harm. The adoption and improvements of APIs and feeds across more publishers may also help pave new switching experiences for telecoms and better personalisation within channel.

The past year has put into motion a range of developments across all areas within the telecoms space. As a result, it's essential for advertisers and publishers within this sector to remain agile through leveraging insights and data. The continued evolution of this sector means 2022 will definitely be an exciting year.