Retailers on the ground are feeling the impact of online shopping more than ever with an average of 16 stores closing each day, PwC’s high street report claims it has been the toughest first quarter since the last recession in 2009-10 as consumers become increasingly comfortable with the reliability of online stores.

In 2017, Awin tracked over 448 million clicks within the fashion sector with the average fashion programme on the network showing 10% growth. The power of the affiliate channel led to a 15% increase in spend within the sector, a 22% increase in traffic, 16% increase in sales and revenue and an 18% increase in publisher rewards last year.

Benchmarking your fashion programme

To continue to grow within the affiliate space, brands need to understand their performance against the market. Between January - May 2018 the average UK fashion programme on Awin saw an average order value of £65.99, a 4.5% conversion rate and a 15% uplift on publisher rewards.

Factors need to be considered when benchmarking fashion programme rates to that of the industry average. For example, if rich content and influencer partnerships form part of a fashion brand’s channel objectives, content publishers often have a lower conversion rate comparative to some incentive publishers; so consider your publisher mix, by publisher promotional type, when optimising your conversion strategy. If Average Order Value is the key KPI for your business, you can introduce the Commission by Basket Value tool within the Awin interface (UI) which enables you to predetermine specific commission rate depending on the value of an order.

Snapshot: transaction trends

Whilst traditional payment methods within the channel make the affiliate industry relatively risk-free, it is important to get budgets and targets phased correctly throughout the year.

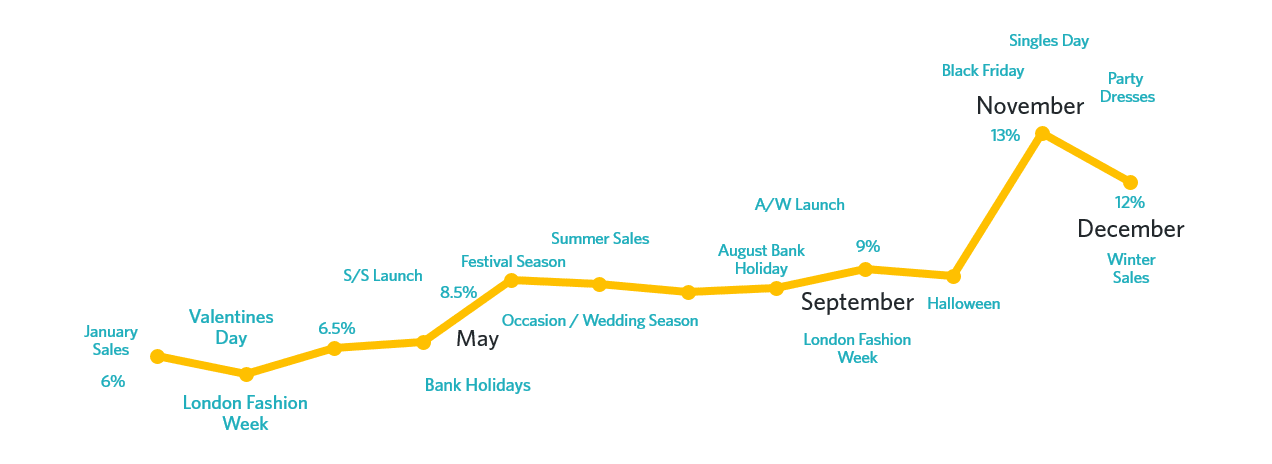

The graph below is a trend line from fashion retailers on Awin, showing the distributions of sales by month in 2017 against key dates in the fashion calendar.

Source: Awin

The first two sales peaks fall in May and September, due to the launch of new season collections driving higher conversions as the weather changes. December is responsible for 12% of total annual sales, though it’s November which is the biggest annual trading peak. Awin saw 13% of all fashion sales fall into November, a result of global retail events; Black Friday, Cyber Monday and Singles Day in China.

A consistent strategy

The variety of promotional types within Awin’s pool of publishers allows us to support and achieve a range of business objectives for a fashion brand; from awareness to customer loyalty, harnessing the power of publishers as a collective will drive programme value. Here are some tips:

- Share objectives with publishers; the affiliate channel is all about people and relationships so it is pivotal that brand objectives are shared and that communication is open and honest. It is much easier to achieve a desired goal when all parties are working towards the same result

- Keep programme objectives consistent once they have been defined; this doesn’t mean that fail-fast tests no longer play a part in a programme strategy, but that all tests continue to hit the long-term desired objectives

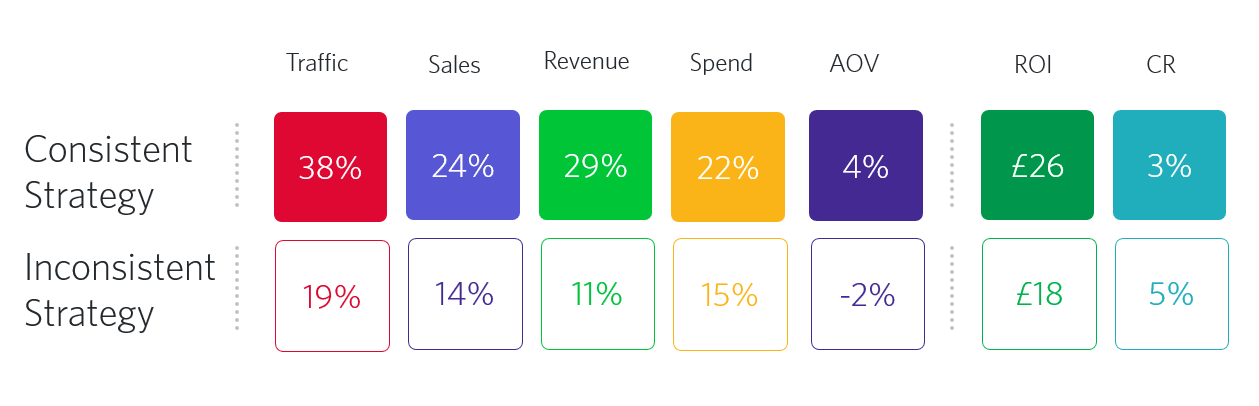

The below chart shows fashion programmes with a consistent strategy (2014 – 2017 inclusive) comparative to fashion programmes with an inconsistent strategy over the same time period. Although the objectives were not identical, the similarity is keeping these objectives consistent over time.

Source: Awin

Almost every core programme KPI has seen an increase in growth when the programme strategy remained consistent versus a programme with continuously fluctuating channel objectives.

Conversion rate is the only KPI weaker for those operating a consistent strategy. On average these ‘consistent’ programmes saw content publishers make up 50% of their programme, compared to just 33% of content publishers for those ‘inconsistent’ programmes; discount codes hold the 50% share here, which is why it represents a stronger conversion rate.

As an industry it’s vital to ensure tracking and rewards are supportive and fair, communication is open, honest and frequent and channel objectives are shared and remain consistent to ensure future growth for the fashion affiliate sector.