Mounting economic pressure means less sales but boosts to AOV

Written by Alfie Staples on 5 minute read

Dwindling consumer confidence will lead to shifting shopping habits that place sustainability and value-for-money front of mind this peak trading quarter.

After the biggest pandemic in over a century, the Ukraine-Russia conflict, rising energy and fuel prices, and supply chain difficulties have resulted in some of the highest inflation hikes in recent times.

This coupled with an all-time low in consumer confidence is leading to a number of changes in consumer behaviour as they lean on their lockdown learnings and make savings by spending more time at home, scaling down and buying cheaper alternative products, and making sustainable substitutions over all-out sacrifices.

Lower sales, but spending more?

At first sight, this might seem like a paradox. Given the current pressures on consumer spending, we expect that sales volumes would generally be down. But we might also expect the same from Average Order Values (AOV) too. But, in part because of inflation growth we actually expect AOVs to increase over Q4.

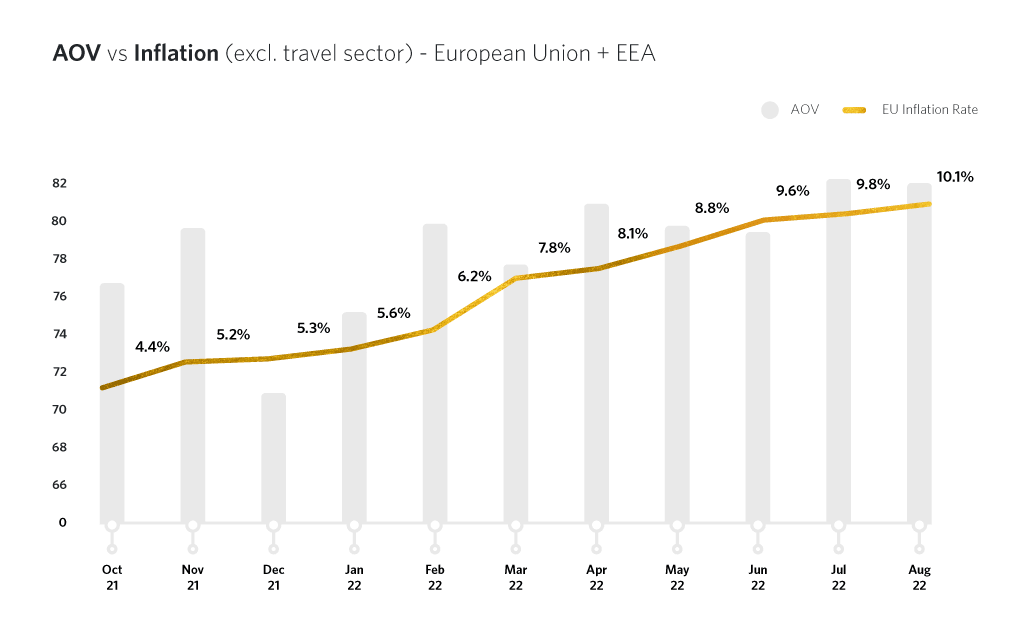

As the above graph shows, rising inflation across the European Union and EEA (Iceland, Liechtenstein and Norway), correlate directly to bigger basket value – but is this simply a story of brands selling less but consumers spending more?

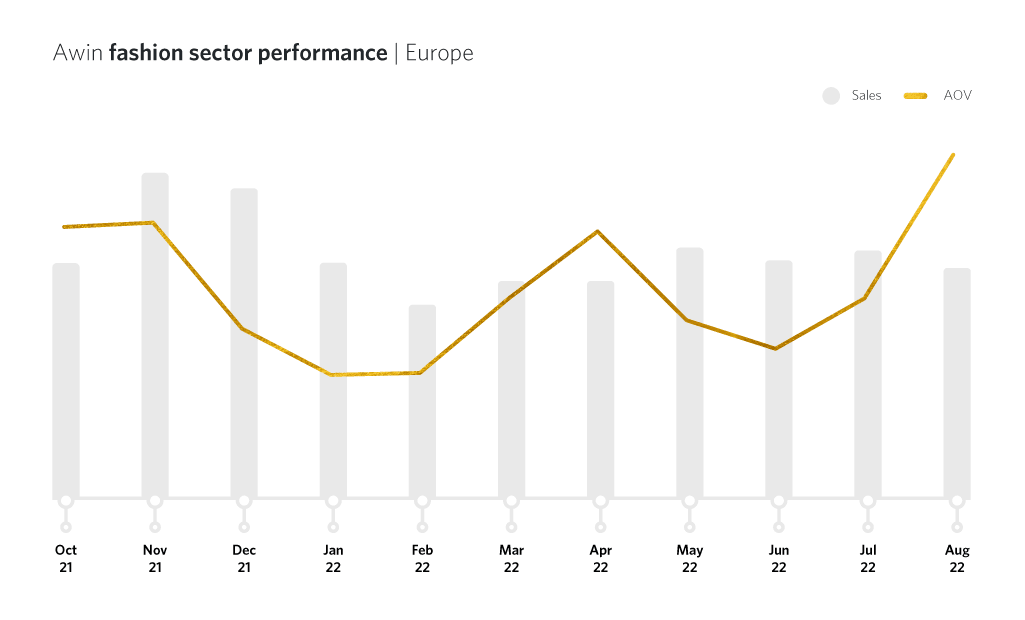

The fashion sector tells an interesting tale as we see sales decrease steadily in line with rising inflation across 2022 with an average quarterly decrease of -4% from Q2 to Q3. However, AOV continues to grow with an average quarterly increase of 17%, with further growth forecasted for the rest of the year.

What does this mean?

In light of inflation, we’re seeing shopping habits shift and consumers split into two camps; those willing to spend less for low-cost alternatives in higher volumes, and those willing to spend more but less often for sustainable, longer-lasting products.

A recent report by FirstInsights indicates that across all age demographics consumers are willing to pay 10% more for sustainable products, seemingly taking inspiration from the eco-savvy Gen Z. Although younger shoppers will naturally be on the hunt for savings where they can make them, such as via TikTok tutorials on the best budget make-up, we still expect to see basket values increase gradually as consumers become more conscientious of the products they buy, spending more for durability and sustainability.

However, as the season of deals and discounts approaches, we predict a slight uptick in sales volume of more than 1% for the fashion sector. This signals the temporary return of those discerning consumers to the (digital) aisles as they try to make a little go a long way with Cyber Week savings.

Who is still spending?

As we enter the Golden Quarter of trading, it’s worth considering which demographic is ‘least’ affected by the spiralling state of the economy.

Consumer confidence has dwindled to an all-time low but PwC’s Consumer Sentiment Survey offers a little hope for brands with under-25s remaining net positive at the time of research (March 2022). Unsurprisingly, under-25s are more likely to live with parents and have less responsibility for household bills, and therefore marginally more sheltered from a large part of the current economic crisis. With those living at home generally less responsible for spiralling utility bills, these younger shoppers may still find space in their digital wallets for more lifestyle consumption such as going out, takeaways, and impulse fashion purchases. Gen Z could be both the target and saviour of brand campaigns this winter and help boost average basket sizes across many sectors.

How can brands continue to sell value to consumers?

When examining how consumers will spend their cash, we see two main contributing factors that will determine which sectors see a spike in AOV: sustainability and the World Cup.

For the first group, brands can appeal to shoppers’ desire to be more sustainable by communicating their own environmentally-friendly practices throughout their Cyber Week marketing campaigns.

While smaller brands may struggle to feel they make a ‘big enough’ eco impact to warrant promoting, through the affiliate and partner marketing channel they can create online partnerships that will allow them to fulfil their eco-conscious customers’ expectations. For example, brands on Awin’s global platform can now partner with Ecosia, the world’s leading not-for-profit search engine that plants a tree for every sale made through its Freetree browser extension.

When it comes to crafting ethically-minded marketing campaigns this Cyber Week, brands that tell an authentic and compelling narrative about their genuine efforts can establish longer-term relationships with this audience. By contrast though, any disingenuous attempt by brands to greenwash this winter risk coming under fire as the public become more wary of such cynical marketing efforts.

As for the impact of the World Cup, it’s coinciding with the biggest shopping events of the year means cost-conscious consumers will be on the lookout for the best bargains for food, alcohol, sportswear, merchandise, and home entertainment even more than usual.

Brands will be able to capitalise on the fandom from Cyber Week to Christmas with campaigns starting even earlier than 2021. Read our full analysis on that trend here in our first prediction, World Cup to drive longest Cyber shopping campaigns ever.

Check out our partner recommendations for the peak season below:

Access the Awin Report 2022 to learn more about the 100 most innovative #Power100 partners on our global platform who can help you make the most of the busiest trading period of the year.