Sowing the seeds for sales: £12:1 return for DTC plant subscriptions

Written by Angela Davey on 4 minute read

UK consumers are getting green-fingered, average spend for DTC plant subscriptions increase by 6.5% YoY.

Key takeaways

- 144% YoY increase in the number of DTC plant subscriptions.

- 6.5% increase in the average order value for plant subscriptions.

- £12:1 return on investment for affiliate activity in the plant subscription market.

During lockdown, UK consumers were eager to bring a little of the outdoors inside; direct-to-consumer plant subscription services blossomed with high demand.

Research by the Flower and Plants Association states that the UK’s freshly cut flowers and indoor plants market is worth £2.2 billion. On average, flower sales reveal that this figure equates to a £36 annual average spending per individual (£8 on plants and £28 on flowers, respectively). Customers buying flowers and plants for private purposes account for approximately 60% of the total £2.2 billion spent. UK trends indicate that more people are buying flowers and plants for themselves, and often for decorating purposes versus five years ago, most shoppers only splurged on flowers for special occasions.

Blossoming sales growth

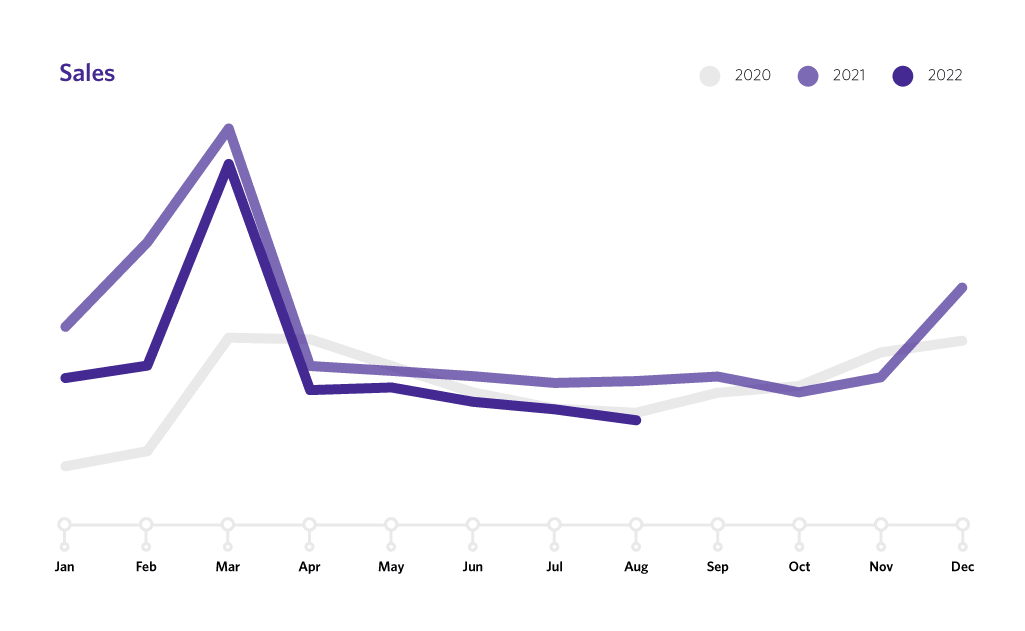

Data tracked on the Awin platform shows that plant subscription sales have increased +144% year-on-year (YoY), with almost £12 million being spent by customers with DTC plant brands. Plant subscriptions saw an immediate spike in March-2020, the beginning of UK lockdown, with sales dipping but remaining steady throughout the rest of the year. Since then, monthly subscriptions have trended above the pre-pandemic baseline, with sales gathering momentum again in January-2021, producing a large spike in sales in March, before stabilizing for the rest of the year, with another peak around Christmas.

2022 didn’t have quite the same impact as 2021, with sales trending slightly lower, however, it is still outperforming 2020. January and February saw 10,000 more sales than 2020, while March 2022 saw a 100% increase in sales from the same month two years’ previous, proving that plants really do have staying power.

AOV shoots up

The growth in subscription sales coincides with an increase in spend per transaction. In 2020, the average order value (AOV) for flower subscriptions was £33.37, increasing to £35.54 by the end of 2021. This performance has remained strong in 2022 – the highest AOV seen year-to-date was £43.55 in April, almost £10 more than 2020. With the average person killing off seven houseplants in their lifetime, according to research by the SWNS, and more of us self-purchasing and growing plant families, this could account for why people are buying so many.

Digging for deals

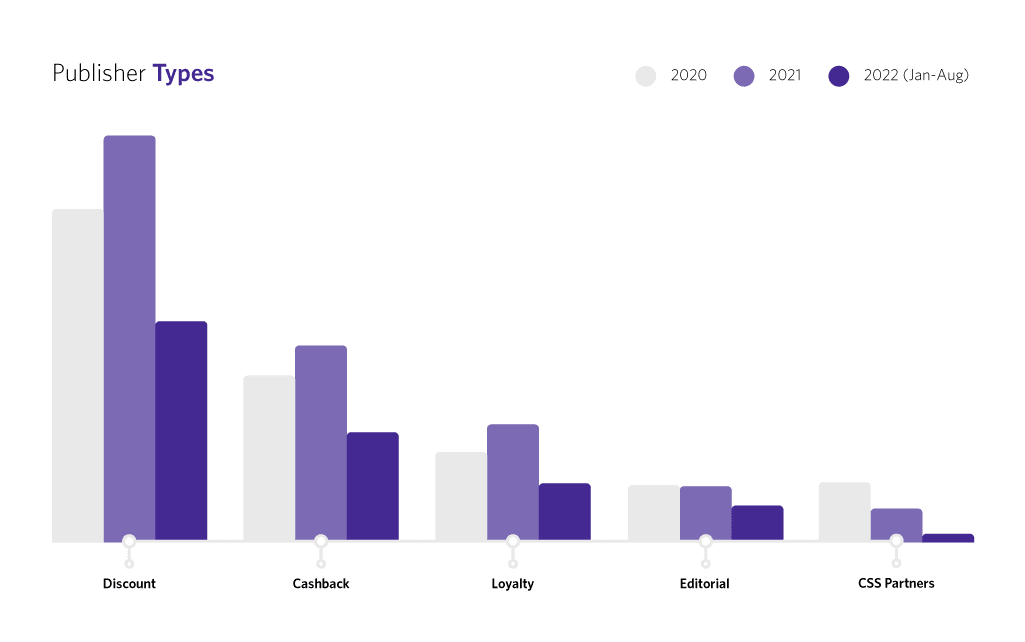

The affiliate type supporting the growth in plant subscription performance is Discount Code affiliates, accounting for 36% of all subscription sales. Cashback affiliates account for almost a fifth of sales (17%), which is perhaps unsurprising as plant brands look to boost their conversion in an increasingly competitive landscape. The remainder of the sales mix is made up from Loyalty (10%), Editorial (5%) and CSS Partners (4%).

Between 2020 and 2021 the growth in Cashback (+118% YoY) was testament to the competitiveness of the landscape, a plethora of plant subscription brands popped up and advertisers were keen to reward repeat purchases. The surge in Discount Code performance (+123%) saw consumers take advantage of free shipping (or in some cases, a free plant pot). Over the course of 2022, although sales haven’t quite reached the peak of the previous year, they are keeping level with the performance of 2020, which is still decent. 2022 has created a more diverse mix of publisher types for plant sales; content creators and influencers now account for 2% of sales within the sector, while media brokers have taken 7% of market share from other publisher types.

Content

Discount, Cashback & Loyalty

CSS Partners