10 Black Friday Predictions for 2025

Written by Richard Towey on 10 minute read

Ahead of peak season and the usual Black Friday frenzy, we share some of the main trends for affiliates and advertisers to look out for.

As we gear up for the Q4 peak season, affiliate marketing continues to evolve at breakneck speed. AI tools are reshaping how consumers discover deals, major platforms are making strategic entrances and exits, and an uncertain economy is forcing retailers and shoppers to think differently about Black Friday.

Here are our top 10 predictions for what affiliates and advertisers should expect this November.

1. Traffic down, CVR up due to AI search

ChatGPT's user base exploded from 300 million to 800 million weekly active users between December 2024 and April 2025, while competing platforms like Gemini, Claude, Perplexity, and Microsoft Copilot have also seen exponential growth.

As consumers shift some of their everyday searches to these tools, we predict a decline in top-of-funnel “research” traffic for many retailers, as shoppers lean on AI to source deals directly. Meanwhile, conversion rates may climb from AI tools responding to queries with just one or two definitive options, making the traffic more qualified and coming with higher purchase intent.

Google claims its AI Overviews drive "more queries and higher-quality clicks" to publishers, but industry reaction tells a more mixed story. Many publishers report the opposite, and this disconnect suggests we're entering uncharted territory for Black Friday traffic patterns.

Logically, AI search traffic should convert at a higher rate. However, individual merchants often find that the increase in CVR does not sufficiently compensate for the traffic loss.

This Black Friday represents the first true test of AI's impact on affiliate marketing during peak season. Prepare for fewer but possibly more qualified visitors who arrive ready to buy rather than browse. Then make sure you do everything you can to convert them when they show up.

2. Amazon's shifting Google Shopping strategy highlights CSS value

Amazon's month-long pause from bidding on Google Shopping ads created a rare window of opportunity for retailers and Comparison Shopping Services (CSS) alike. With one of the channel's fiercest competitors suddenly absent, CSS partners were able to secure greater visibility and demonstrate their agility in capturing impression share for brands.

Now, Amazon has re-activated its Shopping campaigns in many international markets but notably not in the US. This selective return underscores how volatile competition within Google Shopping auctions can be, and why CSS partners remain a valuable strategic option for advertisers. Even as Amazon resumes bidding, retailers working with CSS providers can still benefit from additional impression share, optimized feed management, and a pay-on-performance model that helps mitigate rising CPCs.

As smec noted in its analysis, while Amazon's absence briefly boosted efficiency for rivals, other major players like Temu quickly filled the gap, limiting how far CPCs could fall. That said, the test period proved CSS affiliates can deliver strong ROI and provide resilience when market dynamics shift.

If you're looking to diversify your Google Shopping strategy before Black Friday, our top 10 CSS partners on the Awin platform are ready to help.

3. CPI will deliver extra clarity in its first Q4

Awin's Conversion Protection Initiative (CPI), which requires our advertisers to deploy modern tracking standards such as server-to-server, mobile app, and our own probabilistic model, will deliver its first full Q4 performance data this year.

It will give participating advertisers unprecedented visibility and precision into how different partners contribute to sales during peak season, as well as comprehensive learnings to carry into their 2026 planning.

In its first few months, CPI recovered over one million sales, tracked and attributed over $100 million in revenue back to our advertisers, and redirected more than $8.5 million in commission to publishers. Imagine how pronounced the impact will be over the industry’s most lucrative quarter.

Recent developments like the UK's Online Safety Act add urgency to tracking accuracy discussions by requiring social media platforms and search engines to implement stricter content moderation and user safety measures. As a result, virtual private network (VPN) penetration has increased, especially in the UK, making it harder for advertisers to capture conversion data through traditional methods. Will more programs see the need to adopt server-side tracking in response?

4. App tracking will highlight social partner influence

One of the conditions of CPI is for advertisers with a transactional mobile app to deploy specialist mobile app tracking, which should reveal the true impact of social-focused partners during peak season.

Early results show dramatic improvements in attribution accuracy. One global sportswear brand saw a 74% increase in sales and a 26% rise in revenue from influencers after implementing app tracking.

Influencers represent a growing promotional strategy worth monitoring closely. Amid reports of creators doubling their costs in response to increased demand, accurate measurement is now vital for calculating ROI and calibrating investments.

5. Tariffs will ramp up pressure on core market sales

Foreign brands used to capitalize on Black Friday to promote themselves in new markets. Now, price rises from recently announced US tariffs will hit shoppers hard, putting strong pressure on supply chains and marketing budgets.

At the time of writing, expected US tariffs include 35% on Canadian imports, 25% on Mexican-made goods, and 30% on Chinese products.

We don't know how Q4 spending will pan out globally, but affiliates promoting international brands should prepare for less aggressive promotions and softer sales performance. Supply chain disruptions and increased costs will likely force brands to reduce marketing budgets or shift strategies away from heavy discounting. This could soften the overall impact of Black Friday deals and underscore the importance of preserving margin in what is undoubtedly a tough retail environment.

6. CSS, CRO, and retargeting partners will maintain value

It’s a rollover of last year’s prediction of a strong showing for tech partners specializing in reducing abandonment, incentivizing purchases, and assisting customers. We can see them performing just as well – if not better - in 2025.

These partners consistently deliver results because they address fundamental Q4 shopping behaviors. Looking at the top revenue contributors to affiliate programs during peak season 2023 and 2024, we see very little change to the hierarchy. Hence, we predict a similarly strong showing from these partners in 2025, judging by how they performed in Q4 2024.

To partner with these publishers, simply click on their name:

1. ShopForward - CSS (-)

2. Tangoo – display/retargeting (-)

3. intent.ly – CRO (-)

4. Upsellit – CRO (+1 place)

5. Preciso - (new entry)

Already working with one or more of these partners? Consider expanding your toolkit with these additional, fast-growing options:

Help Me Choose A.I: Turns visitors into customers through AI product quizzes.

Squadded: Gives your influencers shoppable storefronts to close the gap between content and commerce.

Birl: Create a resale program and let birl take care of everything, from logistics to issuing credit.

7. Content investments will prove their worth in brand partnerships

Brands that have strategically invested in creating high-quality third-party content are already reaping the rewards through increased visibility in AI-powered search recommendations. These retailers are capturing significant traffic from shoppers who use AI tools like ChatGPT's Product Finder for personalized product suggestions.

What makes this particularly intriguing is the underlying economics: the product manufacturers themselves are likely financing these prominent placements. They're investing in creating a seamless customer experience that transitions from AI-generated product summaries to comprehensive buying guides, and ultimately to their product pages on their retail partners’ websites. This creates a sponsored pathway that feels organic to consumers.

Lee Metters, Awin’s Regional Senior Brand Partnership and Retail Media Lead, recently discussed this trend at New Digital Age:

“Currys provides a strong model here. They’ve invested in endemic-funded media campaigns for some time, using third-party content to attract high-intent shoppers back into key category pages, where their own on-site retail media campaigns continue the conversion journey… This type of content feeds into AI-generated responses and engages shoppers earlier in their decision-making process, often before they’ve even visited a retailer’s site.

“Ultimately, retailers and brands that partner with media publishers, affiliates, and content creators now will be best positioned to stay visible and competitive as the digital path to purchase evolves.”

8. Retailers will upgrade tools to weather economic pressures

Price sensitivity will be very high this November as retailers prepare to use every available tool to optimize media spending to ROI and maximize visitor value.

Consumer electronics giant Samsung leaned into this approach during last Black Friday, increasing ROI by 52% year-over-year using Commission Flexibility to allocate special rates to publishers selling key products.

Visitor recovery tactics can also help keep customers on-site and focused on buying. Tefal boosted conversion rates by 23% through nunami's cart abandonment triggers.

Prepare to see more stories of retailers using specialist tools to offset economic headwinds.

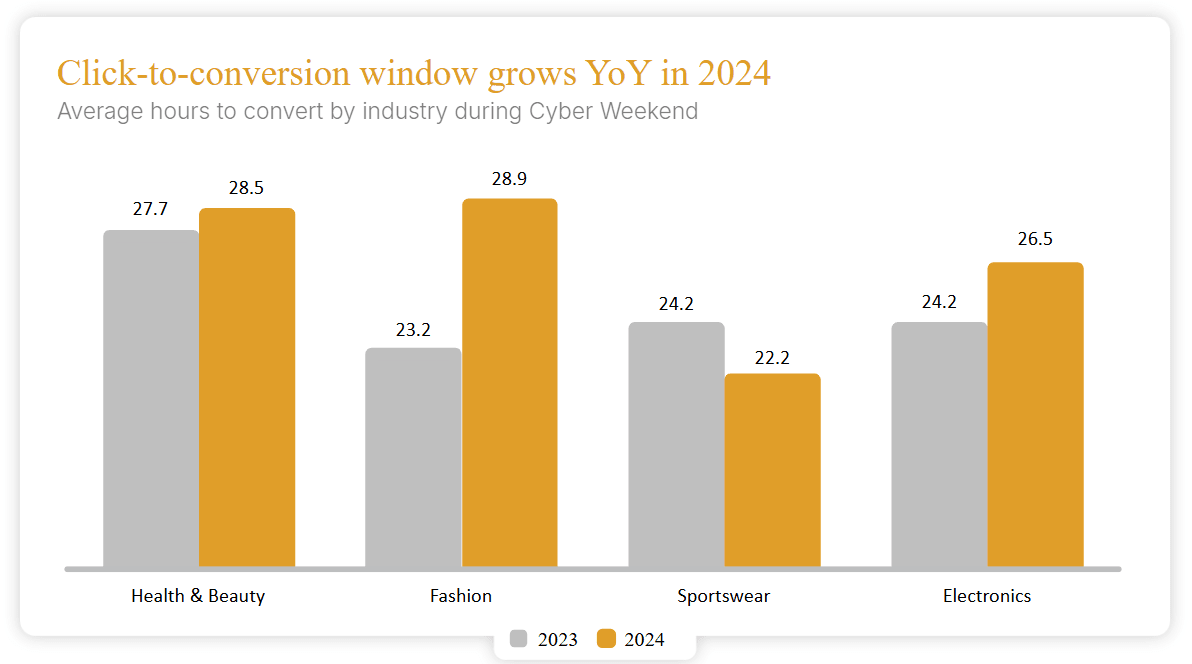

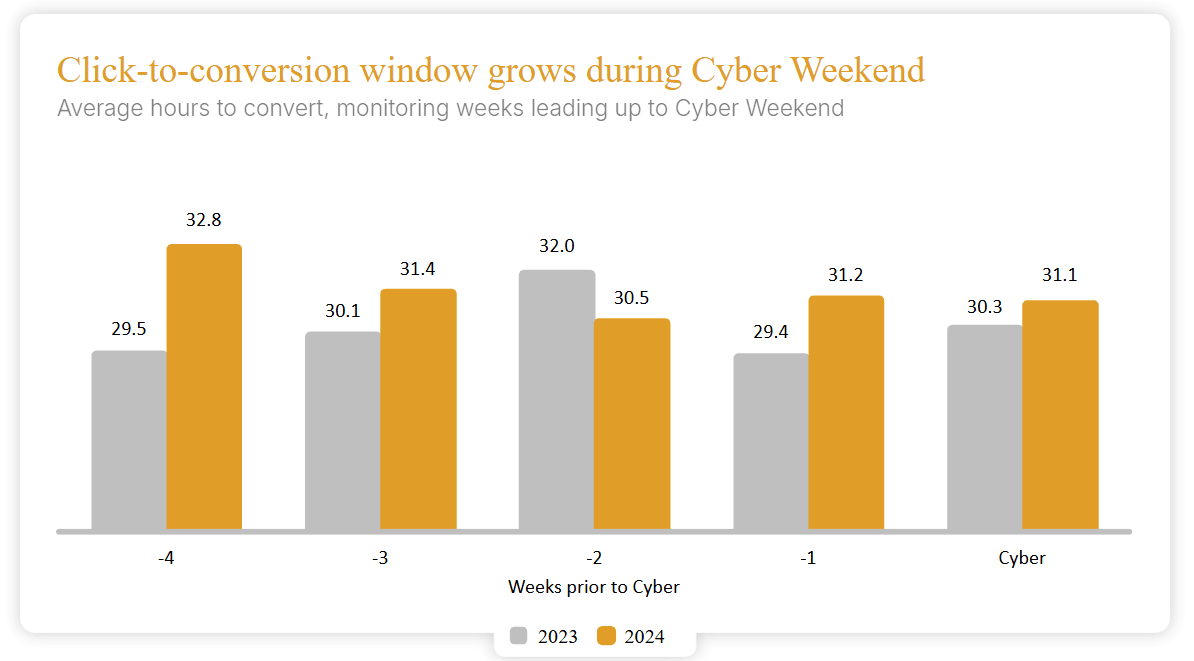

9. Click-to-conversion windows will expand

A decline in consumer confidence will see longer click-to-conversion windows from shoppers spending extra time comparing products, searching for offers, and conducting research.

Our data shows increased click-to-conversion times across many key sub-sectors during Cyber Weekend 2024, and we expect these figures to climb again in 2025.

Q4 tends to see bigger windows than usual, as we observed the same pattern in the weeks leading up to the Q4 peak shopping days last year.

This behavior reflects broader economic uncertainty and suggests shoppers will keep taking more time to make purchase decisions.

Advertisers should adjust their attribution windows and campaign optimization strategies to accommodate these longer consideration periods. Understanding that conversions may take additional days or weeks will help prevent premature campaign changes and ensure proper credit allocation across the customer journey.

10. Small businesses must get creative with influencer partnerships

As tenancy costs at traditional affiliates reach their peak in Q4, small businesses are forced to develop creative strategies for competing with larger retailers during Black Friday. In a recent development, many are now choosing strategic influencer partnerships to cut through the noise without allocating massive upfront investments.

Users of Awin's Access service plan, designed specifically for small businesses, increased influencer investments by 45% year-over-year. These partnerships give small businesses access to established audiences without big minimum spends or long-term commitments.

We now expect SMEs to increasingly turn to CPA-based creator partnerships on dedicated influencer subnetworks like ShopMy, Klarna Creator, and Stylink to stand out in Q4.

Closing thoughts

The brands that will thrive this Black Friday are those that embrace environmental changes rather than resisting or ignoring them.

Whether it's investing in AI-optimized content, upgrading tracking capabilities, or partnering with emerging tech solutions, the common thread is clear: performance-based partnerships offer the flexibility and accountability that traditional marketing channels simply can't match.

Contact Awin today to discover how we can unlock these partnerships to transform your approach in Q4 and beyond.