Black Friday records tumble as baskets soar

Written by Alfie Staples on 5 minute read

As travel bounces back and inflation nudges average retail baskets above €100 ($104), Awin records biggest commission pay day on record.

1. Sales volumes dip, but baskets soar

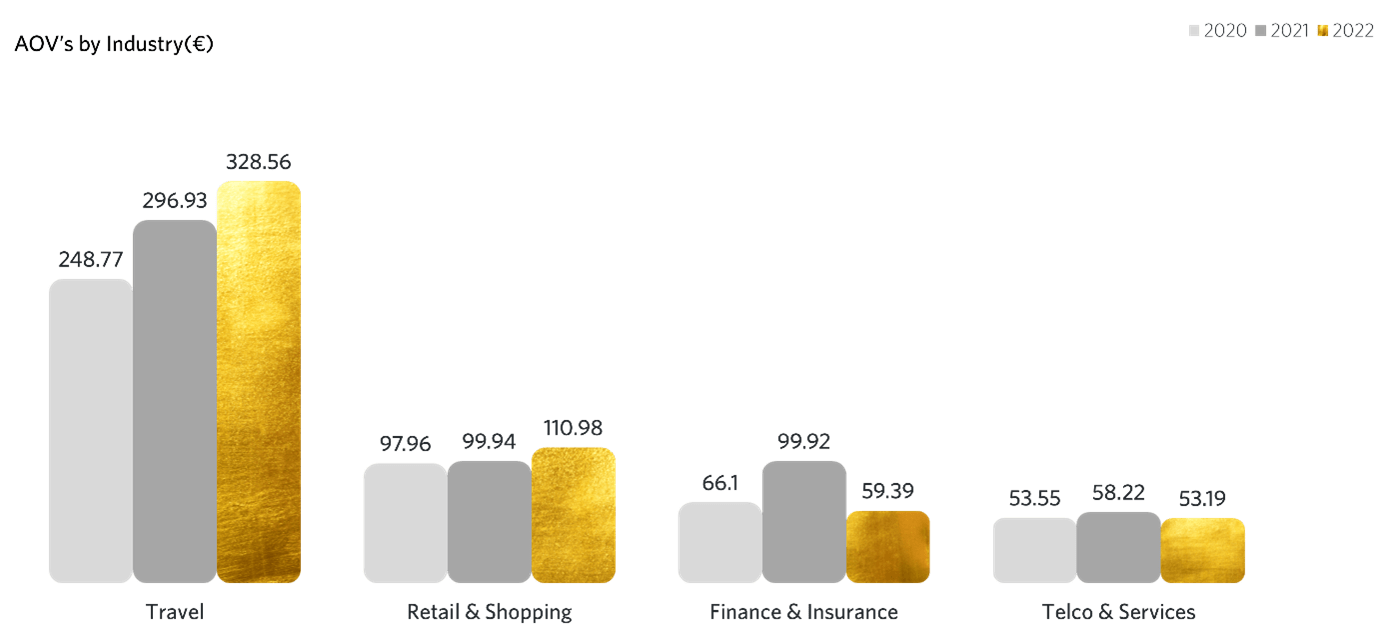

The impact of inflation was felt across the board at Awin. Continuing the basket spike from 2021, average retail order values surged by almost 11% year-on-year.

With economic uncertainty prevalent, it’s perhaps unsurprising sales dipped slightly, but this is a performance trend we’ve seen more generally as Black Friday deals are pushed ever earlier in the month. Sales fatigue by the time the big day rolls around means that while Black Friday dominates the month, bigger year-on-year growth is seen elsewhere in November.

Revenue numbers remained strong, up 6%, most likely a result of the €11 ($11.40) increase in average order value on Black Friday 2022 on 2021's numbers in the Retail and Shopping sector. However, is inflation wholly responsible for this increase in AOVs?

2. Consumers are not necessarily spending less

During moments of economic uncertainty, consumers revert typically into two camps: low spend, high volume and high spend, low volume.

In reviewing sales performance of one of the largest sectors on Awin, fashion brands appear to have lower average order values (under €75/$78) and struggled across the month of November. Looking at data up to and including Black Friday, sales were down by about a quarter. By contrast, higher basket sales of up to €150/$155 spiked by 45%.

This perhaps shows how consumers are spending more this Black Friday on higher-priced items than before. Stretch and save codes, higher cashback rates and other promotions all help push baskets higher. However, are consumers still relying on discounts during the promotional period?

3. Discount partners continue to be vital for growth

Discount publishers have been facing a readjustment of late with brands seeking to protect margins as production costs soar, however, despite this Black Friday remains the golden day on the discount calendar.

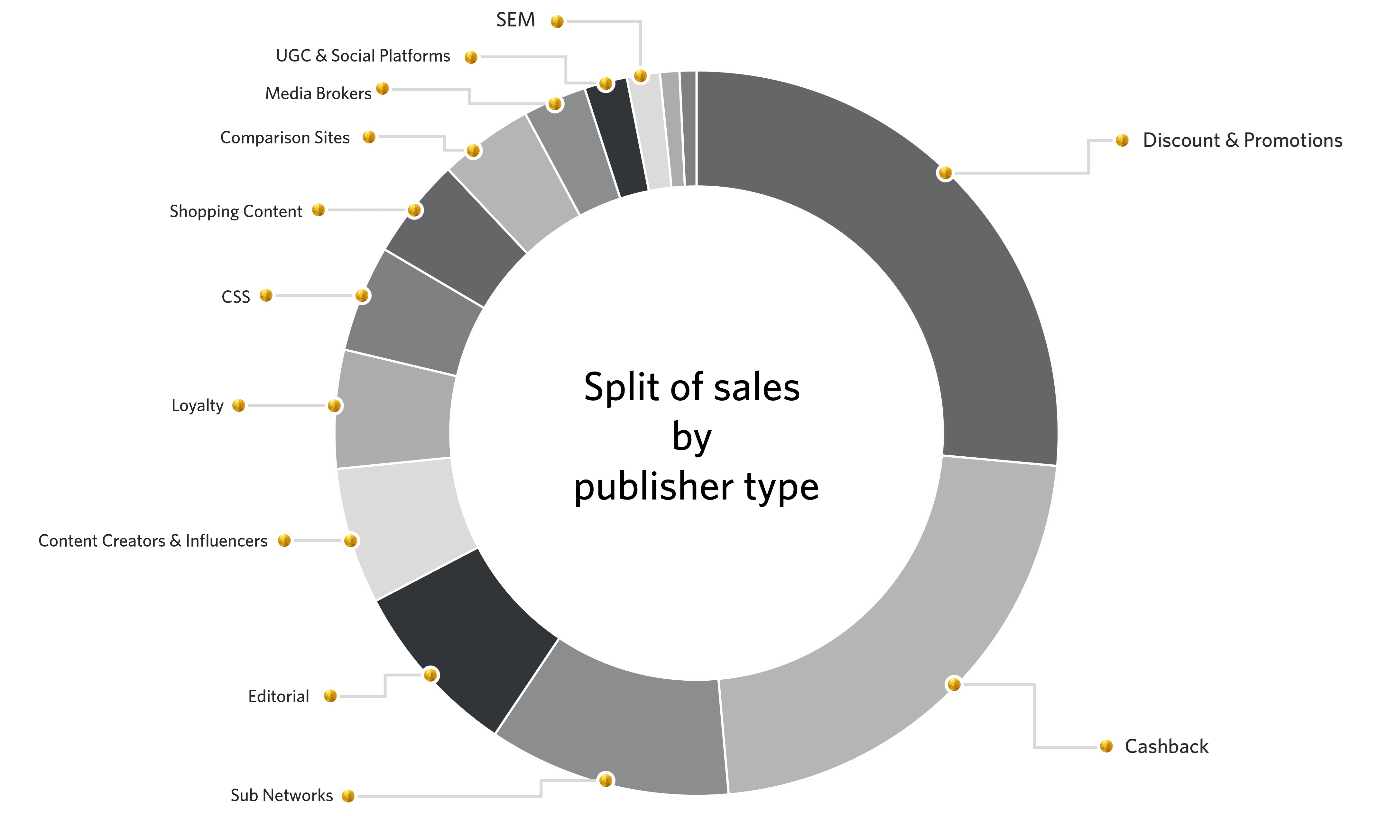

Despite the percentage of transactions containing a coupon being slightly down in 2021, a third of all network sales were still driven by a discount partner. This highlights their continuing importance for consumers and how a well thought out discount campaign can be crucial to help advertisers hit their targets. While discount, voucher and coupon code publishers helped deliver growth for advertisers, content creators and content partners also provided immense value during Black Friday.

4. Content continues to increase its value through affiliate marketing

While content has been growing in market share for advertisers for years now, Black Friday 2022 saw content partners deliver significant additional growth across a wide range sectors.

Editorial content, influencer and content creator partners on Awin continue to increase their market share; however, while high-quality publisher content thrived on Awin, influencer performance was a key driving force in consumer engagement for brands. The combination of this diversification saw the cashback and coupon code publisher share drop below 50% of sales for the first time on Black Friday.

5. Influencers are vital partners for awareness and conversion

As we predicted in late October, influencers have been even more impactful on Black Friday than anticipated. About one in nine clicks came from influencers and while their early funnel activity means they under-index on sales, the importance of influencers and content creators in the affiliate channel has been cemented.

Influencers thrived in key sectors such as department stores, with a 36% increase in sales and electronics where like-for-like numbers were up more than 50%.

The huge role mobile is playing for these publishers comes into focus, not to mention how central app-tracking is also becoming.

6. Mobile performance on Black Friday makes even more strides in 2022

Last year for the first time average baskets on mobile almost caught up with desktop on Black Friday. This year the gap between handset and traditional web performance has narrowed further, with mobile sales making up 48% of transactions on Awin this Black Friday compared to 46% in 2021.

7. Tapping into App

Whilst more and more advertisers are tapping into the world of apps, advertisers have faced challenges in adopting app tracking for the affiliate channel.

However, 2022 appears to be seeing continued growth in the app tracking space, with the advertisers who have integrated it within their campaigns unlocking significant additional revenue through the channel.

In the two years since Black Friday 2020, sales are now tracking at twice the rate.

8. The impact of the World Cup

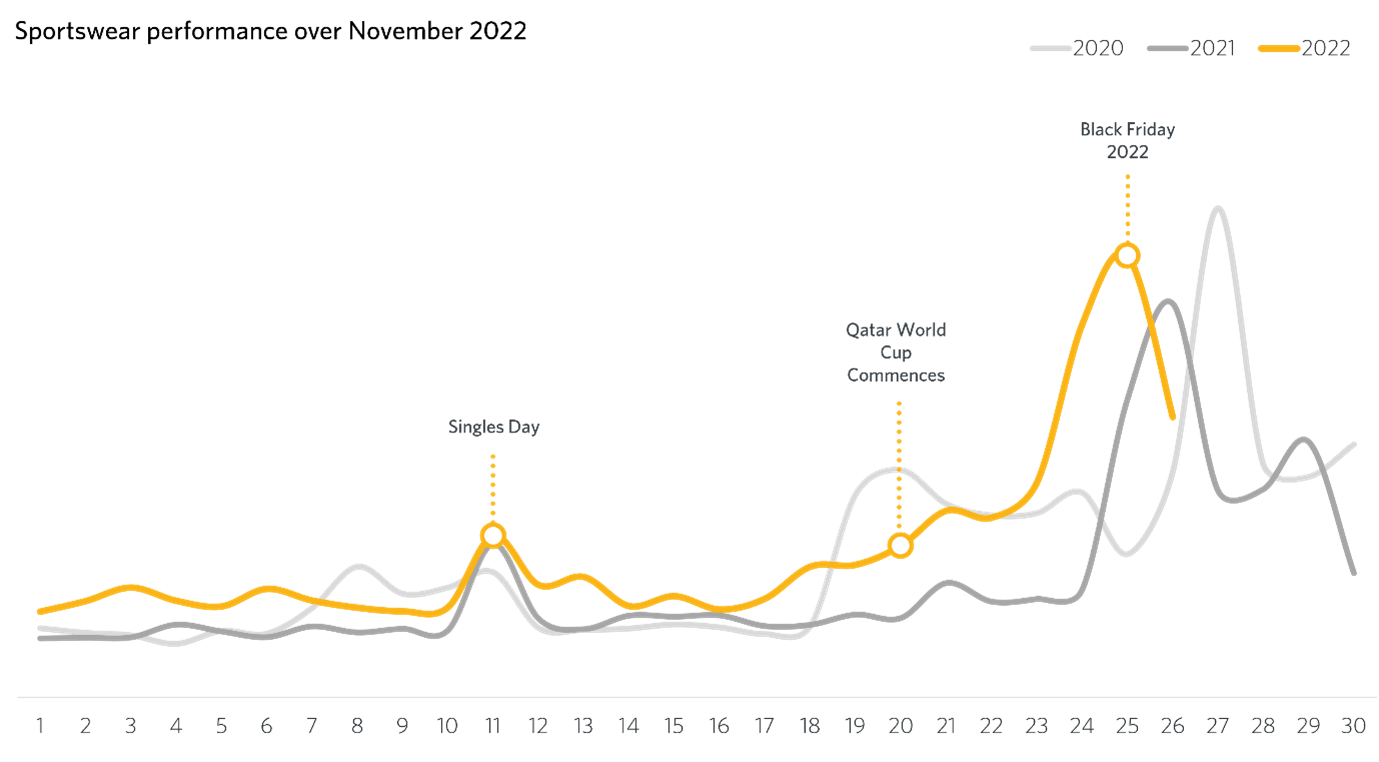

The World Cup could be playing out for the affiliate channel. Sportswear is up year-on-year by 60% across the month of November compared to 2021, with Black Friday tracking 12% more sales.

This impressive month-long uplift is indicative of brands going early. Some sportswear retailers faced supply chain issues last year that resulted in them running shorter campaigns and smaller promotions. With those challenges alleviated and the increased interest in sports due to the World Cup, their 2022 performance has impressed.

9. Health & Beauty continues to shine during Black Friday

The Health & Beauty sector has continued to bounce back in 2022 and has piled on strong performance across the year. Awin tracked 20% more sales and conversion rates spiked.

The powerhouses of LOOKFANTASTIC, Cult Beauty and Dermstore helped drive unprecedented interest in a sector that has re-established its footing after the pandemic.

10. Brands are flocking to affiliate marketing

Inevitably retailers come and go but the attractiveness of the affiliate channel for brands continues to resonate as Awin’s portfolio of advertisers expanded. Publishers had almost 1,500 new brands to choose to promote this Black Friday compared to last year on the network, fuelled in part by the success of Awin Access, Awin's small business affiliate marketing solution.

Appealing to the micro-small business audience, performance is up by around 50% year-on-year, with sales topping $21m/€20m/£17m in November.