DTC coffee sales get a caffeine kick with 105% year-on-year growth

Written by Lee Metters on 2 minute read

It’s time to wake up and smell the coffee, Awin data reveals consumers spent over £500k on DTC coffee roasting brands in 2021.

Research by the British Coffee Association estimates that around 95 million cups of coffee are consumed per day in the UK, with the coffee industry bringing an estimated £177 billion into the British economy each year.

The closure of pubs, cafes, restaurants and offices became an all too familiar sight during the pandemic, yet consumer demand for coffee remained. Awin witnessed an increase in the number of speciality coffee roasters moving into the online space and offering subscription-based models to consumers, delivering barista-worthy coffee direct to the door. Ground coffee and at-home coffee pods are becoming increasingly popular, particularly amongst millennials, representing 16% of UK buyers.

Despite the easing of restrictions, DTC coffee sales have sustained momentum as online coffee-retailers continue to drive significant YoY growth via partner marketing.

High demand for coffee subscriptions

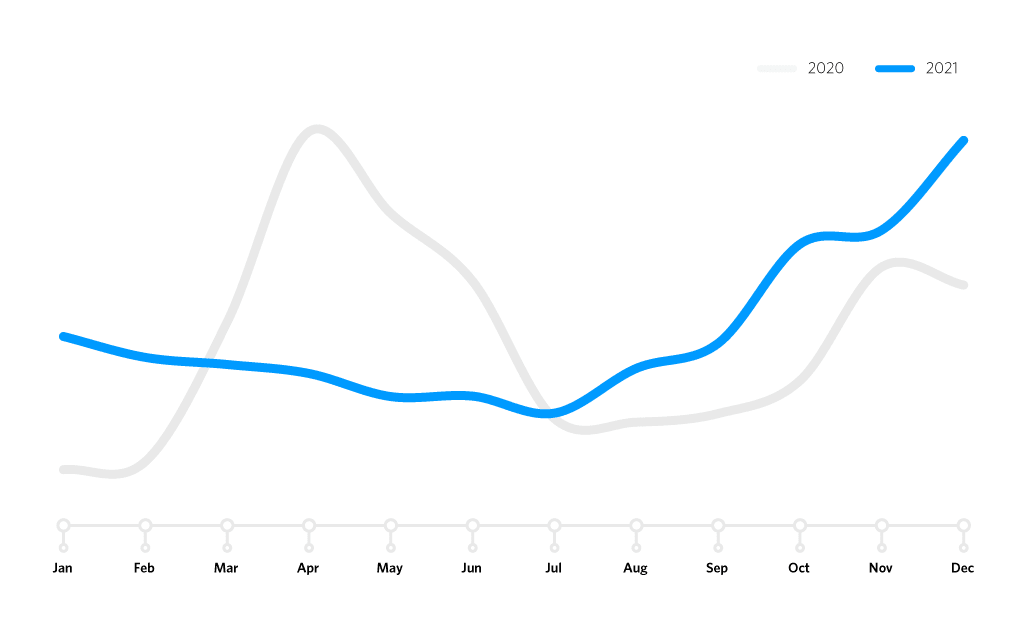

Awin data shows that coffee subscription sales have increased +105% year-on-year (YoY), with over £500k being spent by customers with DTC coffee roasting brands. Coffee subscriptions saw an immediate spike in April 2020, the first full month of UK lockdown, with sales increasing +115% month-on-month (MoM). Monthly subscriptions have continued to trend far above the pre-pandemic baseline, with sales gathering momentum again in July 2021 with continued MoM growth.

Average Order Value on the rise

The growth in subscription sales also coincides with an increase in spend per transaction. In 2020, the average order value (AOV) for coffee subscription services was £18, increasing to £34 by the end of 2021. This suggests that coffee subscription services have provided a new alternative for coffee consumption that will stand the test of time long after the coronavirus pandemic.

Publisher Split

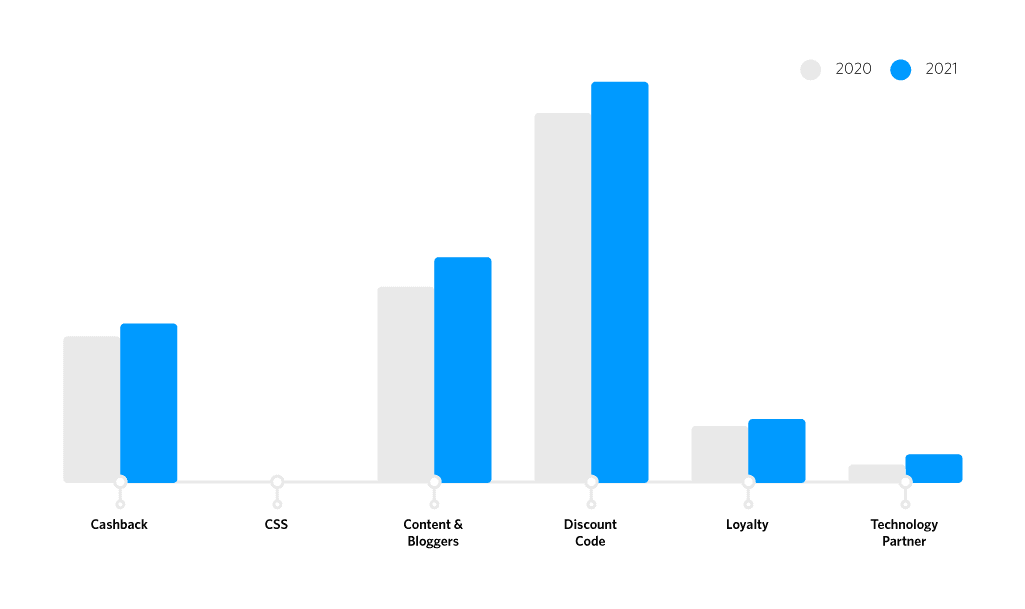

Delving into the supporting affiliate types, Content & Blogger sites account for 25% of all coffee subscription sales. Discount Code affiliates account for almost half (47%), which is perhaps unsurprising as coffee roasting brands look to boost their conversion in an increasingly competitive landscape. The remainder of the sales mix is made up of Cashback (18%), Loyalty (7%) and Technology Partners (3%).

The growth in Technology Partners (+62% YoY), including a selection of Google Comparison Shopping affiliates, proves the digital-first approach that these DTC brands have taken. We’ve also seen coffee subscription brands use Technology Partners to serve on-site and re-targeting optimisation strategies to enhance their conversion rate and customer journey.

For more information on DTC coffee subscription trends and how it might benefit your coffee roasting brand, contact the Awin client partnerships team or get in touch here.