DTC flower power achieves 96% online growth year-on-year

Written by Angela Davey on 3 minute read

Awin's insight series reveals how the pandemic has given rise to new sub-sectors improving online market share and driving growth via partner marketing.

Key takeaways

- 96% YoY increase in the number of DTC flower subscriptions

- 3% increase in the average order value for flower subscriptions

- £12:1 return on investment for affiliate activity in the flower subscription market

Flower subscriptions are well and truly blooming. COVID-19 dramatically increased the number of online florists springing up and offering subscription-based models to their customers. During a time where self-care became of utmost importance, coupled with people needing an outlet to let their loved ones know they’re thinking of them when they were unable to see them, it’s unsurprising that direct-to-consumer (DTC) letterbox flower sales, offering quick delivery, surged in popularity.

A shift in consumer purchases

Research by the Flower and Plants Association states that the UK’s freshly cut flowers and indoor plants market is worth £2.2 billion. 60% of this spend on flowers is attributed as a private purchase, with more and more people purchasing flowers for themselves, and often for decoration. On average, this figure equates to a £36 annual average spending per individual (£8 on plants and £28 on flowers, respectively). This signifies a shift in consumer purchase trends, as five years ago, most shoppers only splurged on flowers for anniversaries, weddings and other special occasions.

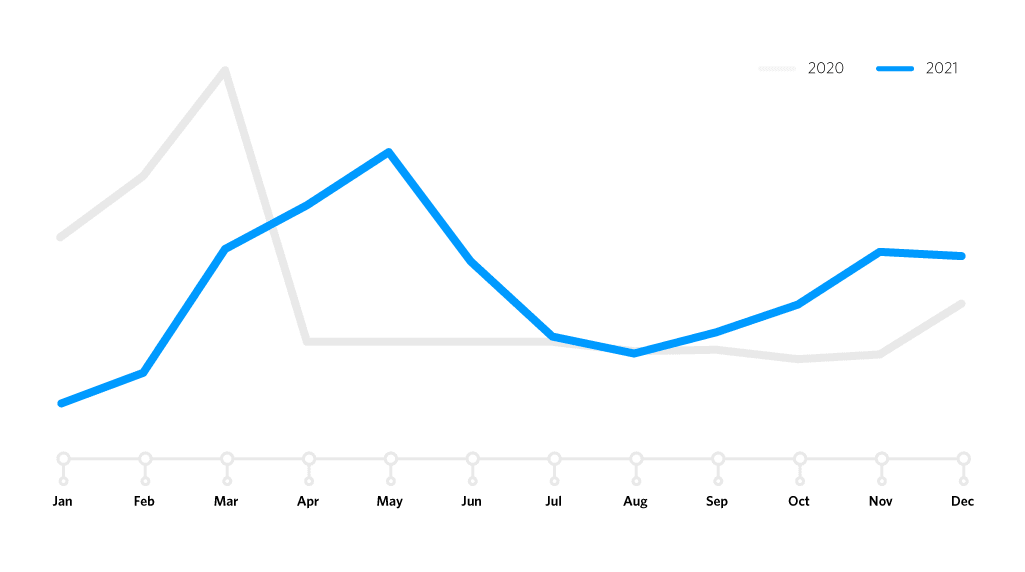

Awin data indicates that flower subscription sales have increased +96% year-on-year (YoY), with over £69 million being spent by customers with DTC flower brands. Flower subscriptions saw an immediate spike in March-2020, as the UK lockdown was announced, with sales remaining steady throughout the rest of the year. Since then, monthly subscriptions have continued to trend above the pre-pandemic baseline, with sales gathering momentum again in May-2021 and November-2021.

Average order value growth

Interestingly, the rise in subscription sales also coincides with an increase in spend per transaction. In 2020, the average order value (AOV) for flower subscription services was £32.85, increasing to £33.83 by the end of 2021. This is an indicator that the longevity of flower subscription services improves consumer loyalty, and signifies a shift away from impulse buys.

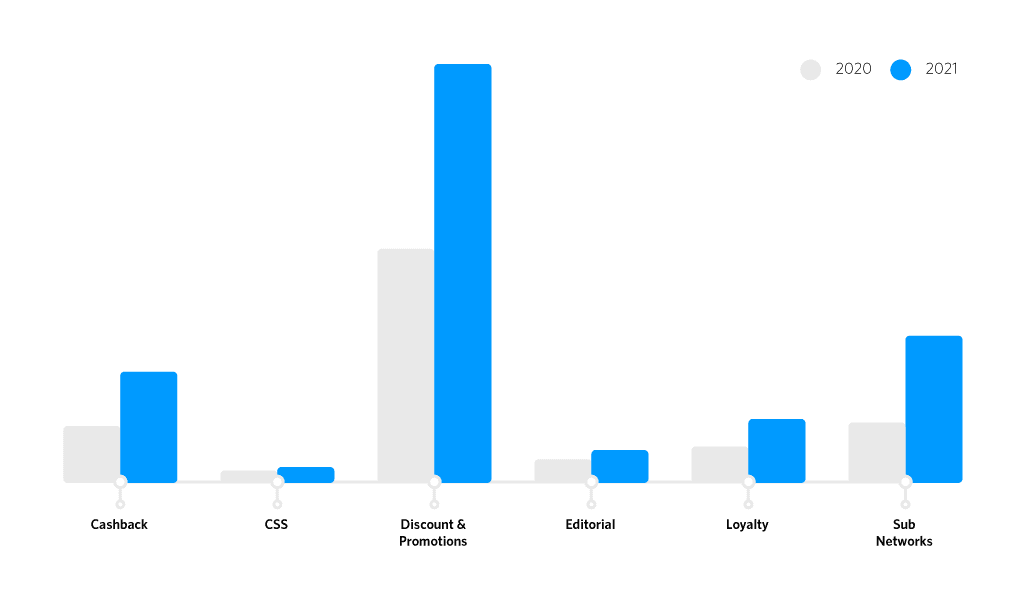

The growth in flower subscription performance can be split by affiliate type. Editorial Content sites account for 3% of all subscription sales. Discount Code affiliates represent more than half (52%), which is perhaps unsurprising as flower brands look to boost their conversion in an increasingly competitive landscape. The remainder of the sales mix is made up from Cashback (14%), Loyalty (8%) and CSS Partners (1%).

The growth in CSS Partners (+60% YoY) is testament to the digital-first approach that these DTC brands have taken. The boom in Editorial Content performance (+35%) is evidence of flower brands taking advantage of content formats such as lists collated by Stylist and The Sun on the best flower subscription brands available.

For more information on DTC flower subscription trends, and how it might benefit your flower brand, please get in touch with a member of the Client Partnerships team here.

For further market trends and insights sign up to The Pulse newsletter.