What H1 Told Us About Trends in Finance and Insurance

Written by Chris Blower on 7 minute read

Awin’s Chris Blower covers everything from lower premiums to global uncertainties in his review of H1 for the UK finance and insurance space.

As we hit the halfway mark of 2025, like me, you may be wondering where the first half of the year has gone.

Globally, there’s been much change. From Trump’s tariffs to interest rate drops, and geopolitical unrest, there's a lot to unpack for anyone connected to the finance and insurance industry.

Focusing on the UK market, Awin has seen a +32% increase in customer acquisition compared to 2024. With H2 to go, here are some interesting trends on the Awin platform, which should help you prepare for the months ahead.

Insurance policies see triple-digit growth

Insurance categories have seen the most growth across Awin this year so far. Looking at revenue in H1 2025 vs the same period in 2024, the top performers are:

- Life insurance: +330%

- Car insurance: +216%

- Motorcycle insurance: +128%

These indicate a powerful combination of renewed consumer confidence and lower premiums, which were observed vs the same period last year.

According to confused.com, car insurance premiums have seen a -17% decline, while for life insurance, premiums are forecast to grow +4.4% in 2025 (down from +5.8% in 2024).

Looking at insurance more broadly, the policies available in this category were up +43% year-on-year (YoY) in H1. Customers now have a greater selection of options in niche areas like pet insurance (+42%), showing greater demand for cover for our furry friends.

Some core sub-categories have however seen a down-turn. Gadget and home cover options were down -44% and -32% respectively in H1.

These declines are likely driven by a mix of insurer exits, stricter underwriting, and reduced consumer demand, particularly in areas where premiums have risen or coverage has become harder to obtain.

The rise of the “financially conscious” consumer

At Awin, we’re observing a growing trend towards financial self-awareness. In fact, investment (commission paid to publishers) in categories such as financial care and credit score checks was up +148% in H1 YoY.

The investment has created a stark change in customers committing to signing up to sites like Experian and the Emma budget app, highlighted by a 3x increase in conversion rate (CVR) in H1 2025 vs 2024.

The growth in savings and credit score services would point to a UK audience that’s becoming more financially literate and proactive.

Whether they’re preparing for economic uncertainty or simply making smarter money moves, consumers are seemingly prioritising their long-term financial health.

We see further evidence of this from the continued growth in aggregator sites (+24% new customer acquisition YoY), which take the burden of providing deals for lots of finance categories.

This suggests a continued long-term trend of customers taking time to find the best value deals on sites such as MoneySuperMarket, which now has 12 million customers.

Are you an Awin affiliate? Partner with these advertisers:

Regulation shapes shopping habits

With continued developments in finance regulation, there have been some modern examples as to how this has impacted consumer habits and created “Be There” moments.

Take for example the energy market, which has seen a resurgence since the end of the ‘Energy Price Guarantee’ back in July 2023 in response to ongoing wholesale market pressures for gas following Russia’s invasion of Ukraine.

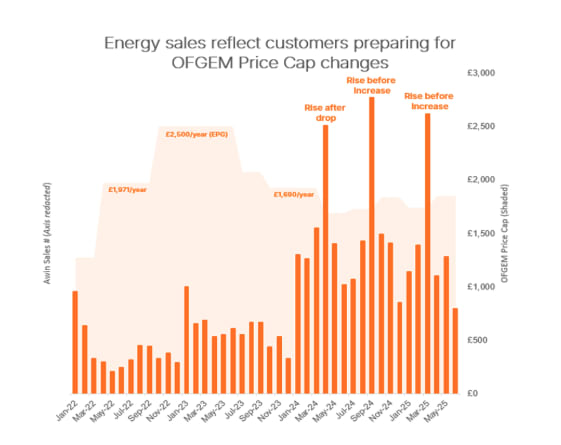

From looking at energy sales on Awin’s platform, we saw a sharp rise in sales after the OFGEM cap fell, and conversely, a sharp rise in sales before the OFGEM cap rose.

This, as you can see below, has created these micro-moments of action for consumers. It’s therefore wise to consider how these can be factored into an effective trading strategy.

It also has completely eradicated the notion that January is the ‘big month’ to change energy provider. In 2022 and 2023 this is clearly evident within the graph as January is at least 40% higher than any other month in the year, but that trend doesn’t bear the same importance in 2025.

One development to keep an eye on for the remainder of the year is the Digital Markets, Competition and Consumers Act (DMCC), which has been enforced since April 2025.

This act gives new powers to ban misleading practices like drip pricing and fake reviews and fine companies directly for non-compliance (up to 10% of turnover).

Financial and insurance marketers must now clearly disclose all costs upfront, which is reshaping how comparison sites and digital ads are structured

A continued unabating desire for travel

Despite economic pressures and global uncertainty, British consumers’ appetite for travel remains strong and resilient in 2025. The post-pandemic surge in “revenge travel” (planning the trips that couldn’t happen due to lockdowns) has evolved into a sustained cultural shift, with travel now seen as a non-negotiable part of life rather than a luxury.

Extra ancillary products for that perfect travel itinerary, such as travel insurance and travel money, have seen increases of +30% and +69% respectively.

Are you an Awin affiliate? Partner with these advertisers:

Are you an Awin advertiser? Partner with these affiliates:

Editorial and brand partnerships are driving growth

Data from Awin shows editorial content and brand partnerships becoming key growth drivers in the finance and insurance space:

- Sales from content-led partnerships were up +54% YoY in H1

- The top 15 publishers in H1 2025 across finance and insurance included several new entrants, including BrandSwap, Clearscore, and Groupon.

- Money Saving Expert continues to lead the pack, reinforcing that trust in finance content is paramount.

- While cashback remains strong, diversification is proving essential.

This shift highlights the growing importance of brand alignment, trust, and storytelling in performance marketing, especially in finance, where credibility is everything.

As explained in our free guide to brand partnerships, advertisers that embrace this fast-growing partner type can unlock new audiences, strengthen loyalty, and create more rewarding experiences for their customers.

In 2024, brand partnerships drove 1.6 million sales through the Awin platform, demonstrating a +86% sales increase vs 2023. We see this partner type going from strength to strength over the remainder of 2025.

Are you an Awin advertiser? Partner with these affiliates:

Get growing in H2 by partnering with our trending advertisers and publishers, or contact chris.blower@awin.com for specific guidance.