Staying ahead in an evolving finance sector: strategies and tips

Written by Jennifer Harris on 5 minute read

We highlight how affiliate and partner diversity provide opportunities for growth in a regulated finance market.

As rules and regulations are continually evolving within the UK financial market, we address the important question of how to revive marketing practices in the face of ever-tightening marketing regulations and global challenges – all of which are having huge impacts on consumer behaviours within the finance sector.

In January 2022, the Financial Conduct Authority (FCA) brought in new measures against price-walking which prevented car and home insurers from offering more competitive premiums to new customers versus renewing policyholders.

While regulations are necessary and beneficial for consumers, they create new challenges for insurance marketers unable to optimise using traditional marketing methods. No longer able to use pricing incentives such as cashback, insurers face the new question of how else to incentivise purchases and acquire new customers.

The affiliate channel offers new opportunities for growth via partner diversity; emerging publisher types can help to incentivise purchase behaviour, reach new audiences and increase consumer loyalty.

An increasingly regulated environment

The wider financial industry is also facing increased scrutiny on customer targeting within digital marketing. Changes in December 2022 required firms to regularly report back to the FCA on financial promotions they have approved, helping the FCA to crack down on rogue adverts.

"Social media and online advertising means that consumers are taking less time between seeing a promotion and making a financial decision. It is, therefore, essential that they are equipped with the right information at the right time so that they can make good financial decisions."

Sarah Pritchard, Executive Director of Markets, FCA

What more can providers do to stabilise and grow their affiliate channels?

“Finfluencers” and the rise of TikTok

While the FCA are rightly addressing forms of coercive advertisement taking place on social media, it can’t be denied that customer behaviours are changing and platforms such as Instagram and TikTok are huge, untapped resources for younger audiences. By leveraging the partner marketing channel, there is space for these platforms to be used as safe, reliable touch points for promoting financial services if certain cornerstones are adhered to:

- Outreach to the right influencers

Trust is key when it comes to shortlisting creators for influencer campaigns. Be selective. Your campaigns will succeed based on the authenticity of your creator, driven by audience engagement and consumer trust.

- Provide a clear brief with guidelines

Influencer marketing can pose a risk to brands if influencers do not adhere to required ASA guidelines such as using the #Ad hashtag. Ensure that your campaign brief incorporates guidelines on tone, language and criteria of what is deemed non-compliant, and have a contractual agreement in place with rights to sign-off material before the campaign goes live.

- Obtain sign off

Within affiliate marketing, we work closely with compliance and ethics teams to ensure promotional content meets legal regulations. Having buy-in from your compliance team will ensure adherence to any relevant FCA regulations.

- Keep your target audience in mind

Remember, influencer marketing is all about creativity. Influencers are great at speaking to their audiences and driving engagement from their followers. Allow them to be creative when producing content, just make sure that you have final sign-off from compliance.

Snoop trends on TikTok

Money-saving app Snoop collaborated with some of the UK’s best-known finance creators to drive app downloads and educate users on Snoop’s brand messaging. By featuring product testimonials, demonstrations and simple, humorous content, they were able to authentically reach a new younger demographic, driving over 55K conversions and 77M impressions over the course of the campaign.

Content will become King of finance

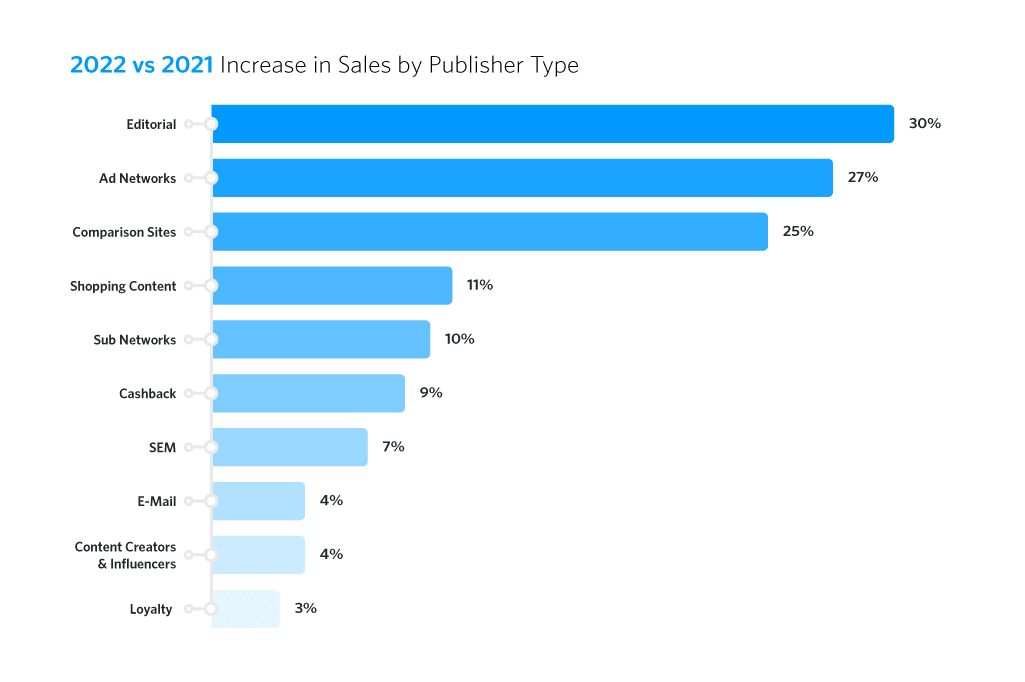

Traditionally an under-utilised publisher type within the finance sector, content sites are seeing significant engagement due to customers seeking advice during the ongoing cost of living crisis. Content affiliates saw +30% sales uplift in 2022 versus 2021 and +211% revenue increase YoY as customers demanded financial advice from trusted and informed sources. Financial advertisers can leverage content opportunities to communicate brand messaging and provide additional product value to customers actively seeking to save money.

Stand out from the crowd with brand partnerships

Awin advertisers have seen huge success with brand partnerships opening up new streams of incremental revenue and driving consumer loyalty in a highly competitive marketplace. MoneySuperMarket partnered with Buymobiles and Mobiles.co.uk to drive +35% referrals and +31% credit check applications. Brands can collaborate and partner with non-competing brands across verticals and sectors to target potential new customers and affinity audiences, drive sales and revenue and diversify their publisher base.

Giving back with rewards portals

Customers are becoming increasingly savvy in their purchasing traits, resulting in a surge of reward portals and loyalty sites. With customers becoming increasingly price-focused, brands should consider offering a reward to potential customers to increase affinity and encourage a return to site. For insurance brands bound by stricter FCA regulations, this reward can be in the form of a charity donation promoted on cashback websites such as TopCashback, Quidco and easyfundraising.

Looking ahead to 2023

Whilst increased regulations surrounding promotional advertising in the finance sector can be seen as detrimental, the affiliate channel proffers brands new opportunities. Regulations bring stability in an uncertain world. Having an agile approach to your digital marketing strategy and leaving space to keep abreast of changing consumer behaviours will ensure that you are reaching a whole new customer base. Diversifying your programme by investing in different publisher types will also future-proof your brand against upcoming regulatory changes.