How Do Small Businesses Use Affiliate Marketing?

Written by Alfie Staples on 8 minute read

The emergence of self-serve affiliate platforms has worked in the favor of small businesses. But what are the characteristics of their programs?

Cost-effective, risk-free, and predictable. The defining components of affiliate marketing’s commercial model align perfectly with the needs of small businesses.

We’re talking specifically about companies with 100 employees or fewer. Think flat structures, an enviable lack of red tape, and limited bureaucracy, delivering greater capacity for experiments, and a laser focus on growth.

Despite their lack of internal hurdles, small businesses haven’t always found it easy to navigate the infrastructure and nuances of the affiliate channel. Operating legacy platforms and building relationships with partners required time, commitment, and specialist skills – commodities that were rarely afforded by the one or two staff manning the marketing department.

Then, the tables started to turn. Intuitive self-serve tools and SME-focused plans like Awin Access delivered the automation to power hassle-free, plug-and-play affiliate marketing, much to the delight of time-poor marketers.

While the affiliate industry is full of stories like agency RevWise maintaining and growing hundreds of SME programs on Awin, less is known about the way these businesses engage with partners and vice versa.

We’ve combined data from Awin’s platform with findings from our survey with Forrester on hundreds of small businesses to reveal the full picture. It’s Insight of the Month time.

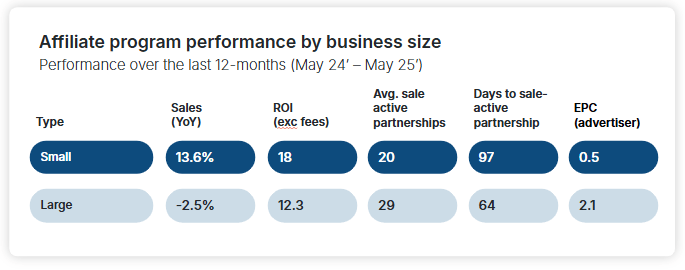

Small business sales are up, and ROI sits at 18:1

From a growth perspective, small businesses are thriving at Awin.

Sales are up +13.6% year on year on our platform amid a small decline at large enterprises (-2.5%), which we’ll use for a comparison to show how businesses of widely different structures fare in the affiliate channel.

ROI is also significantly higher for small businesses (18 vs 12:3). Evidently, if you have a goal and a tight budget to achieve it, you could do much worse than affiliate marketing.

It’s not all positive, though. Large businesses earn +123% more per click than smaller businesses (€0.5 vs €2.1), potentially from extra levels of trust justifying much bigger purchases.

Do influencers inspire greater diversification of small business programs?

Fewer internal approval processes should make it easier for small businesses to test new ideas and bring different publisher types into the mix.

Does that translate to more diverse programs? Our study with Forrester indicated as much, with small businesses voting partner diversity as the top strength of the affiliate channel and deeming more publishers ‘important’ to their organization than medium and large enterprises (5.2 vs 4.9 and 5.1).

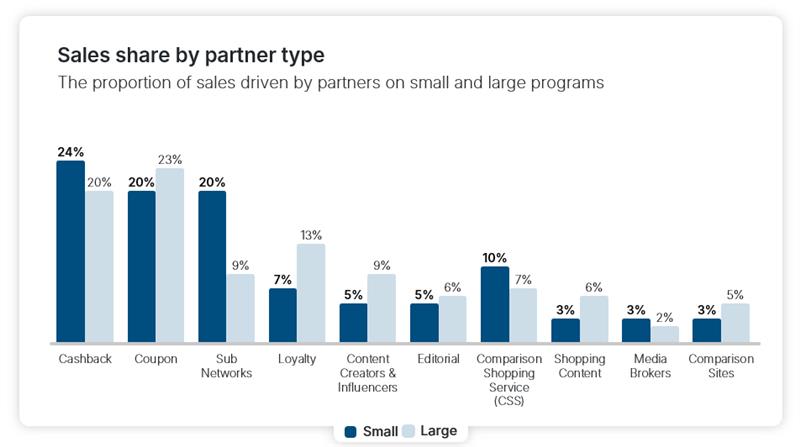

If anything, data from Awin’s platform shows large businesses having a slightly more even split of publishers driving their sales.

Cashback, discount partners, and sub-networks are high performers across both cohorts. However, our eyes were drawn to the significantly lower level of sales for content creators and influencers at small businesses compared to large enterprises (5% vs 9%).

This runs parallel with a finding from our recent exploration into the rise of influencers within affiliate marketing and the trend in larger businesses relying more on content creators for sales.

Watch this space for change, however. Awin is full of stories of challenger brands like Tomahawk Shades using affiliate’s pay-on-performance model as their risk-free route into influencer marketing.

It’s no surprise that influencer sales are growing much quicker for the smaller advertisers on Awin’s Access plan (+44% year on year) than they are for the larger advertisers on Awin Advanced (+3%).

Are discount partners a small business growth hack?

Influencer contributions might be growing at small businesses. Whether this results in any significant change to the hard figures remains to be seen.

Influencers dominate the view of sale-active partners on both large and small programs (51% and 32% respectively) but drive a relatively meager proportion of sales (9% and 5%).

Who are the real revenue drivers? Looking solely at small business programs, cashback (24%), coupon (20%), sub networks (20%), and loyalty (7%) fill an incentive-heavy frontline.

These findings mirror what we discovered in the Forrester report, where micro businesses over-indexed in their adoption of discount publishers. Looking at the top five partners on their programs, the order is:

- Coupon (57%)

- Loyalty (56%)

- Cashback (54%)

- Email (53%)

- Media houses (53%)

That’s caveated by the same survey revealing their top affiliate marketing objective to be ‘growing average order values’. Ranking above popular choices like ‘improving retention’ and ‘increasing customer acquisition’, the focus on increasing the value of their sales appeared to temper any worries of small businesses playing a dangerous race to the bottom.

We also have to consider the unique scenario of small businesses having a lower profile than some of the affiliates they partner with, particularly in the discount space. No one is ignoring the challenges of turning a profit through activities that reduce your margin. But by partnering with big-name coupon and cashback sites, small businesses can instantly position themselves in the same shop window as their industry leaders.

Publishers might pay for ignoring openness of small businesses

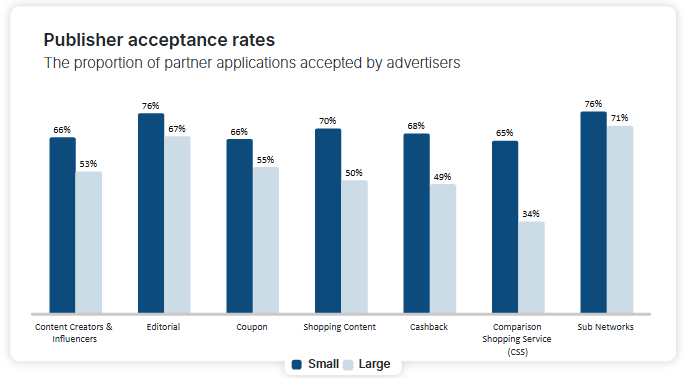

Going deeper into small businesses’ use of different partner types, we drew a solid conclusion when studying acceptance rates – the proportion of publisher applications approved by advertisers.

Publishers, here’s your headline: the smaller the advertiser, the more likely you are to be approved on their program.

It’s a major consideration for comparison shopping services (CSS), shopping content, and cashback partners in particular, who are sometimes twice as likely to be accepted by a small business program than a large one.

Publishers have every right to focus on partnering with the biggest possible brands, but a rejected application is worth nothing. Could any difference in commercial value between a small and large program be replaced in the aggregate?

Small businesses wait an extra month for partners to become sale active

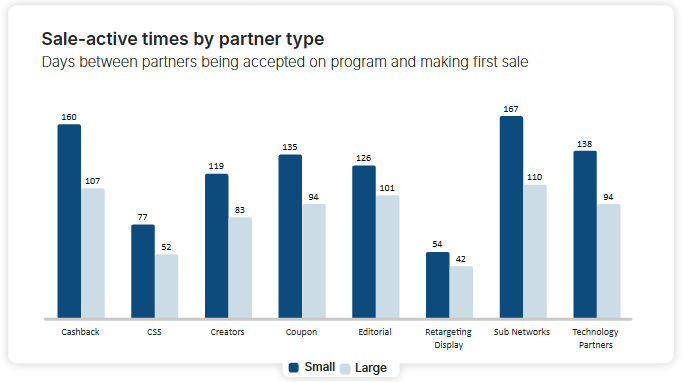

Speed was a recurring point of differentiation between small and large businesses.

Small businesses typically wait 97 days for a new partner to reach the threshold of being sale active, far longer than the 64 days reported by large businesses.

Slower partner launch times for smaller businesses were apparent across several categories, from cashback and coupon, to technology partners.

So, let’s theorize. Are large businesses with bigger budgets being prioritized in the onboarding phase?

If that’s true, we return to the point of publishers leaving commission on the table by neglecting a cohort that welcomes new ideas and partner types.

Are there more innocent factors at play? Affiliates could take longer to scope out and integrate less-established brands. A lack of profile could mean they’re not always front of mind and instantly considered for new activities.

On the advertiser side, smaller businesses opting to self-manage their program may lack the support to get their partners firing quickly. In our survey with Forrester, small business marketers named “managing relationships” as their top challenge within the affiliate channel, which could be eased by investing in support.

Contrastingly, large enterprises often require expert guidance due to the scale of their programs, which can accelerate partner launches and ease collaboration.

Social content is a solo-sale titan

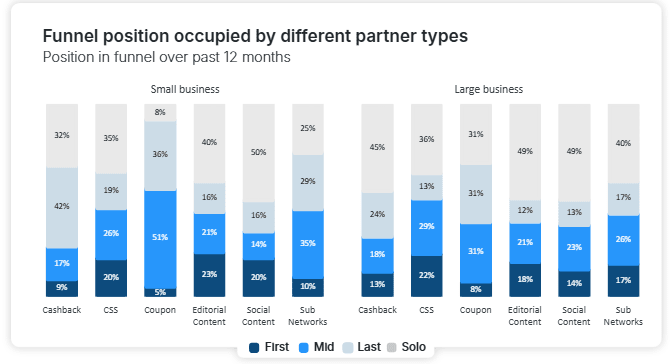

We’ll cap things off with a rundown of where specific partners are most likely to add value to a typical small business customer journey.

Using Awin’s Funnel Report, you can see where key affiliates tend to contribute to an action on these programs:

- Solo (converts on its own): Social content

- First click (great for building awareness): Editorial content

- Mid (increases purchase intent): Coupon

- Final (converts the sale): Cashback

While it’s no surprise to see editorial content assisting the sales that cashback partners eventually convert, it’s compelling to see social content being adept at driving purchases on its own.

Large businesses have a fairly similar set of readings, although cashback and coupon appear less effective at driving the final click.

If you’re a small business interested in launching an affiliate program, read how Awin Access is built especially for your needs.