It was the summer of ’22: UK travellers spend +56% on holidays

Written by Joelle Hillman on 8 minute read

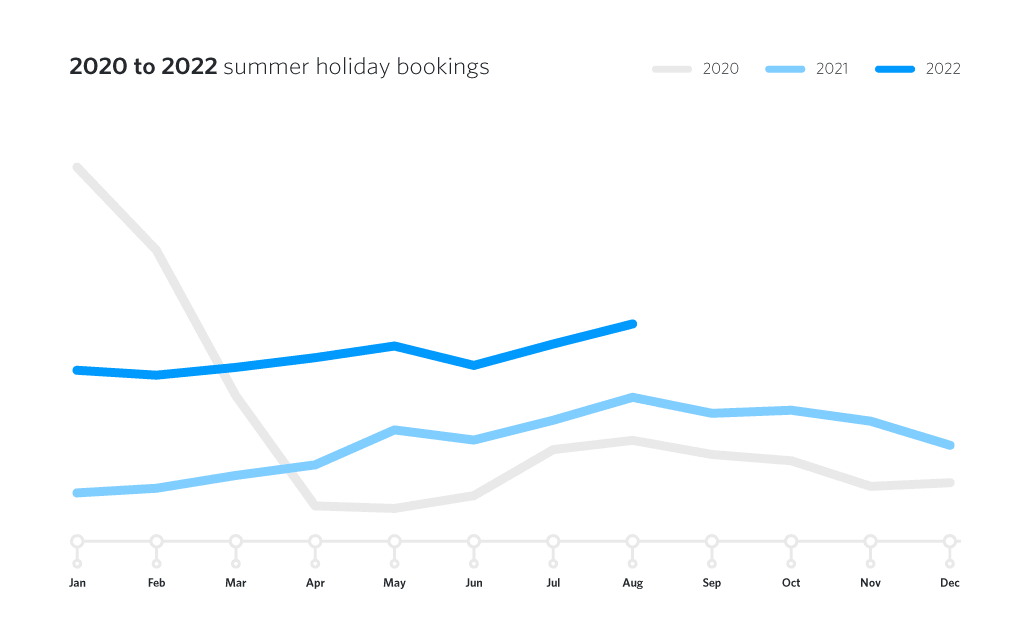

Consumers had boarding passes at the ready for summer 2022, with July and August bookings up +34% versus summer 2021 and +147% YTD.

Travel takes off in 2022

We finally saw summer bookings soar exceeding performance from the last few summers. As Bryan Adams reflected, those really were “the best days of our lives”. Awin tracked +34% increase in 2022 July and August bookings from that of 2021, and up +71% from 2020. Looking at the full year, January to August 2022, bookings were +147% up on bookings compared to last year.

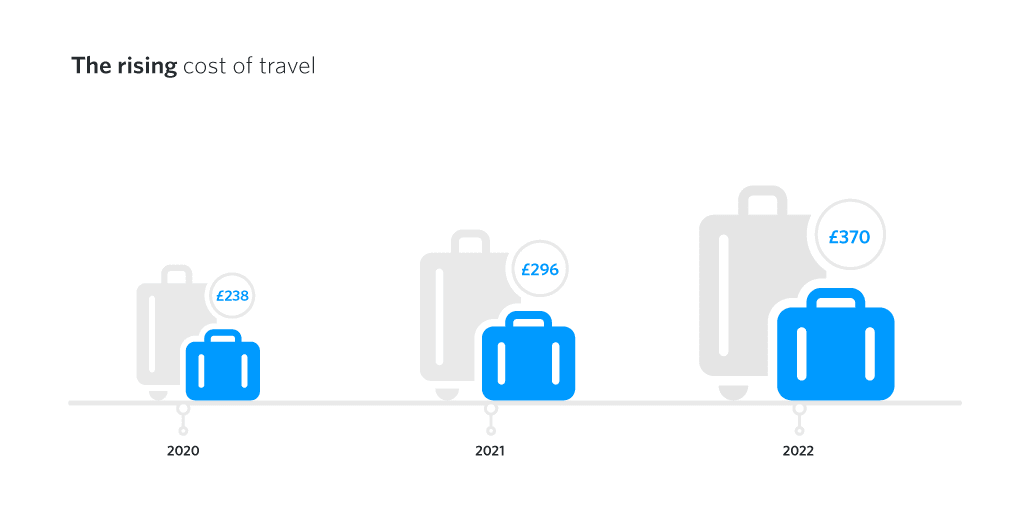

Not only were UK travellers booking more trips this year, but we were also spending more on average per trip. Awin average order value (AOV) for the travel sector is +56% over two years, and +25% YoY from January – August 2021 to 2022. This is down to a handful of factors, firstly flight prices were sky high this summer (excuse the pun) and in popular consumer demand. Travellers previously accustomed to a yearly holiday had been saving for over two years and were ready to make up for the memories they had missed out on. Whilst this consumer appetite for travel is set to continue, as we empty the holiday-piggybanks and experience the continued cost-of-living crisis, it will be interesting to watch the market response to increased holiday costs.

Get your sea legs; consumers seek alternative transportation

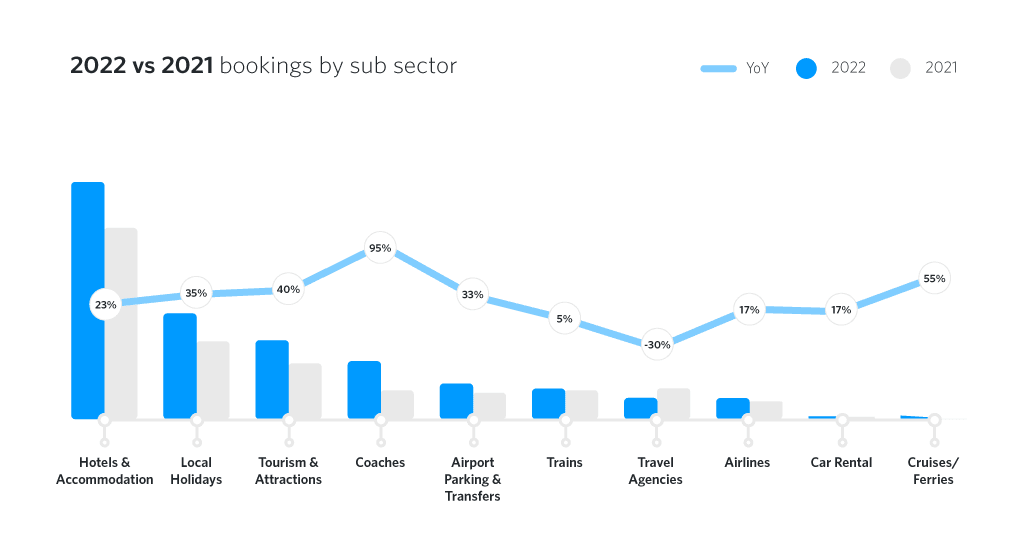

Focusing on the core summer months of July and August, whilst hotels and accommodation saw the biggest number of bookings on the Awin UK platform, it’s interestingly coaches, cruises and ferries seeing the biggest gains YoY. It’s no surprise travellers are looking for alternative modes of travel following the summer of scaremongering news around airport delays, flight cancelations and lost baggage. These stories of chaos also help explain the increase in airport transfers and parking bookings, as well as fast-track and lounge entries as people opted to pay for upgrades to avoid the turmoil.

Local holidays and tourism and attractions (everything from Zoos to National Parks) also saw strong growth YoY +35% and +40% consecutively. The travel restrictions, complex border regulations, and personal safety advice saw travellers move away from holidays overseas and travel (when allowed) around the UK over the past couple of years. This has opened our eyes up to the amount of staycation opportunities we have right on our doorstep. Not to mention we all want to travel to see friends and family, and celebrate birthdays and special occasions again. Staycations are also a great alternative for families who purse strings are a little bit tighter this year.

Evaluating your customer journey requirements

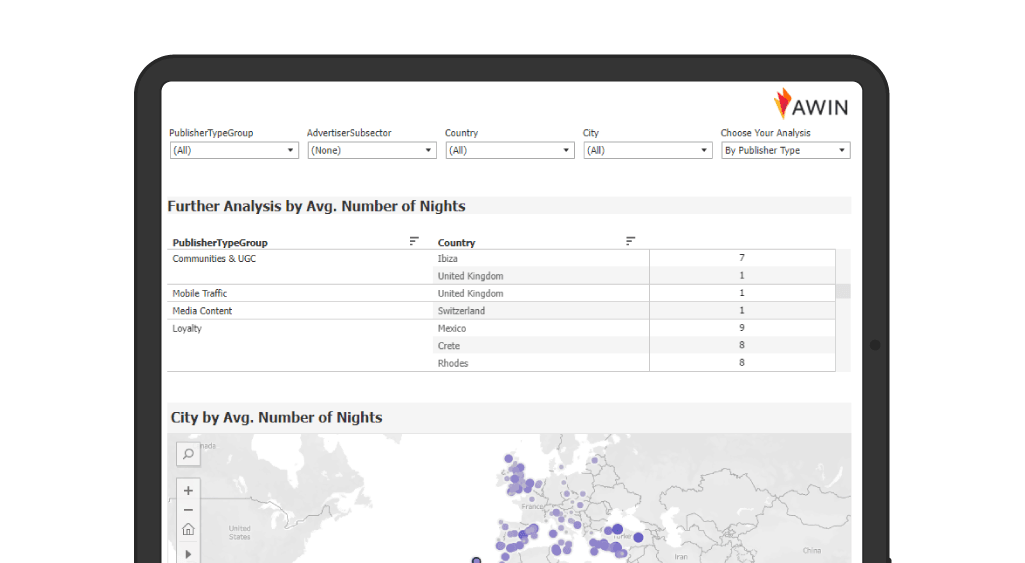

Many of our brands utilise Awin Conversion Analytics, passing us additional booking metrics back in real-time to allow us to report on, and optimise performance based on wider business goals. These metrics can help us understand who is travelling, where they are going, how far in advance they are booking, how many nights they are staying and much more.

We house this data in a travel benchmarking report and brands sharing these metrics with us are able to compare their own performance vs other travel brands on the network to assess lag times, percentage of business versus leisure bookings and the destinations they are over or under-indexing for.

Here’s a visual example of the travel benchmarking report.

UK travel consumers have Euro-vision

In July and August, the top booking destinations were UK, Spain, Turkey, Greece, Tenerife, Italy and Portugal. The destination with the lowest AOV was unsurprising the UK at £211 per trip, whilst Turkey saw the highest AOV at £2184 per booking. In terms of number of nights, travellers were going long-haul to Mexico for an average of 12 nights, 10 nights in Cape Verde, and 9 nights in Thailand, whilst some travellers were spending just 1 night in Ireland and other parts of Europe. Looking at booking behaviour, customers were booking last minute for Mykonos with just a 16 day lag time, Slovenia at 12 days, and Ireland with just 5 days between booking to trip. At the other end of the scale, travellers are planning ahead to go to Santorini next summer with 315 days lag time, Estonia at 264 days and Thailand in 220 days.

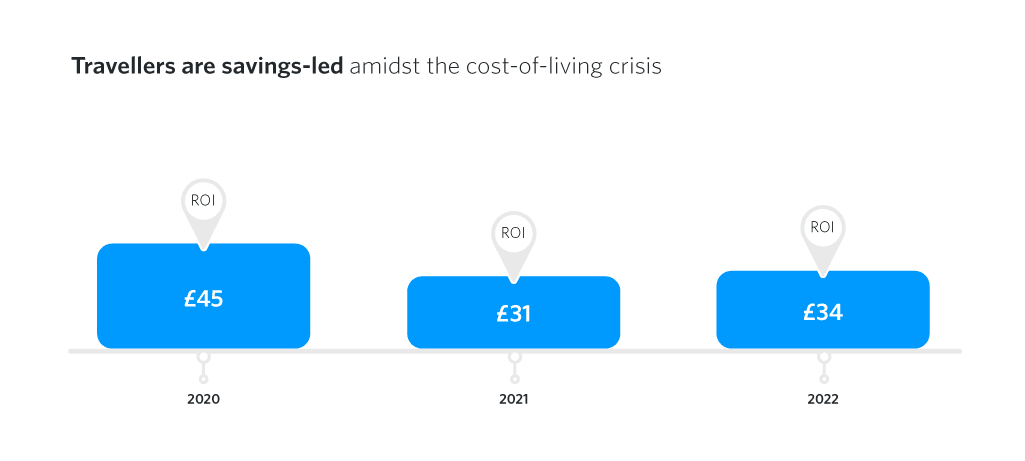

Publisher ROI reaches £33.60 in 2022

The market has been turbulent to say the least, with the limited opportunity to retain bookings during the pandemic, came a natural decline in investment. But as restrictions lifted, consumer confidence grew, and as we have seen, channel performance returned this year. This year ROI sits at an impressive £33.60 for the year.

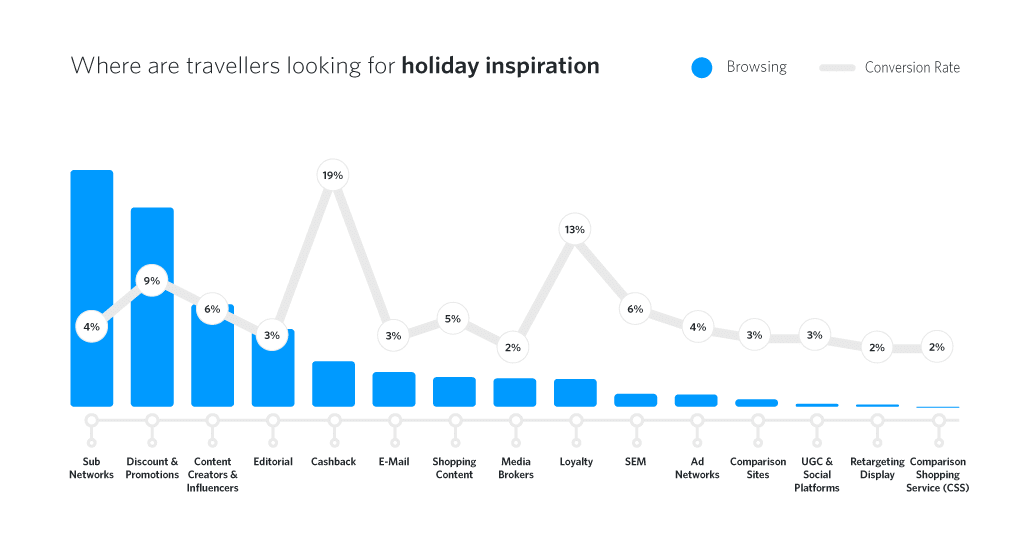

This graph demonstrates the types of publisher driving the most amount of clicks to travel brands, and the conversion rate. Over 60% of traffic was driven by sub-networks, promotional sites, and content and influencers. Cashback and loyalty partners drove the strongest conversions rates at 19% and 13%. Cashback also drove the strongest AOV with an average of £703.11 spent per booking, whilst social rewards, SEM and email partners drove the strongest ROI at £76, £52, and £41 consecutively.

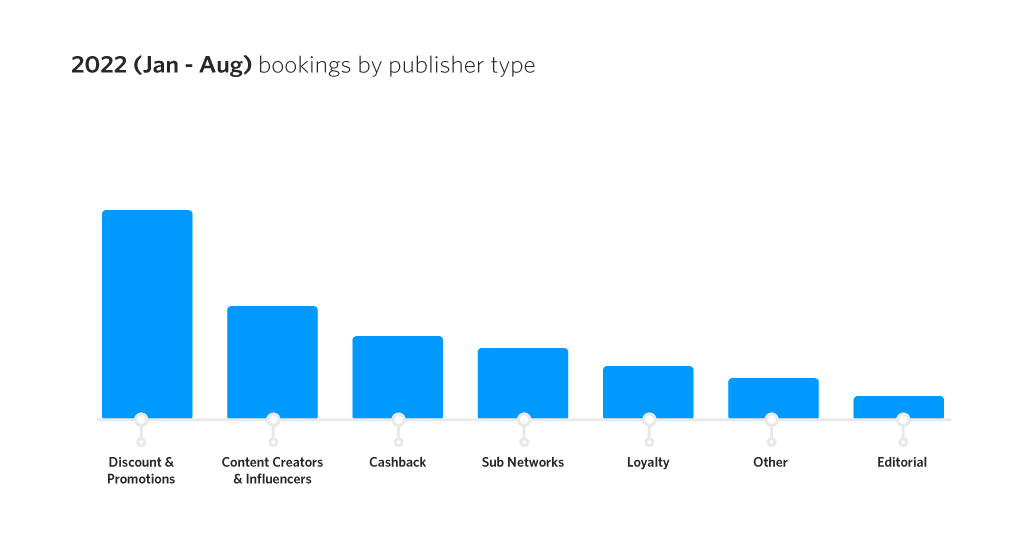

Discount and promotional sites drove the largest proportion of bookings across all publisher types at 35%, followed by content creators and influencers driving 19%, and cashback driving 14% of bookings in 2022.

It’s imperative that travel brands invest in a variety of different publisher types, fuelling their programmes with diversity, limiting business risk, and reaching a wide audience, at every point within their booking journey.

Travel forecast for 2023

As we move into 2023 we will continue to see continued success in the travel sector as people value experiences and time with friends and family. For many brands summer 2022 surpassed that of performance summer 2019 and there is excitement to see the return of January peak once more in 2023, Invoca predict 96% market recovery by 2023 2023 Travel Trends and Tips for Tourism Marketers (invoca.com) It will be interesting to see the first full year without any real travel restrictions and see the traditional travel bookings curve once more.

That said, with excitement also comes apprehension, with UK inflation up over 10% and energy prices due to rise again in October and early 2023 it will be tougher than ever for travellers to prioritise holidays. AOV has increased significantly over the last couple of years and The Business Travel Magazine predict this rise in price is set to continue into 2023.

Five tips to help plan for a successful travel future:

- Future-proof your programme with best-in-market tracking from server-to-server to tracking in-app. Fill your programme with diversity offering the security of multiple partner types. Create a balanced programme and focus your efforts on optimising partners that drive the most important KPI’s for your business needs. Awin have a publisher or technology partner on hand to support every business goal, from driving traffic, driving strong ROI and increasing conversion rate.

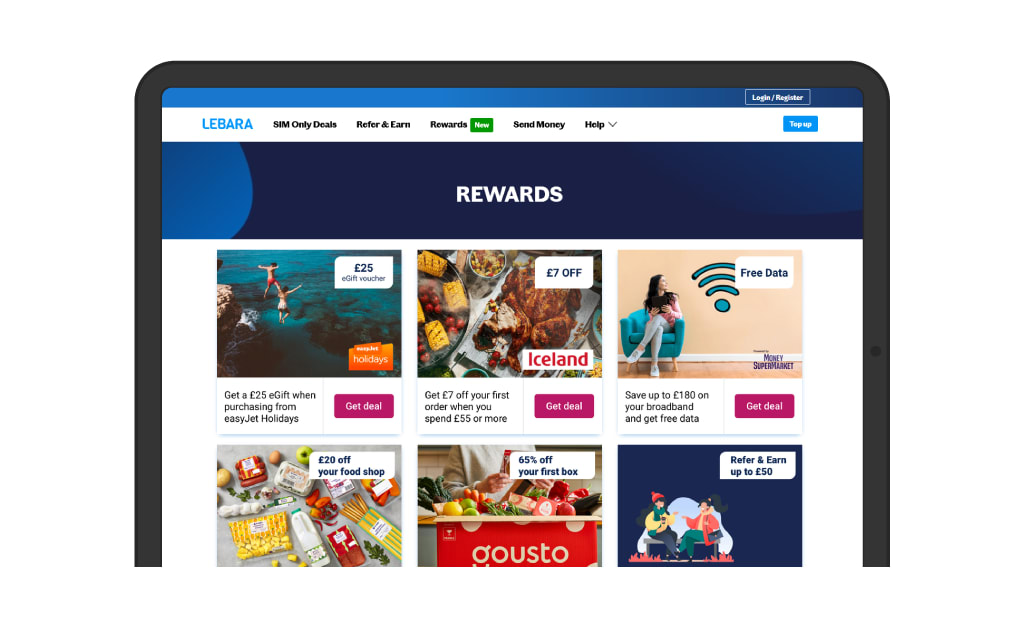

- Try something new with brand-to-brand partnerships. Partnering with other brands through the Awin platform allows you to utilise the reach of a trusted brand, to reach a new audience of potential customers, or perhaps offer your own audience rewards for non-competing brands to encourage customer loyalty.

Here’s an example campaign with the Lebara Rewards Portal including EasyJet Holidays:

- Leave no data source unturned, and share all of the data you have available with your affiliate platform and agency to help support your programme reporting and partner optimisation strategies. Speak to your Awin contact about Awin Conversion Analytics and gaining access and insights to the Travel Benchmarking Report.

- Think big, not in terms of sales volumes but your impact on the world. Consumers are more mindful than ever, and browsing for holidays is no exception. Klarna consumer research found that 70% of Gen Z and 73% of millennials are more likely to purchase from brands with a sustainable or ethical mission. Partnering with publishers with a more sustainable and ethical shopping focus can help you reach these customers, and improve your brand impact, and performance from these publishers is on the rise.

- Be frugal with your budgets. Just like your customers, monitor your outgoings and the value you receive. Partners in the affiliate channel are your secret weapons in achieving all business KPI’s, reaching customers at every part of the booking journey, and delivering a strong ROI. Spend within the channel is performance-based, so it’s always a wise investment. Think outside the box; work with other departments across the business, or utilise your tourism board relationships to secure additional budget to support you in securing bookings, driving brand awareness and testing new partnerships.